Amberdata Crypto Snapshot: Crypto Regulations, Hacks & Market Dynamics

Several extremely notable events happened over the last two weeks. From regulations to hacks, here is a quick run-through of the most important ones:

- Chairman of the SEC Gary Gensler testified again in front of the House Financial Services Committee in a hearing entitled Oversight of the Securities and Exchange Commission. Expect several social-media “share-worthy” statements over the next few days as the politicians use the platform to state their positions and posture on the now partisan area of cryptocurrencies and the role of the SEC.

- JP Morgan’s Chase bank in the United Kingdom stopped users from transferring funds to crypto services, citing fraud and scams. It appears that the US’s 2020 playbook has crossed the Atlantic. Given the recent MiCA legislation in Europe and the support of cryptocurrencies from Prime Minister Rishi Sunak, this is a curious move.

- Taking the complete opposite approach, Citibank is launching a private blockchain for Citibank tokens known as Citi Token Services (CTS). The tokens will allow the bank, its partners, and institutional clients “instantaneous” and “cross-border access” to liquidity. Some are calling it a Bitcoin killer, though that is obviously clickbait.

- The SEC has moved the decision on ARK 21Share’s Bitcoin ETF to 2024 and onto the Commission’s final decision deadline date. This is the first of the ETF filings up for a decision, so it is highly likely that the rest of the spot ETF filings will also be delayed.

- Due to a lack of profits, Blocknative will be suspending its MEV-Boost Relay and Ethereum block builders next week. Apparently, the protocol running the relay did not use the service for its own gain.

- Popular Hong Kong-based cross-chain transfer protocol Mixin Network lost $200 million this week after a hack exposed their database, representing nearly half of the protocol’s holdings spread across 48 networks. Reimbursement for losses has not yet been decided.

- HTX (formally Huobi) was hacked for $8 million, according to new board member and Tron founder Justin Sun. The CEX offered a 5% reward for the return of funds, but typical protocol rewards are 10%.

- US Senator Menendez took a vow to stay in Congress and fight bribery charges despite urges from fellow Democrats to step down. Menendez’s previous work included accountability for human rights abuses, and he has been critical of cryptocurrency in the United States. He co-sponsored a proposal for an assessment into El Salvador’s adoption of “risks for cybersecurity, economic stability, and democratic governance in El Salvador.” The bill failed, and the irony of the bill accusing cryptocurrencies of opening a door to bribery and corruption makes this story all the more interesting. It is unclear if he or his co-sponsor added these words to the bill.

- Popular social-media scammer Ben Armstrong (Bitboy), who is also known for running the scam token Ben Coin, was arrested on livestream over a Lamborghini argument with his neighbor. The extremely convoluted livestream came just days after he claimed he needed to borrow $10 for gas despite his wallet sending large sums of money to addresses including this one. Incredible how scams continue to grift large sums of money from individuals in a bear market. This is not a recommended strategy.

- FTX has sued SBF’s father and mother Allen Bankman and Barbara Fried for stealing millions of dollars worth of funds and benefiting from the exchange’s dealing. The trial for SBF begins next week.

- Coinbase Wallet users may have noticed a wave of notifications this last week as the much-loathed messaging feature has had an influx of spam from addresses that appear to be the 0x0000…0000 burn address. These vanity addresses are leveraging the permitfrom() function scam vector we’ve discussed in previous newsletters, which has accumulated over $85 million on Ethereum alone. This situation has similarities to Facebook’s poor community safety protocols years ago.

Crypto Spot Market

%20comparisons%20from%20weeks%2009122023%20and%2009192023..png?width=724&height=299&name=Centralized%20Exchange%20(CEX)%20comparisons%20from%20weeks%2009122023%20and%2009192023..png) Centralized Exchange (CEX) comparisons from weeks 09/12/2023 and 09/19/2023.

Centralized Exchange (CEX) comparisons from weeks 09/12/2023 and 09/19/2023.

%20trading%20volume%20market%20share%20over%20the%20last%2030%20days..png?width=724&height=243&name=Centralized%20Exchange%20(CEX)%20trading%20volume%20market%20share%20over%20the%20last%2030%20days..png) Centralized Exchange (CEX) trading volume market share over the last 30 days.

Centralized Exchange (CEX) trading volume market share over the last 30 days.

As we expected, Binance’s market share plummeted this week to new lows while Binance US’s market share has all but disappeared. The main benefactor of Binance’s market share decline is OKX. The Seychelles-based exchange has been growing reserves for the last few weeks.

%20trading%20volumes%20over%20the%20last%2030%20days%20for%20the%205%20top%20traded%20pairs..png?width=724&height=256&name=Centralized%20Exchange%20(CEX)%20trading%20volumes%20over%20the%20last%2030%20days%20for%20the%205%20top%20traded%20pairs..png)

Centralized Exchange (CEX) trading volumes over the last 30 days for the 5 top traded pairs.

Overall trading volumes have also been in a decline, with BTC/USD daily trading volumes peaking at just over $400 million last week. This is far from August’s $950 million daily trading volume peak.

DeFi DEXs

%20protocol%20from%20weeks%2009122023%20and%2009192023..png?width=937&height=82&name=Decentralized%20Exchange%20(DEX)%20protocol%20from%20weeks%2009122023%20and%2009192023..png)

Decentralized Exchange (DEX) protocol from weeks 09/12/2023 and 09/19/2023.

%20trading%20volume%20by%20pair%20for%20the%20week%20of%2009192023..png?width=724&height=256&name=Decentralized%20Exchange%20(DEX)%20trading%20volume%20by%20pair%20for%20the%20week%20of%2009192023..png)

Decentralized Exchange (DEX) trading volume by pair for the week of 09/19/2023.

DEX trading volumes for USDC/WETH continue to far outpace other tokens. The stablecoin appears to be growing in popularity for traders who are taking positions in native tokens, a signal that the bear market is continuing. Meanwhile, WBTC/WETH was the third-highest traded pair on DEXs last week. Much further down the list, PEPE_WETH and LINK/WETH are the only two trading pairs in the top 10 pairs that include at least one non-native or stablecoin token.

%20over%20the%20last%203%20months..png?width=724&height=256&name=Number%20of%20additions%20or%20removals%20from%20liquidity%20from%20Decentralized%20Exchange%20(DEX)%20over%20the%20last%203%20months..png)

Number of additions or removals from liquidity from Decentralized Exchange (DEX) over the last 3 months.

The number of DEX liquidity events has slowly declined over the last few months, with fewer individuals taking new positions on Ethereum-based exchanges. We see that the number of liquidity additions is still slightly higher than withdrawals, but we have not yet seen movements that signal a change in market direction.

DeFi Lending/Borrowing

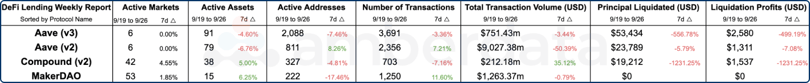

DeFi Lending protocol comparisons from weeks 09/12/2023 and 09/19/2023.

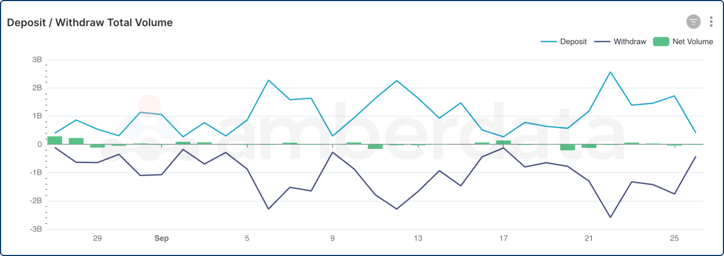

DeFi Lending protocol deposits and withdrawals from the last 30 days.

Deposit and withdrawal volumes have netted nearly equally for the last month, but there have been slightly more withdrawals than deposits. Liquidity has been high over the last several months, and borrowers seem to have very little conviction to aggressively pursue risky opportunities.

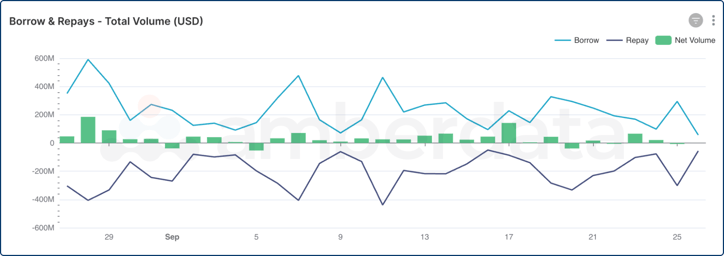

DeFi Lending protocol borrows and repays from the last 30 days.

DeFi borrowing activity has been higher than repayments through the middle of September, but last week saw more repayments as borrowers closed positions. There is no clear trend on where the market will fall over the next few weeks or months. Right now, it is just as likely for borrowers to close repayments as it is for borrowing activity to rise.

Networks

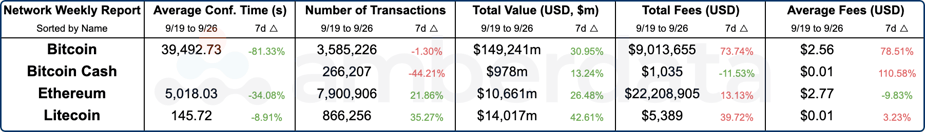

Network comparisons from weeks 09/12/2023 and 09/19/2023.

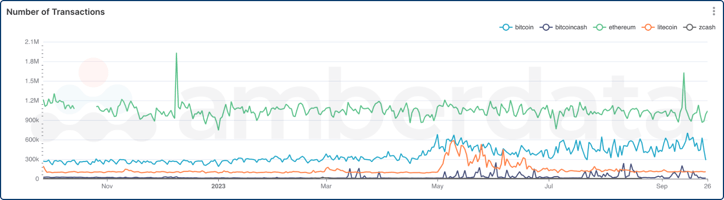

Network transaction comparisons from weeks over the last year.

This month’s network activity on Bitcoin is almost twice what it was in September of 2022 and was most likely spurred by Ordinals. Ethereum has been trending lower since last year likely due to the emergence and growing adoption of L2s.

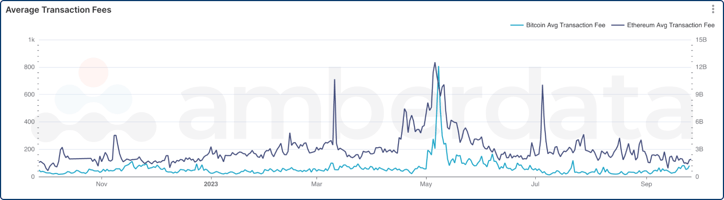

Network transaction fee trends over the last year.

Despite the decline in transactions on Ethereum, the Layer 1 network still had higher network fees than in 2022. Scaling is a critical focus area for the Ethereum Foundation, the most active developer network on the L1 blockchain. Meanwhile, Bitcoin has been trending higher for network fees, again spurred by Ordinals.

Links

Recent Coverage

- Amberdata’s first stablecoin primer: Becoming a Fiat-Backed Stablecoin Maxi

- Amberdata Appoints Christine Moy as Independent Director

- Amberdata and Coalition Greenwich Report: Digital Assets: Managers Fuel Data Infrastructure Needs

- Kitco: Ethereum could see 200% growth in daily active users, $800B fair value by 2025

- Investing.com: Bitcoin Steadiness Expected Post-fed Decision, as Crypto Market Anticipates Rate Hold

- CCN: Fed Rate Decision Today Impact on Bitcoin Explained as BTC Options Expire Friday

- Coindesk: Bitcoin Price Volatility Likely to Stay Depressed After Fed Rate Decision

Spot Market

Spot market charts were built using the following endpoints:

- https://docs.amberdata.io/reference/market-metrics-exchanges-volumes-historical

- https://docs.amberdata.io/reference/market-metrics-exchanges-assets-volumes-historical

- https://docs.amberdata.io/reference/get-market-pairs

- https://docs.amberdata.io/reference/get-historical-ohlc

Crypto Futures

Futures/Swaps charts were built using the following endpoints:

- https://docs.amberdata.io/reference/futures-exchanges-pairs

- https://docs.amberdata.io/reference/futures-ohlcv-historical

- https://docs.amberdata.io/reference/futures-funding-rates-historical

- https://docs.amberdata.io/reference/futures-long-short-ratio-historical

- https://docs.amberdata.io/reference/swaps-exchanges-reference

- https://docs.amberdata.io/reference/swaps-ohlcv-historical

- https://docs.amberdata.io/reference/swaps-funding-rates-historical

DeFi DEXs

DEX charts were built using the following endpoints:

- https://docs.amberdata.io/reference/defi-metrics-exchanges-historical

- https://docs.amberdata.io/reference/defi-liquidity-historical

DeFi Borrow/Lend

DeFi lending charts were built using the following endpoints:

Amberdata

Amberdata is the leading provider of global financial infrastructure for digital assets. Our institutional-grade solutions deliver data, analytics and comprehensive tools and insights that empower financial institutions to research, trade, and manage risk and compliance in digital assets. Amberdata serves as a...