Amberdata Derivatives Newsletter: SOL vs ETH Volatility & Fed Rate Cuts

.png)

The Fed cut rates by 25bps last week, but with inflation still above target, the outlook remains uncertain and the path to May 2026 is unclear. In crypto, SOL volatility looks historically underpriced relative to ETH, suggesting a potential trade opportunity for upside relative volatility. Learn all about it in this week's derivatives newsletter:

- Monday - Fed Governors Speak

- Tuesday 8:30a - US Employment Report (Delayed)

- Wednesday - Fed Governors Speak

- Thursday 8:30a - CPI

MACRO Overview

The big event last week was the FOMC rate decision, which produced a -25bps cut.

The Fed was divided.

The rate cut came with a “Hawkish” tone as the Fed is stuck between its dual mandates.

On the one hand the Employment situation is softening but at a surprisingly resilient rate.

This would normally lean the Fed towards a rate-cutting cycle… but inflation remains above target… The most recent PCE numbers came in at +2.8% y/y vs the Fed’s target of +2.0%.

Despite the stickier inflation, the trend has been lower and tariff effects seem less pronounced than expected.

Again, this signal (to keep rates higher) is muddy.

Now the Fed is divided and the market has no real insight into the future path of rates from now until May 2026, when Powell will be replaced.

Trump recently said in an interview that he’s leaning towards either Warsh or Hassett to led the Fed. He also wants the chairman to consult more with Trump on rates.

Historically, governments are VERY incentivized to get “TOO DOVISH” with rates and money printing, which is why an independent Fed is so important. (AKA The government wants to finance its own spending).

I imagine Trump’s pressure could ignite over-stimulation from aggressive rate cuts.

A market CRASH would be needed to justify aggressive rate cutting and fiscal spending (the twin flames of inflation).

That is the big picture theme to me for the “Debasement Trade”.

- Slow-moving Fed

- Credit Crunch (AI, Crypto, Stocks down)

- Reflexive reaction for the loyalist Fed chairman to overly stimulate

Next week's biggest economic release will be the CPI release on Thursday.

There are various Fed speakers during the week, but I don’t believe those will move markets much given the Fed just concluded the FOMC rate decision.

BTC: $88,087 (-3.7% / 7-day)

ETH: $3,061 (-0.7% / 7-day)

SOL: $129.89 (-2.4% / 7-day)

Crypto Options Overview

Looking back into the crypto space, I continue to think the short-vol BTC 1x2 call spreads are interesting here… It seems like consolidation/grind into EOY makes sense.

For long volatility trades SOL seems interesting.

Using ETH as a relative vol pricing proxy we can compare the spread between SOL and ETH.

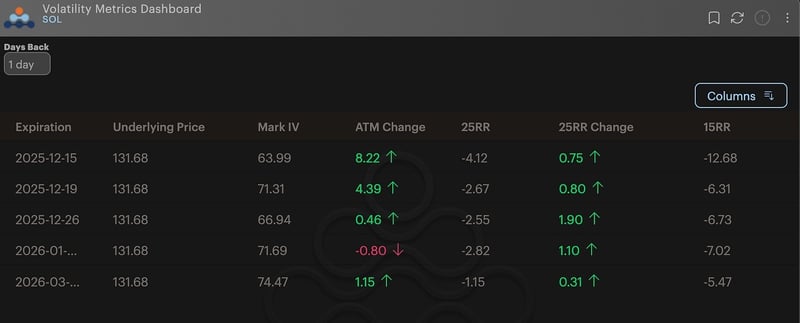

Chart: SOL Volatility dashboard

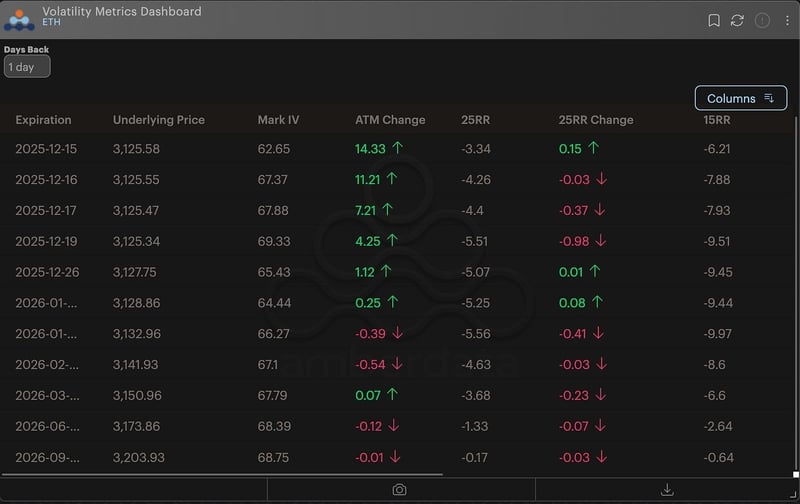

Chart: ETH Volatility dashboard

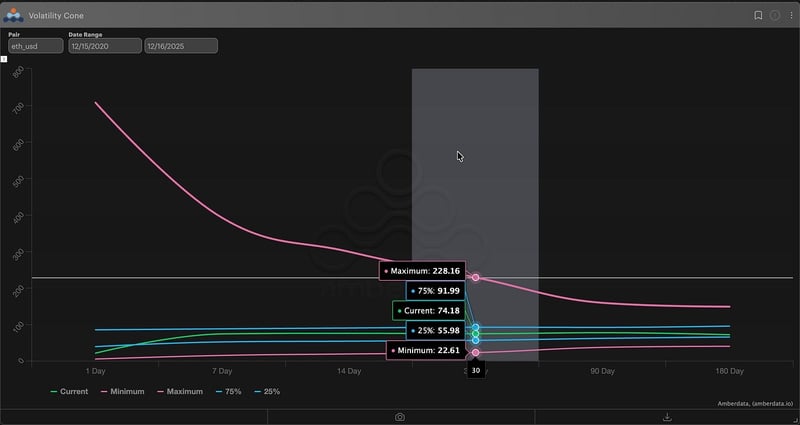

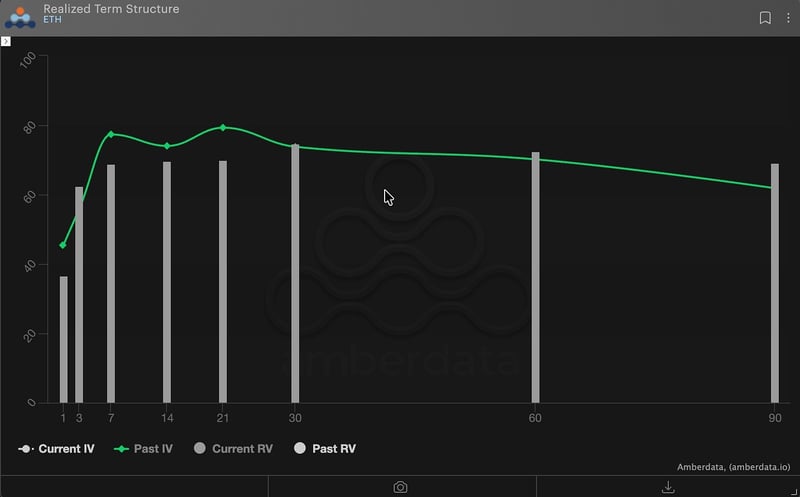

Today Solana volatility is priced the same as ETH volatility, but historical speaking, Solana is near the lower quadrant of realized volatility over the past 5-yrs.

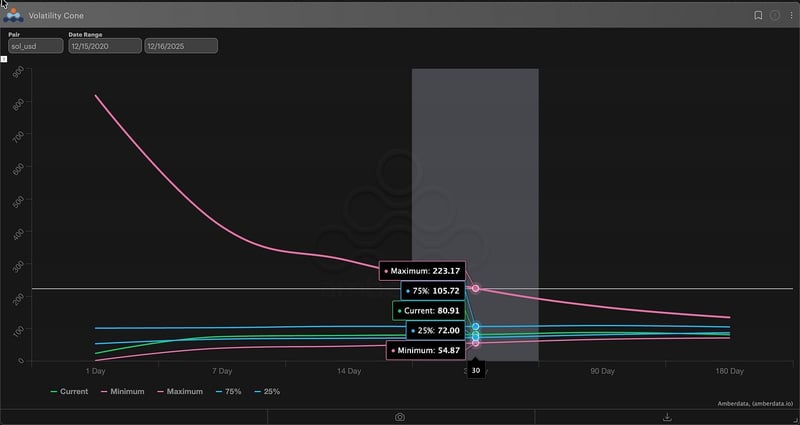

Chart: SOL realized volatility

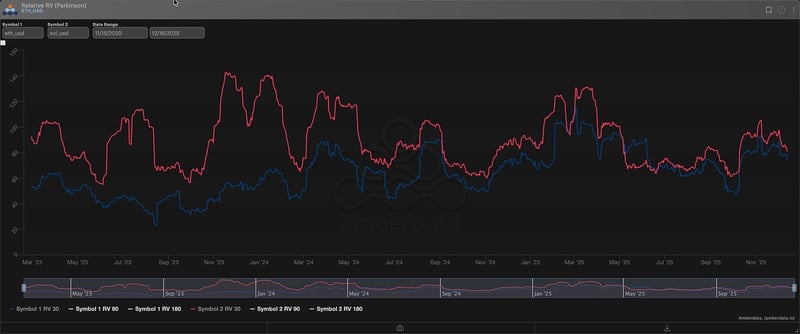

If we compare the 30-day realized volatility of Solana vs ETH historically we can see the spread between the two is near its lowest point.

Chart: 30RV (SOL red), (ETH blue)

Solana realize volatility (red) is near it’s lower end of the range while ETH (blue) is at the median range.

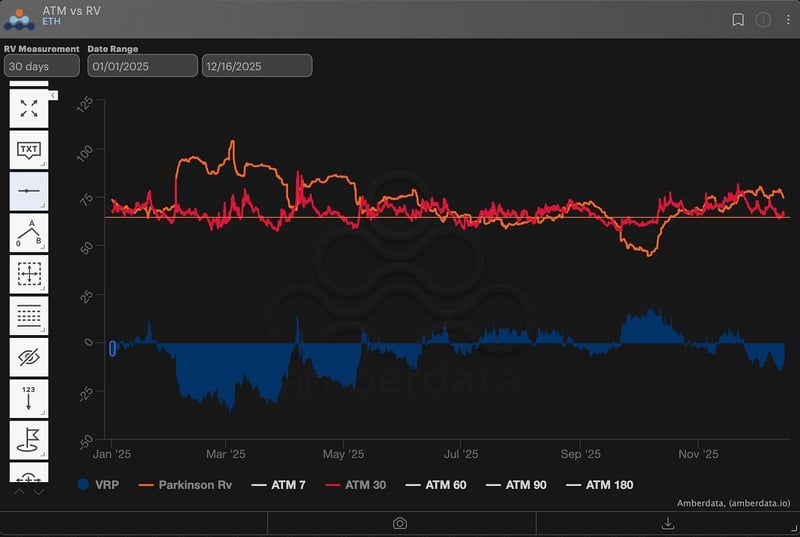

Chart: ETH realized volatility (pro.amberdata.io)

Given that ETH has a market cap of $376B vs the SOL market cap of $76B I expect the RVs to diverge again given some sort of risk catalyst. It takes less money to move SOL around.

Both have spot ETFs listed in TradFi markets today. Bitwise has the BSOL ETF trading today.

If we then look at the VRPs for both ETH and SOL we can see the moments of underpriced volatility have historically favored Solana (-50pts) more than ETH (-25pts).

Some sort of relative volatility trade likely makes sense between the two assets.

(something like sell ETH calls to buy SOL calls)

That’s the main interesting trade on the long volatility side I see today.

I do think both assets could sharply drop lower on a risk-off catalyst. I’m less convinced SOL volatility would out-perform to the downside than I am to the upside.

I could imagine SOL doubling from here before ETH does however.

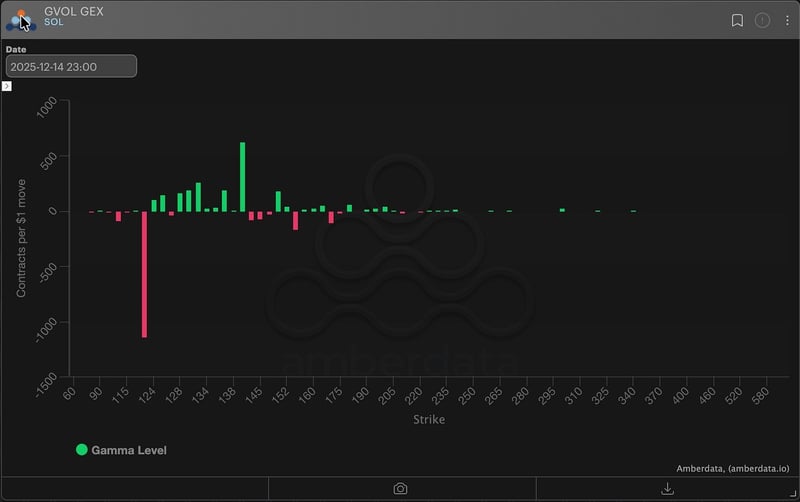

Chart: SOL GEX deribit (pro.amberdata.io)

Solana’s downside profile is well hedged judging by dealer gamma exposure.

Traders seem to be discounting the upside volatility in SOL options.

SOL Gex is still relatively small however for any delta rebalancing effects to move prices imo, but the sentiment is clear from the GEX.

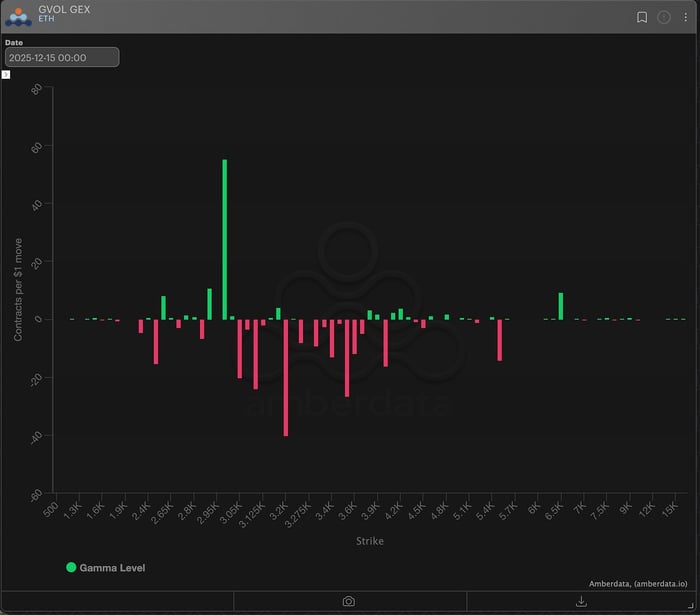

Chart: ETH GEX deribit (pro.amberdata.io)

However, traders (street) are already fully positioned into ETH calls today.

Normally, this GEX profile would suggest dealer rebalancing effects would accelerate the ETH upside, but again, option positioning is small relative to the spot market cap, so instead I view this as traders already anticipating upside in ETH while having ignored it in SOL.

TL:DR - Long SOL calls financed by short ETH calls (the opposite of how the street is already positioned).

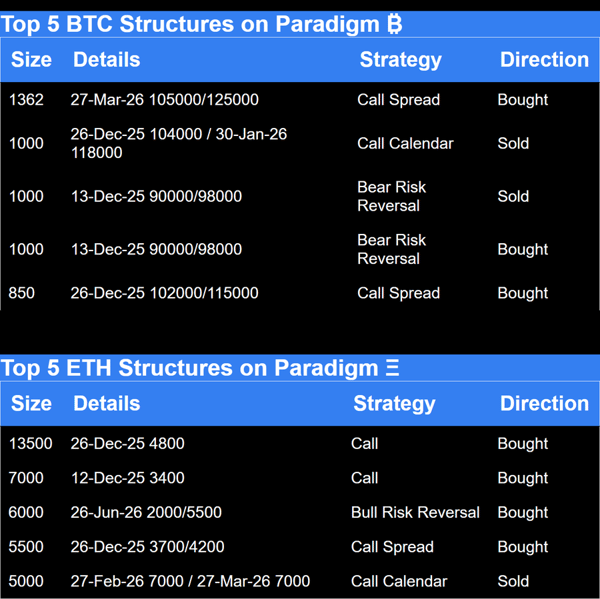

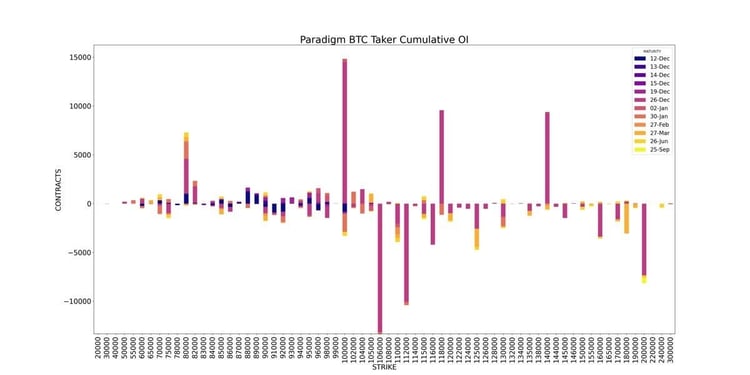

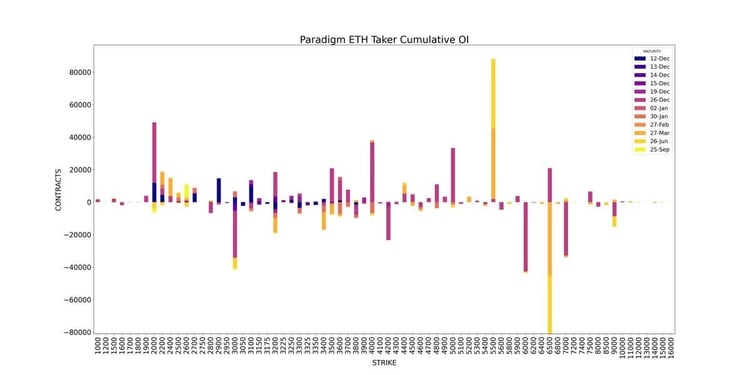

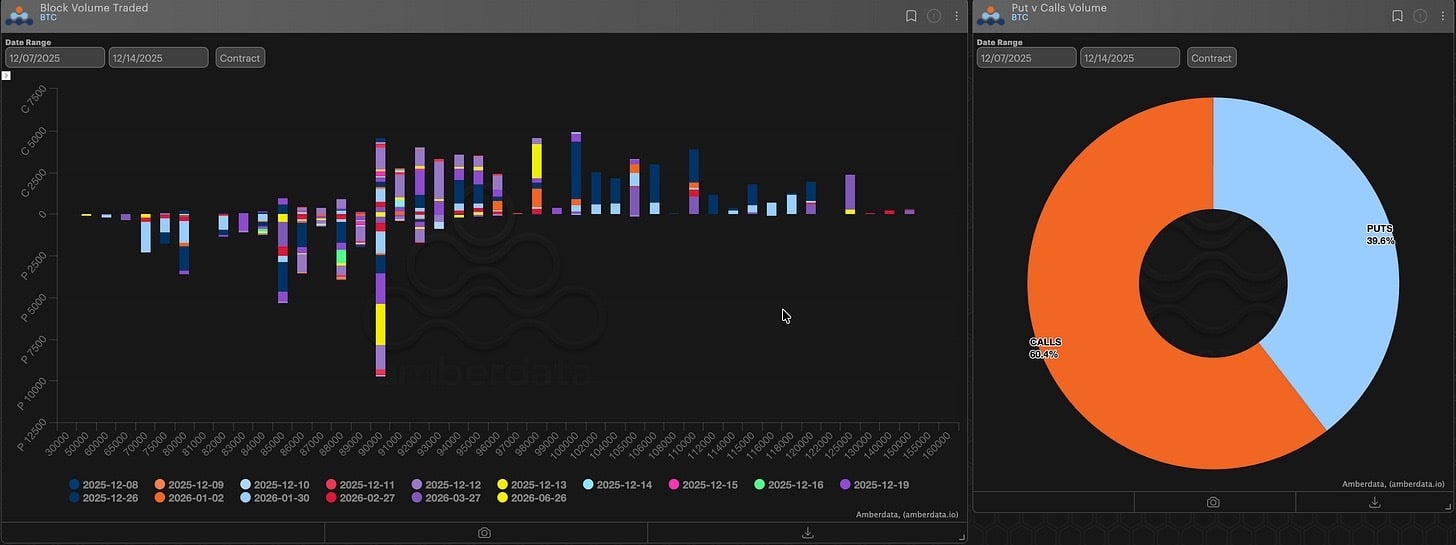

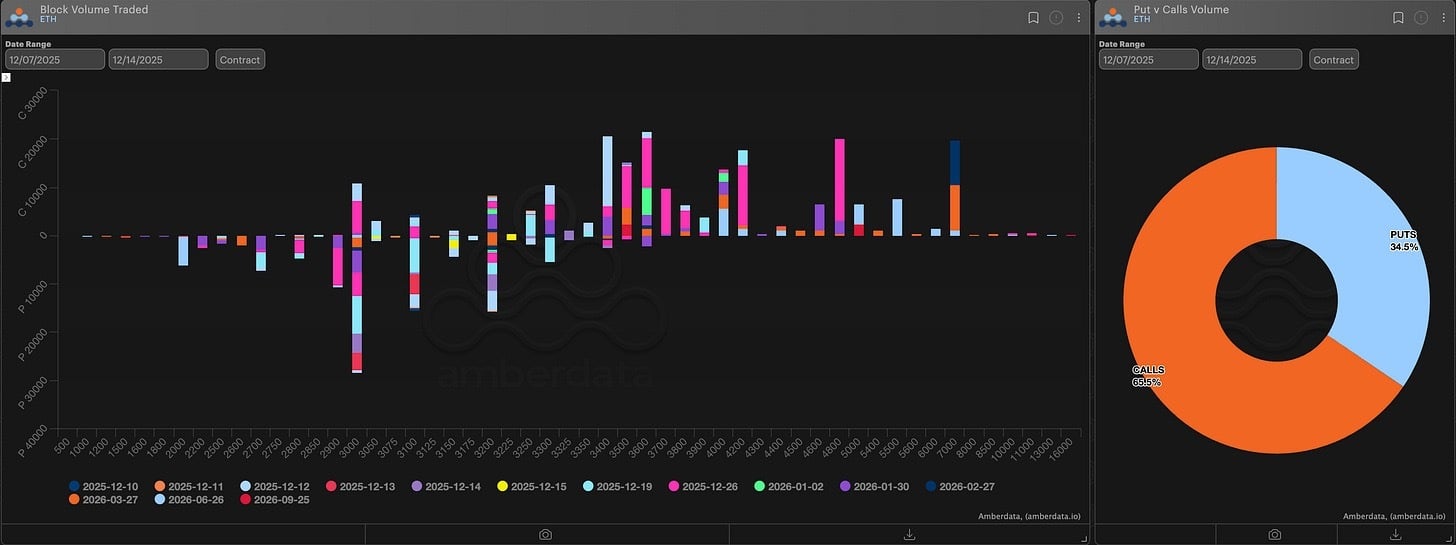

Paradigm Top Trades this Week

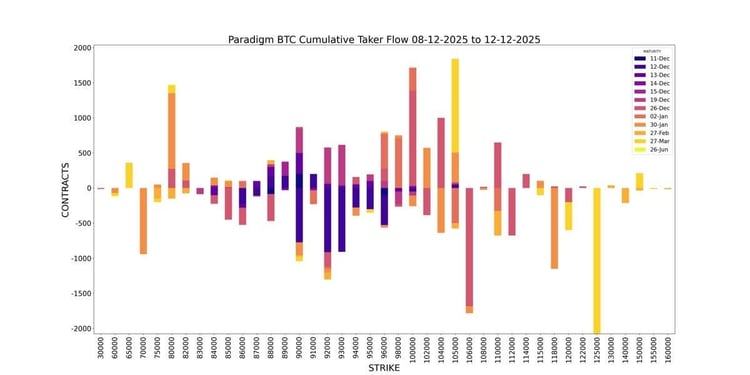

BTC Cumulative Taker Flow

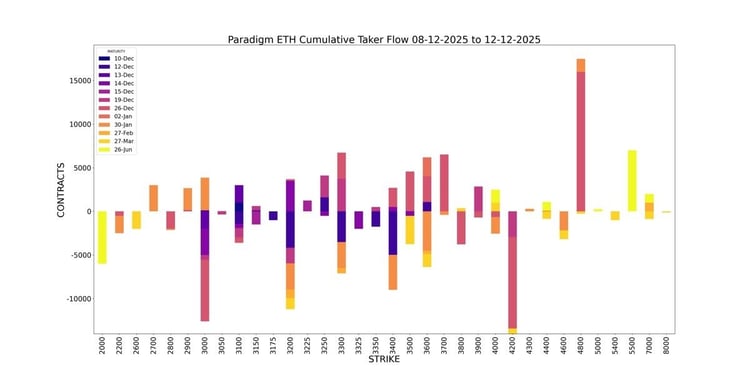

ETH Cumulative Taker Flow

BTC Cumulative OI

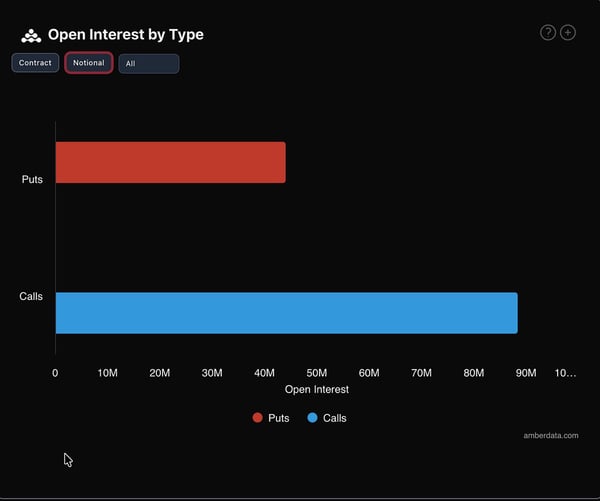

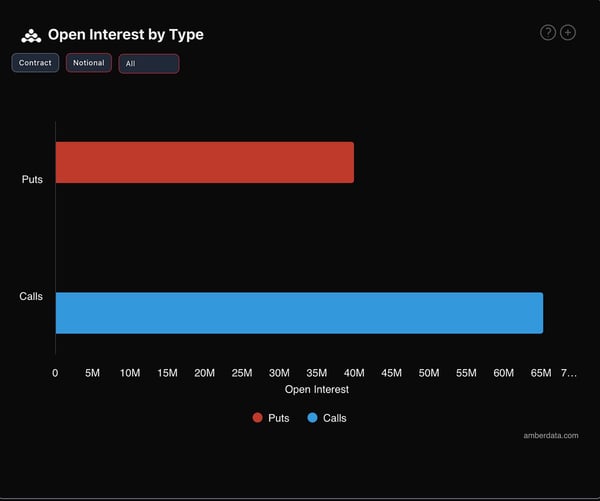

ETH Cumulative OI

BTC

ETH

DERIVE is now the 5th largest OI market in DeFi.

And traction for HYPE options has seen a ton of two-way flows.

AMBERDATA DISCLAIMER: The information provided in this research is for educational purposes only and is not investment or financial advice. Please do your own research before making any investment decisions. None of the information in this report constitutes, or should be relied on as a suggestion, offer, or other solicitation to engage in, or refrain from engaging, in any purchase, sale, or any other investment-related activity. Cryptocurrency investments are volatile and high risk in nature. Don’t invest more than what you can afford to lose.

Greg Magadini

Greg Magadini is the Director of Derivatives at Amberdata. Previously, he co-founded Genesis Volatility (later acquired by Amberdata). Greg Magadini started his career as a proprietary trader for DRW and Chopper Trading in Chicago IL. Greg has nearly 15-years of options trading experience and has been active in the...