Is President Biden’s Digital Asset Executive Order a Green Light for Institutions?

On March 09, 2022, President Biden issued the “Executive Order on Ensuring Responsible Development of Digital Assets,” which outlines the U.S. government’s much anticipated regulatory priorities for digital assets and directs federal agencies to begin work on recommendations and frameworks. Overall, the notion of a regulatory framework for digital assets is bringing confidence to both institutional and retail investors.

Six priorities are highlighted in order:

- Protection of consumers and investors

- Maintenance of financial stability

- Control of illicit finance

- Retention of U.S. leadership in the global financial system and economic competitiveness

- Promotion of financial inclusion

- Ensuring responsible innovation

Additionally, the order directs the government to explore the idea of a U.S. Central Bank Digital Currency (CBDC) and prioritize research and development should it be determined that its creation is necessary.

The administration's order indicates that the government recognizes the growth of digital assets and the asset class created for the financial system (along with potential risks, especially when it comes to retaining the U.S. dollar’s status as the world’s reserve currency).

What are the government’s next steps?

This executive order is merely the first step on the road to developing digital asset regulations, and it is far too early to tell what the outcome will be. The many agencies involved will be soliciting comments in the coming months (and years), so there should be opportunities for the public to influence the regulations that get implemented.

Per the executive order, the following steps will involve:

- The Department of the Treasury has developed policy recommendations to address the implications of the growing digital asset sector and changes in financial markets for consumers, investors, businesses, and equitable economic growth.

- Identification and mitigation of financial risks posed by digital assets and developing appropriate policy recommendations to address regulatory gaps by the Financial Stability Oversight Council.

- All involved agencies focused on mitigating illicit finance and national security risks coordinated with allies and partners to ensure international frameworks, capabilities, and partnerships are aligned.

- Establish a framework to drive U.S. competitiveness and leadership in and leverage digital asset technologies led by the Department of Commerce.

- Production of a report by the Secretary of the Treasury on the future of money and payment systems. This report will include implications for economic growth, financial growth and inclusion, national security, and the extent to which technological innovation may influence that future.

- Study and support technological advances in the responsible development, design, and implementation of digital asset systems.

- Assessment of the technological infrastructure and capacity needs for a potential U.S. CBDC.

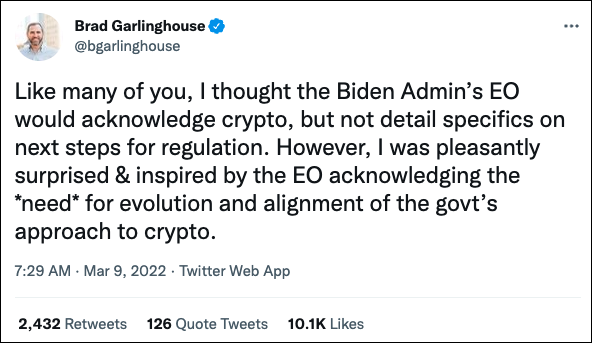

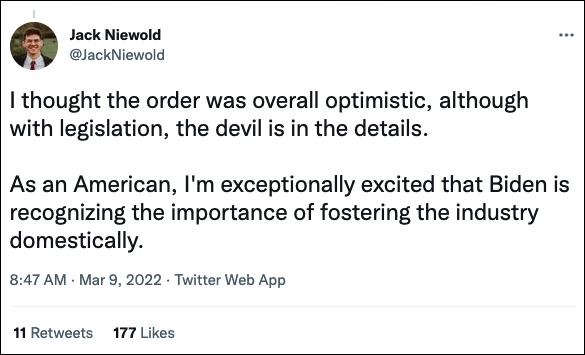

How was the executive order received?

While the segment of crypto market participants that believes the government should take a hands-off approach towards digital assets and opposes the participation of financial institutions in the space (if not their entire existence) was predictably unhappy, the executive order was largely received positively:

With some countries discussing banning cryptocurrencies entirely (or making moves to do so), the U.S. government’s move in favor of crafting regulations while recognizing that digital assets and the underlying technologies offer potential benefits and opportunities, combined with the U.S. position as the leader of the global financial system, could be what the digital asset sector needs to continue its growth. In short, this is the green light many were hoping for.

What are the potential implications?

For institutions in particular, the practical implications are that much of the existing regulatory uncertainty will soon be cleared up, reducing risk and simplifying compliance (particularly with KYC and AML laws). Once regulations are published, it will be possible to create long-term digital asset strategies that currently may not be viable due to regulatory uncertainty. Regulatory certainty should also increase demand for digital assets among more conservative investors who are avoiding the asset class due to their lower risk tolerance.

What regulations, frameworks, and policy changes will be made will be unknown until the first reports and recommendations, but this executive order makes it clear that the U.S. government recognizes digital assets as part of the future of the financial system. Institutions that were hesitant to enter the digital asset space or make more significant investments because of concerns about an outright ban should feel more comfortable going forward now that this executive order has been issued.

Want to learn more about digital assets before you take the next step forward? Our ebook, “The Digital Asset Data Guide for Financial Professionals,” explains why you need digital asset data to be successful, the challenges with accessing it, how these can be overcome to gain an advantage in the crypto economy, and more. Download it today to start learning more about digital assets and the data you’ll need regardless of what regulations the government ultimately enacts.

Amberdata

Amberdata is the leading provider of global financial infrastructure for digital assets. Our institutional-grade solutions deliver data, analytics and comprehensive tools and insights that empower financial institutions to research, trade, and manage risk and compliance in digital assets. Amberdata serves as a...