Introduction to Maker

MakerDAO is an Ethereum-based, peer-to-contract lending platform designed to maintain its flagship USD-pegged stablecoin DAI. Founded by Rune Christensen in 2014 to create a permissionless credit system, Maker has slowly ceded its control of the protocol to MakerDAO (a decentralized autonomous organization), allowing holders of the protocol’s MKR token to make decisions for the protocol via their governance system. MakerDAO is one of the top decentralized lending platforms in the DeFi sector and is a very beginner-friendly platform for those looking to borrow DAI or to put their digital assets to work.

MakerDAO functions similarly to other lending platforms. Users supply cryptocurrency to the protocol to borrow DAI at a 150% minimum collateralization ratio (for ETH). They can earn passive income, unlock asset liquidity, or multiply their exposure to other assets.

MakerDAO also uses a liquidation system to protect the protocol from unhealthy positions. Users are incentivized to be liquidators, or Keepers, to cover undercollateralized positions caused by the depreciation of the underlying asset. Since stablecoins can easily depeg if not kept in check, the protocol must have the means to both mint and burn DAI depending on the fluctuations of USD. A de-pegging event could result in billions of dollars lost during a “death spiral.”

When a user supplies collateral to a Vault and chooses to borrow against it, DAI is generated. When the underlying asset is exposed during the liquidation process, the DAI is then destroyed. This network of Keepers is crucial for maintaining the stability of DAI along with the auction parameters designed for the safety and dependability of liquidations.

MakerDAO Liquidation Basics

Liquidations in the MakerDAO network are triggered by automated Keepers, which watch Vaults with the potential to fall below the Liquidation Ratio. This results in an auction of the outstanding debt and the Liquidation Penalty to cover the position. There are two major ways for Vaults to become unhealthy and eligible to be liquidated: the borrowed digital asset can gain value relative to the underlying asset used as collateral, or the underlying asset can depreciate relative to the borrowed asset. The owner of the Vault may either supply more collateral or partially pay off their position to return their Vault to a healthy status. Failure to do either of these before their Vault falls below the Liquidation Ratio will likely result in a Keeper triggering an auction on that Vault. The Liquidation Ratio is asset-dependent and is determined by the following formula:

Liquidation Ratio = (Collateral Amount x Collateral Price) ÷ Generated DAI × 100

Unlike other lending protocols like Aave or Compound, MakerDAO uses its Dutch Auction System for liquidations. Instead of a first-come-first-serve model, Keepers are incentivized to initiate liquidation auctions on undercollateralized Vaults, triggering a bidding process in which the initial asking price is high but decreases over time according to preset parameters. Other Keepers are then able to set a buy-in price, much like a limit order, at which a predetermined amount of collateral can be automatically purchased if the bid price drops below a certain threshold.

An acceptable bid price is closely tied to the arbitrage opportunity associated with the underlying asset, as Keepers bid to see who will accept the lowest collateral discount and then use it to find profitable arbitrage. In an attempt to “provide easier, less expensive, and more flexible participation,” liquidations in the MakerDAO protocol require no collateral besides enough ETH to cover transaction and stability fees. This is made possible by Maker’s exchange-callee contract.

Below is a visual model of an auction that compares the bid price versus the total auction running time. The dotted red line indicates the Price vs. Time Curve (PVT Curve) responsible for determining the bid price throughout the duration of the auction. While determining the most effective price curve is still an active area of research, according to MakerDAO, “some initial options like linear, step-wise exponential, and continuous exponential have been implemented for research purposes and initial deployment.” PVT curves are known at the start of an auction so users can effectively determine their bidding strategies based on the future of the curve.

Figure 1: Price versus Time curve (PVT).

In their LIQ2.0 system, MakerDAO now allows for partial bidding, meaning any number of users may purchase some or all of the outstanding collateral. This allows those with less ETH at their disposal a chance to participate in liquidations without spending incredible amounts on transaction and gas fees. Additionally, as the Dutch Auction System settles bids instantly, the “lack of a lock-up period mitigates some price volatility risk for auction participants and allows for faster capital recycling.” The lack of lock-up is especially important for Maker liquidations. Without it, this period could prove fatal for arbitrage opportunities in fast-moving markets.

An auction either lasts until the outstanding debt and penalty is fully covered or until the maximum duration is reached (decided by the tail or tau governance parameter, currently set to 72 hours). If an auction terminates before the unhealthy position is fully covered, it will then be eligible for a redo, a process which Keepers can trigger to receive the same DAI incentive as the initial auction.

Building an Automated Auction Keeper

In an effort to bolster amateur participation in the protocol, MakerDAO provides several accessible resources to assist in getting a Keeper up and running. In fact, in order to encourage human interaction within the protocol, MakerDAO has future plans to cut out the middleman completely and integrate bidding directly from the MetaMask extension. Several GitHub repositories such as Maker Market Keeper, Bite Keeper, and the official Auction Demo Keeper work straight out of the box with simple codebases designed to be customized with user-specific strategies. For these Keeper bots, there are two primary profit opportunities:

- Seeking out undercollateralized Vaults and triggering the auction process or, for a similar reward, restarting liquidation auctions that have passed the auction deadline

- Using a preset bidding model to participate in collateral liquidation auctions, and then, if desired, trading the purchased collateral for profit via an arbitrage opportunity.

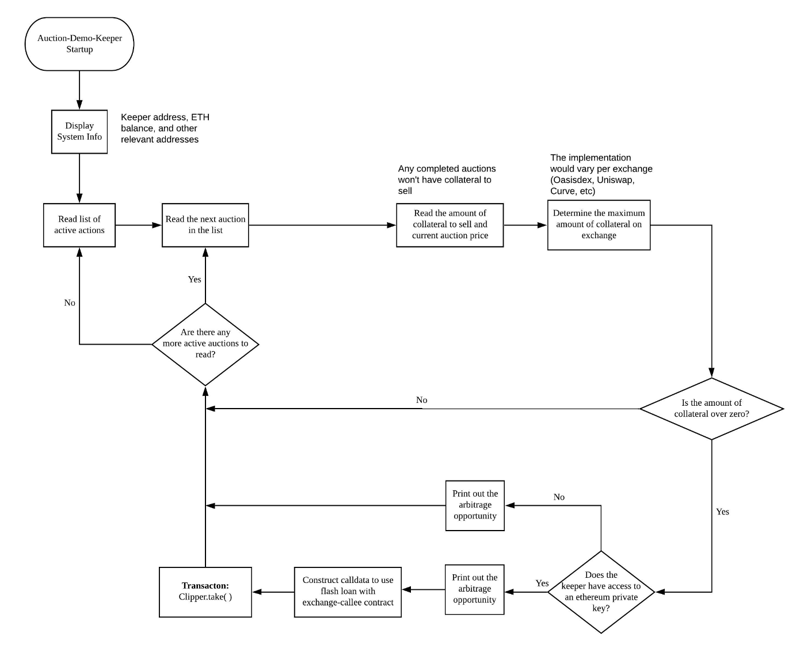

Now, let’s take a look at the basic workflow of MakerDAO’s Auction Demo Keeper, or ADK.

Figure 2: Workflow of MakerDAO’s Auction Demo Keeper.

The ADK is a relatively simple automated system. It reads active liquidation auctions, validates their status, calculates arbitrage, and executes flash loans if an arbitrage opportunity presents itself.

Using MakerDAO’s secure exchange-callee contract, the ADK swaps auctioned collateral for DAI using a DEX like Uniswap, returns DAI to the auction to cover the bid and collects a DAI profit from the spread - all in a single transaction. The Keeper only needs ETH for gas to participate in LIQ2.0 liquidation auctions. To facilitate more advanced bidding models, Maker also offers the auction-keeper repository which allows for plug-and-play with either custom models or models created by the community. Of course, simpler models may lose out to more complex models which actively scan all available digital assets across several markets for arbitrage opportunities and bid accordingly, but given the right circumstances with partial bids, basic model can see success.

In summary, MakerDAO is a beginner-friendly DeFi lending and borrowing protocol that uses Keepers and liquidation auctions to incentivize the liquidation of unhealthy loans. Contact Us to learn how Amberdata can provide the data infrastructure you need to succeed in DeFi and the crypto market.

Amberdata

Amberdata is the leading provider of global financial infrastructure for digital assets. Our institutional-grade solutions deliver data, analytics and comprehensive tools and insights that empower financial institutions to research, trade, and manage risk and compliance in digital assets. Amberdata serves as a...