The Bitcoin Halving is an event highly anticipated within the digital asset community, driven by its significant impact on the Bitcoin ecosystem. Per the Bitcoin Protocol, each block mined introduces new Bitcoin into circulation. This issuance is subject to a predefined schedule where, every four years, the reward allocated to miners for each block mined is reduced by fifty percent. This mechanism, known as the "halving," is ingrained in the Bitcoin Protocol to maintain scarcity and counteract inflation, ensuring a controlled expansion of the digital currency's supply. Bitcoin isn't the only cryptocurrency to experience halving. Other cryptocurrencies can undergo similar events, though Bitcoin's Halving is the most well-known.

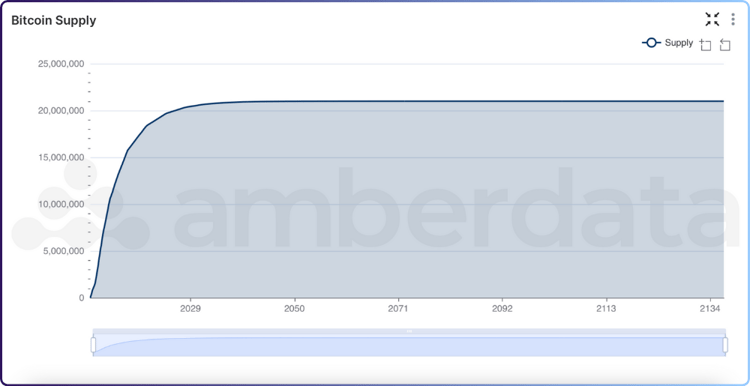

After the network mines 210,000 blocks—roughly every four years—the block reward given to Bitcoin miners for processing transactions is cut in half. This system will continue until about 2140, when the proposed limit of 21 million coins is reached. The halving plays a crucial role in Bitcoin's economic model, acting as a built-in mechanism to control inflation and maintain scarcity, making it a pivotal event eagerly awaited by investors, miners, and enthusiasts alike.

The forthcoming halving in April 2024 marks the fourth occurrence of this event. We will see the Bitcoin block reward change from 6.25 ₿ to 3.125 ₿.

To date, Bitcoin has undergone several halving events, each playing a crucial role in its supply mechanism and economic model.

|

Event |

Date |

Block |

Reward Reduction |

|

First Halving |

November 28, 2012 |

210,000 |

50 ₿ -> 25 ₿ |

|

Second Halving |

July 9, 2016 |

420,000 |

25 ₿ -> 12.5 ₿ |

|

Third Halving |

May 11, 2020 |

630,000 |

12.5 ₿ -> 6.25 ₿ |

|

Fourth Halving |

Est. April 2024 |

840,000 |

6.25 ₿ -> 3.125 ₿ |

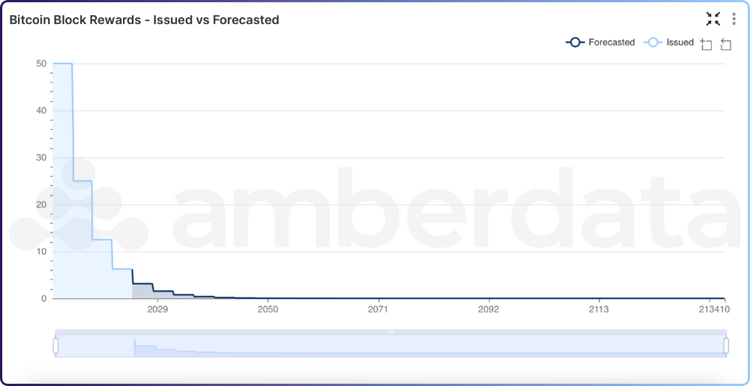

We can see the forecasted Bitcoin block rewards for all future halving events out until the last Bitcoin is mined.

The halving event represents a pivotal economic mechanism within the Bitcoin ecosystem, designed to regulate the currency's supply and enhance its scarcity over time.

The above chart shows us the Bitcoin issuance until the last Bitcoin is mined. By the year 2030, nearly 98% of the total Bitcoin supply will be in circulation.

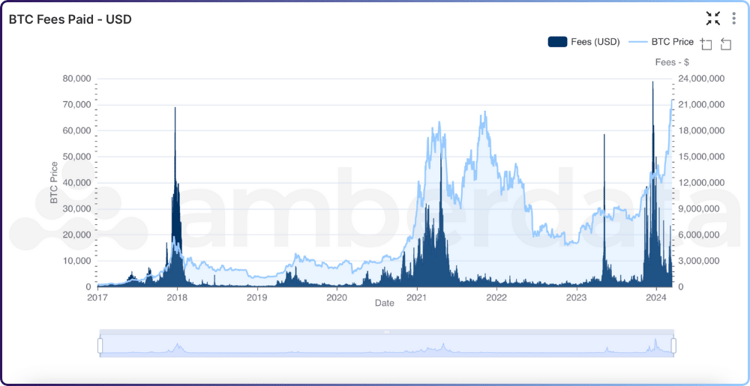

From the perspective of supply constraint, the halving serves a beneficial role, contributing to Bitcoin's value proposition. However, it also imposes a significant repercussion on the network's miners. Assuming the price of BTC remains constant, the reduction in block rewards directly increases operational costs for miners as the compensation they receive for each block mined diminishes. Consequently, this shift compels miners to increasingly rely on transaction fees as a primary source of revenue for including transactions in a block. This dynamic underscores the delicate balance between maintaining network security and incentivizing the participation of miners in the Bitcoin ecosystem.

As the impact of Bitcoin halving on miners' rewards is substantial, it becomes crucial to monitor the volume of transaction fees paid to miners. These fees are a key component in assessing overall miner revenue in addition to the block rewards. This analysis is essential for understanding the financial health and sustainability of mining operations within the Bitcoin network.

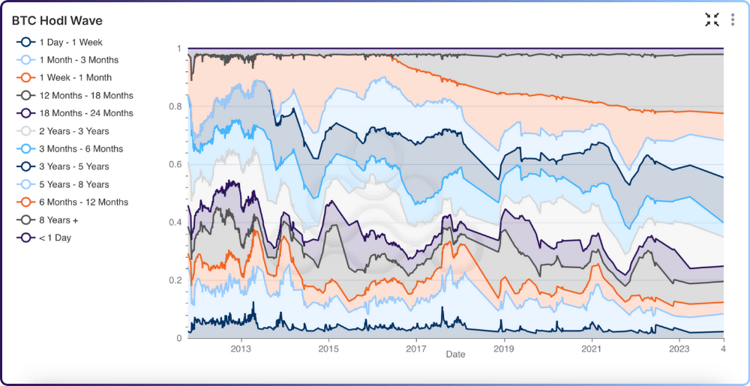

A more nuanced comprehension of user engagement with Bitcoin can be gathered by examining the duration for which BTC remains unmoved. The chart shows the age of Unspent Transaction Outputs (UTXOs), offering a simplified perspective on the length of time Bitcoin has been held without transfer. This analysis is instrumental in understanding the narrative surrounding Bitcoin as a store of value, thereby providing valuable insights into its utilization and perception within the ecosystem.

The large top segment of the chart in lime green shows the percentage of Bitcoin that has not been moved in 8+ years. This is a very bullish indicator that holders of Bitcoin have a long-term outlook on the asset as a store of value. Roughly 20% of all UTXOs have remained unmoved for over 8 years.

While the halving event within the Bitcoin network is an easily anticipated occurrence, marked by its predictable schedule, it remains of paramount importance to engage in a continuous and thorough analysis of the wide-ranging impact this event has on all constituents of the Bitcoin ecosystem. This includes evaluating its effects not only on miners, whose revenue models undergo significant shifts due to the reduction in block rewards, but also on investors, users, and the broader market dynamics, ensuring a holistic understanding of its implications on network security, transaction fees, and the overall value proposition of Bitcoin.