Amberdata Derivatives Newsletter: Markets Turn Bullish as Trump Revives Trade Talks

.png)

Markets are turning bullish as Trump’s Asia trip revives trade talks and risk sentiment, while softer inflation and an expected dovish Fed stance fuel optimism for a year-end rally. Volatility has cooled across equities and crypto, with BTC and ETH stabilizing after the October 10th selloff. Traders are eyeing long-delta and short-vol setups into December as Contango steepens. Learn more in the Amberdata Derivatives Newsletter:

Visit Amberdata.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Authors have holdings in BTC, ETH, and Derive and may change their holdings anytime.

USA Week Ahead (ET):

- Wednesday 2pm - FOMC

- Wednesday 2:30pm - FOMC - Press Conference

- Thursday (South Korean Morning Time) - Trump-Xi meeting

- Thursday 8:30a - GDP

- Friday 8:30a - PCE

MACRO Overview

President Trump is currently in Asia negotiating trade deals and peace deals.

So far, it sounds successful as a peace deal between Cambodia and Thailand has been started, and trade deals executed.

China/US talks look like they’re back on track, and the meeting between Trump and Xi this Thursday is back on!

This is the FIRST meeting between the leaders since the Trump 2.0 term started.

I would call this very bullish for risk assets.

We also have the FOMC rate decision on Wednesday, followed by Powell’s press conference.

CPI was released last Friday and came in slightly below expectations (+3% vs %3.10 expected).

This was a positive reading that sent stocks rallying on Friday.

Chart: VIX (ThinkOrSwim) Schwab.com

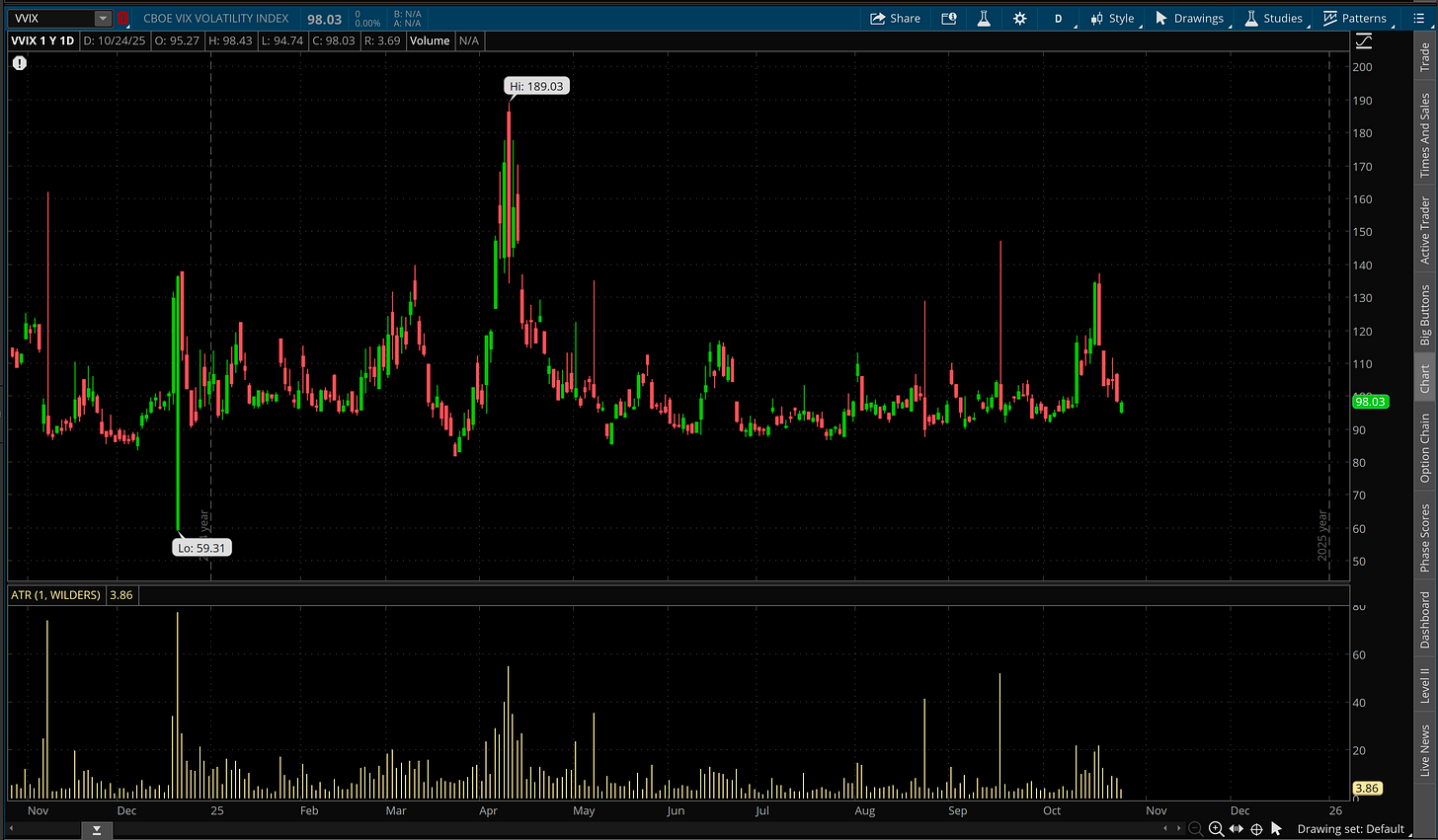

Chart: VVIX (ThinkOrSwim) Schwab.com

Looking at the VIX complex, the October 10th volatility rise was extremely short-lived and quickly got sold.

VIX and VVIX are both back near 12-month lows. This makes me think that this was “it” for bears. We have a lot of reasons for markets to rally into year-end, especially as the Fed is likely to continue in the rate cutting cycle… if anything, any surprises are likely to lean dovish (not hawkish).

Trump and Putin are having a tiff right now, with Trump adding sanctions to Russian oil producers sending /CL from $56 → $62, but I think this is likely a good selling opportunity for /CL.

I wouldn’t want to bet against the lower oil trend right now (short-term / medium-term).

Friday we also have PCE inflation numbers released. This is the Fed’s preferred inflation gauge and used as the 2% inflation target.

BTC: $113,639 (+4.8% / 7-day)

ETH: $4,065 (+2.0% / 7-day)

SOL: $198.89 (+4.1% / 7-day)

Crypto Options Overview

Bitcoin and the broader crypto markets experienced a pull-back on the October 10th “liquidation event”, due to tariffs fears, alongside all risk-assets.

This week the SPX had a couple sharp down-days but really consolidated throughout the week, the same is true of BTC.

The narrative of a year-end rally is still in the cards and the volatility surface is providing good opportunity for that exposure.

(Thesis Bias #1: long delta into EOY)

Chart: Deribit DVOL index 30-dte (pro.amberdata.io)

We can see that since the start of 2025 Bitcoin volatility has had a consistent trend lower. Only recently, on the back of the October 10th “liquidation event” did vol manage to pop higher.

The base assumption here is that volatility will probably resume its down-trend and the recent volatility “pop” is a good selling opportunity.

(Thesis Bias #2: volatility likely to resume a trend lower)

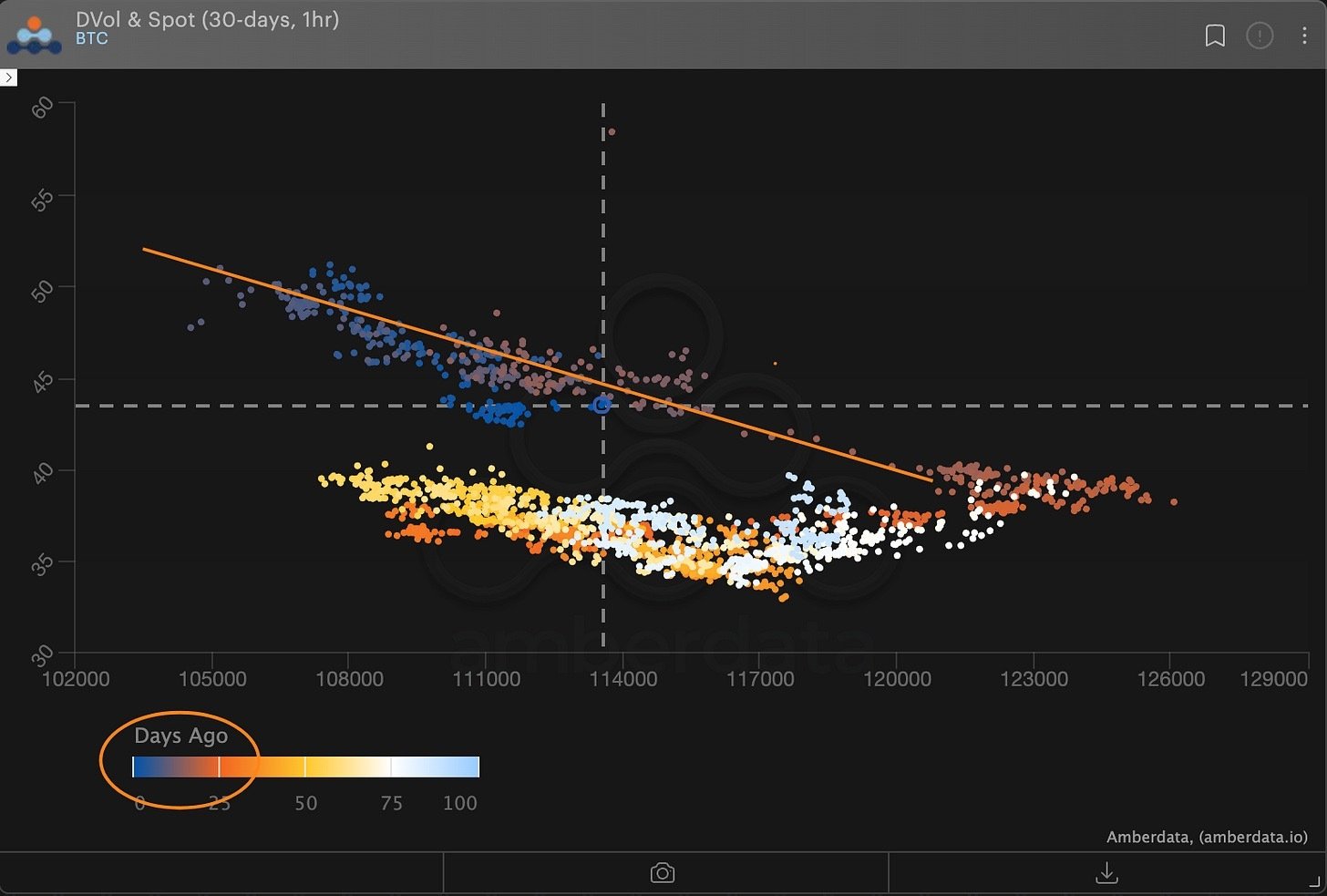

Chart: Spot prices (Vs) DVol index

The chart above highlights the source of the volatility spike was a crash lower in spot prices.

Chart: DVol index (Vs) Spot Prices

If we look at the scatter plot of spot prices (vs) the DVol index we can also see the negative correlation between spot-vol recently.

Now, I find this very interesting because it means the long delta bias naturally hedges the short-vol bias.

(Thesis Bias #3: spot/vol remains negative)

This is a nice combination for Call (+1)x(-2) spreads, or a broken-wing fly, because as prices rally lower volatility diminishes the short calls.

The next assumption revolves around the selection of the option expiration.

The EOY rally is the initial assumption for the long delta trade, but is a DEC expiration cycle the best pick?

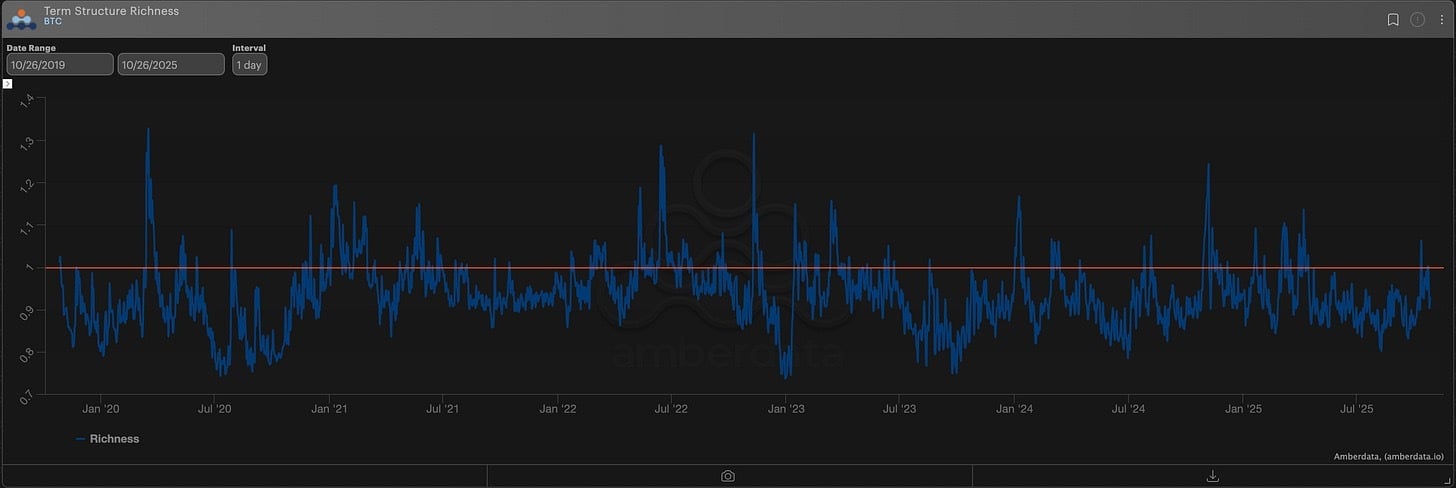

Chart: BTC IV term Structure Richness

Looking at the term structure richness above, we can see that the volatility term structure briefly flattened during the liquidations of Oct 10th, above 1.00, but the term structure is now headed back lower.

That means that Contango becomes very power in terms of expiration selection.

Not only does a shift lower in volatility help the short vega leg of the trade, but a steep Contango provides significant option decay as expiration approaches.

(Thesis Bias #4: Contango steepens)

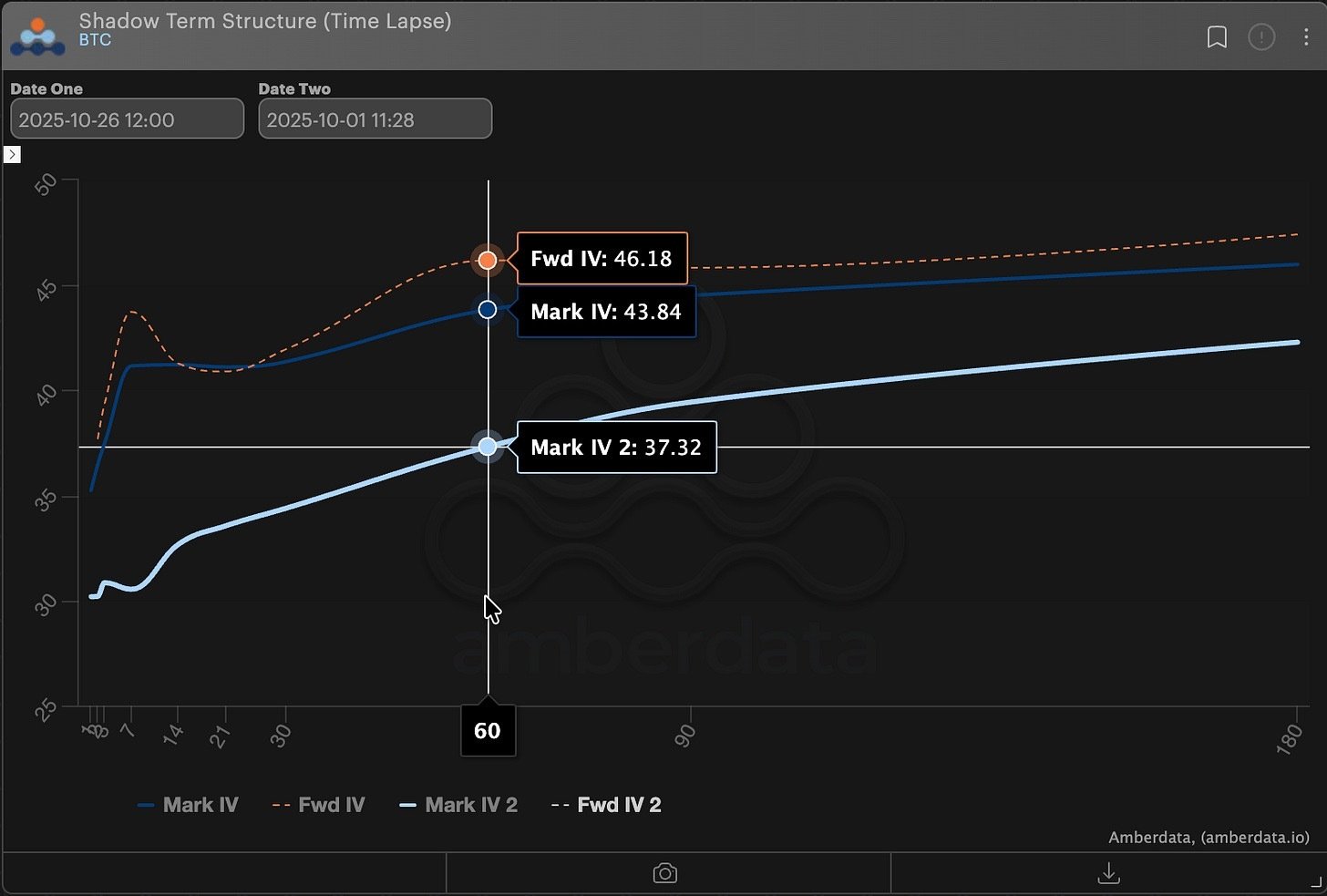

Chart: Time-Lapse BTC Term Structure

Looking at the current term structure for BTC at-the-money volatility on Deribit between now and October 1st, We can see the current volatility term structure is about +10pts higher today.

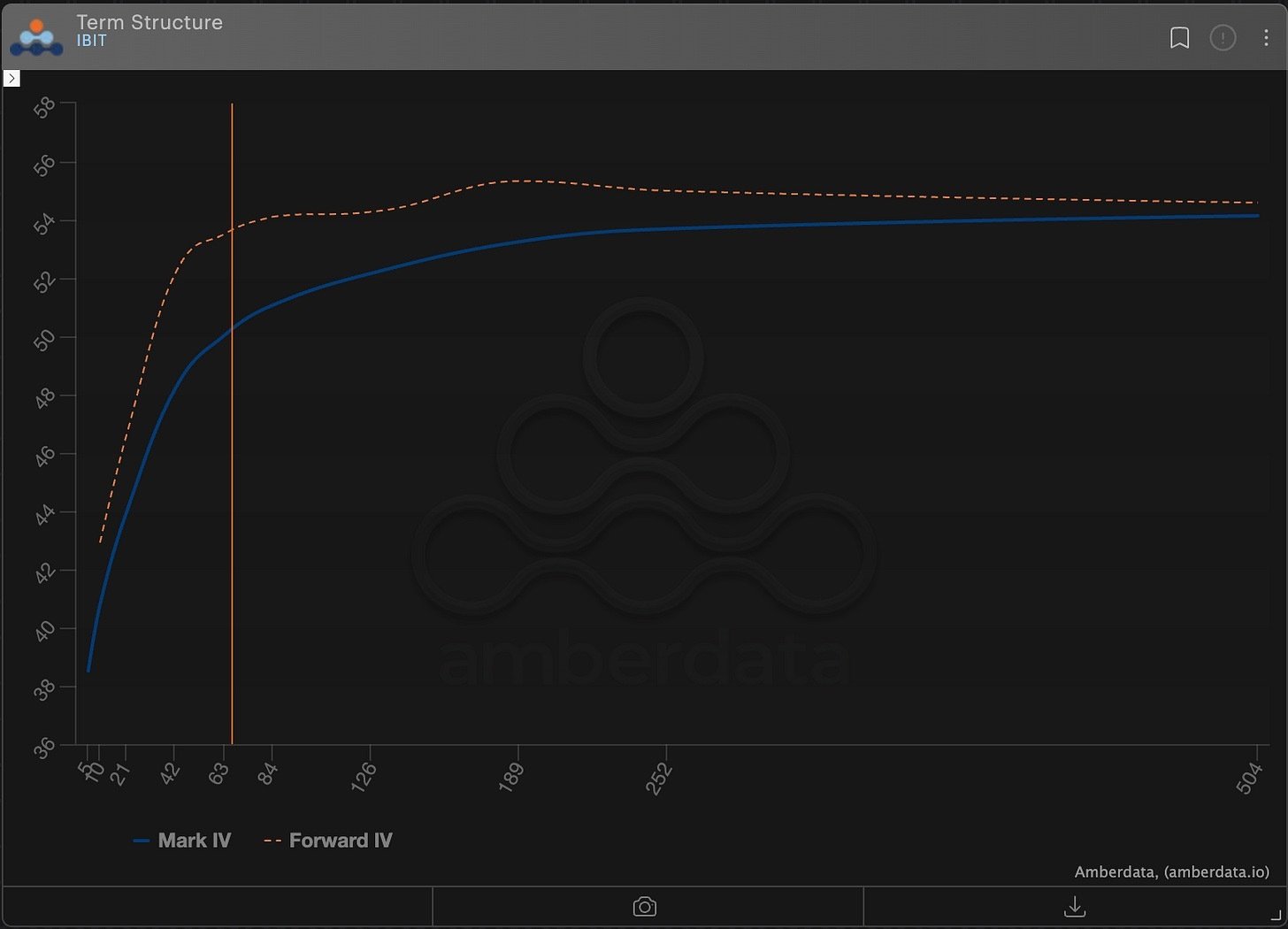

Chart: IBIT Term Structure

Headed out to the current IBIT side of things, if we look at the December expiration cycle (54 dte) range, we can see Contango really starts right around that area.

This means that short-volatility for 54-dte DEC options are my favorite pick.

I think volatility can parallel shift lower, Contango can steepen further, spot rallies, and negative spot/vol relationships hold.

Im currently looking at structures like the IBIT Dec +70Call(1x)/-85Call(2x)

Delta = +11

Vega = -.22

Assuming the assumptions hold, as the market rallies, volatility drops and short gamma gets offset by short Vega.

As time decays away, deltas pick-up, while spot smoothly rallies higher.

As the term structure steepens, these effects are accelerated.

Disclaimer: Not financial advice, just thinking around my market assumptions and how to capture them.

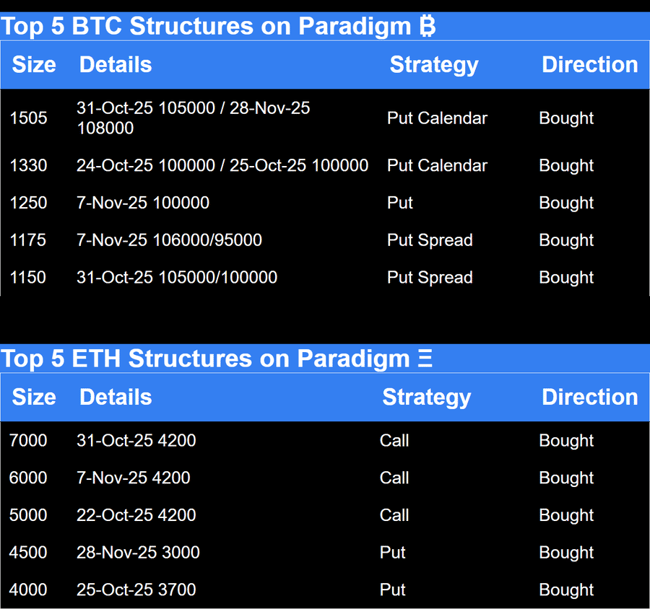

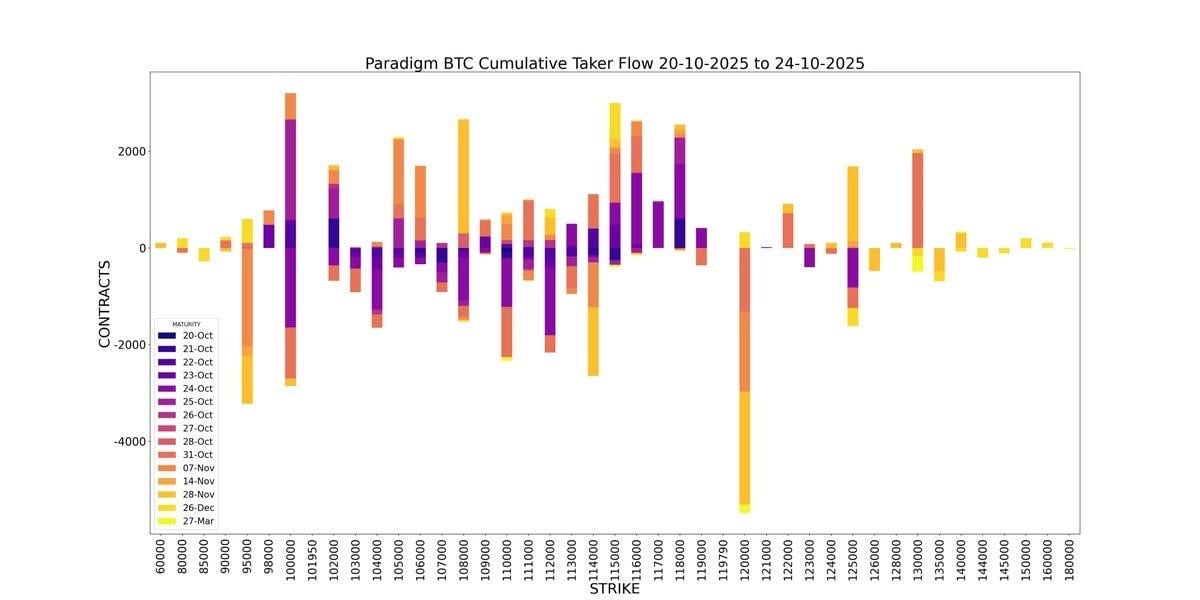

Paradigm Top Trades this Week

BTC Cumulative Taker Flow

ETH Cumulative Taker Flow

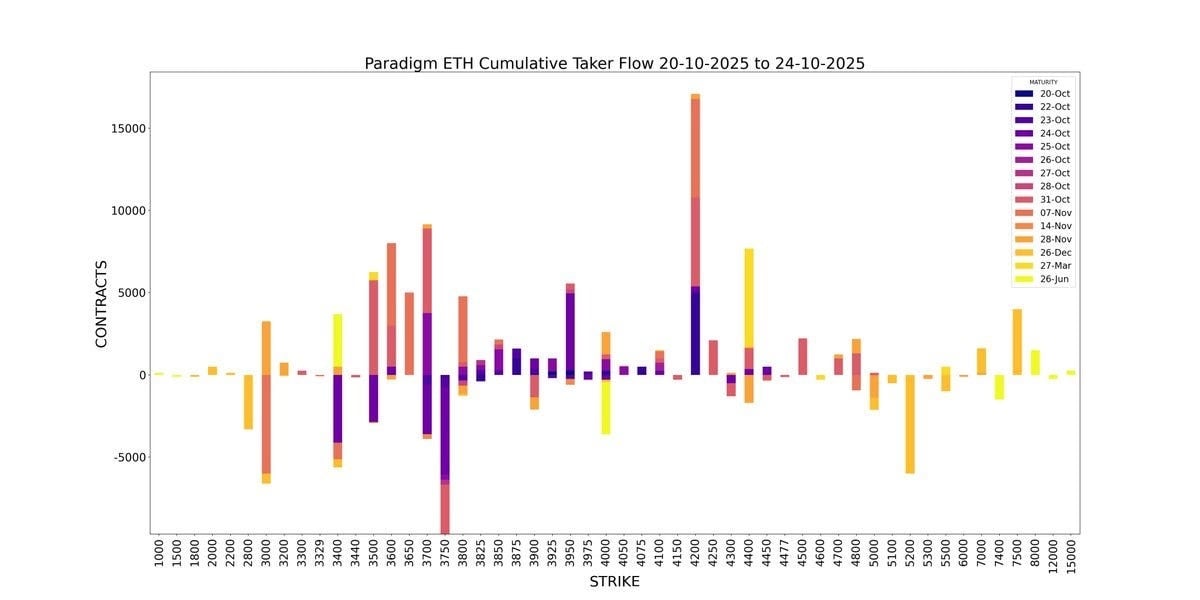

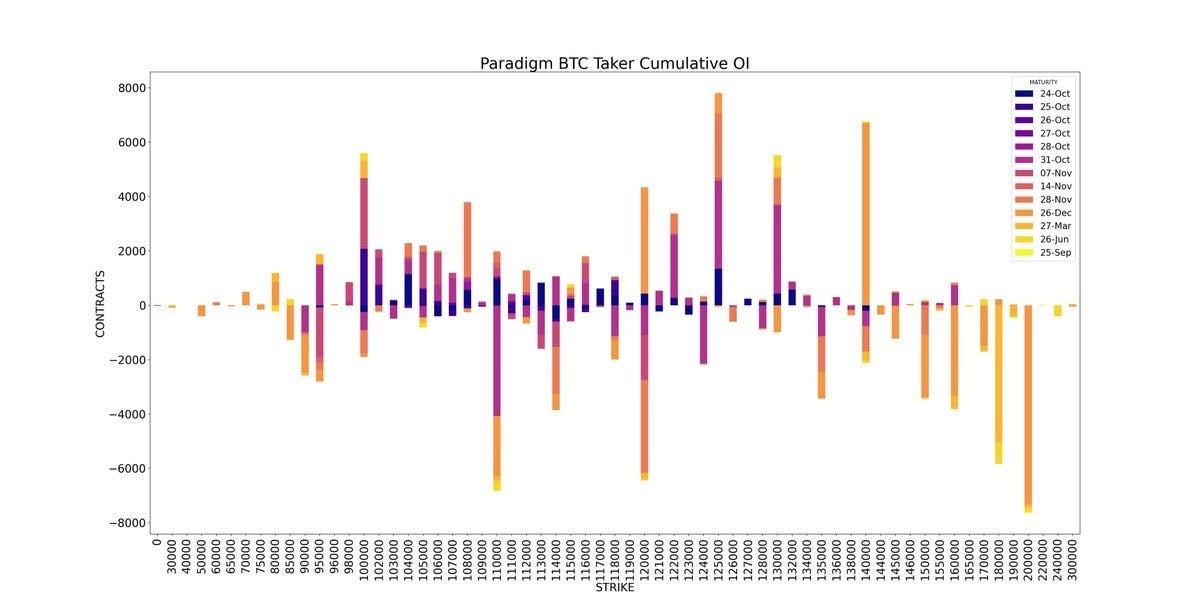

BTC Cumulative OI

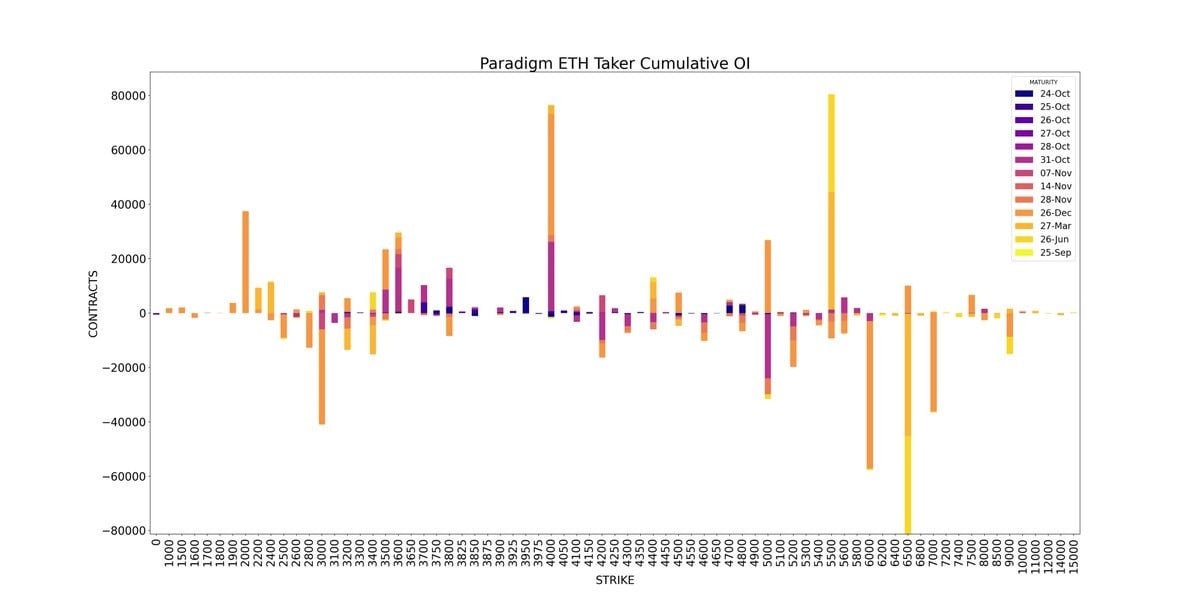

ETH Cumulative OI

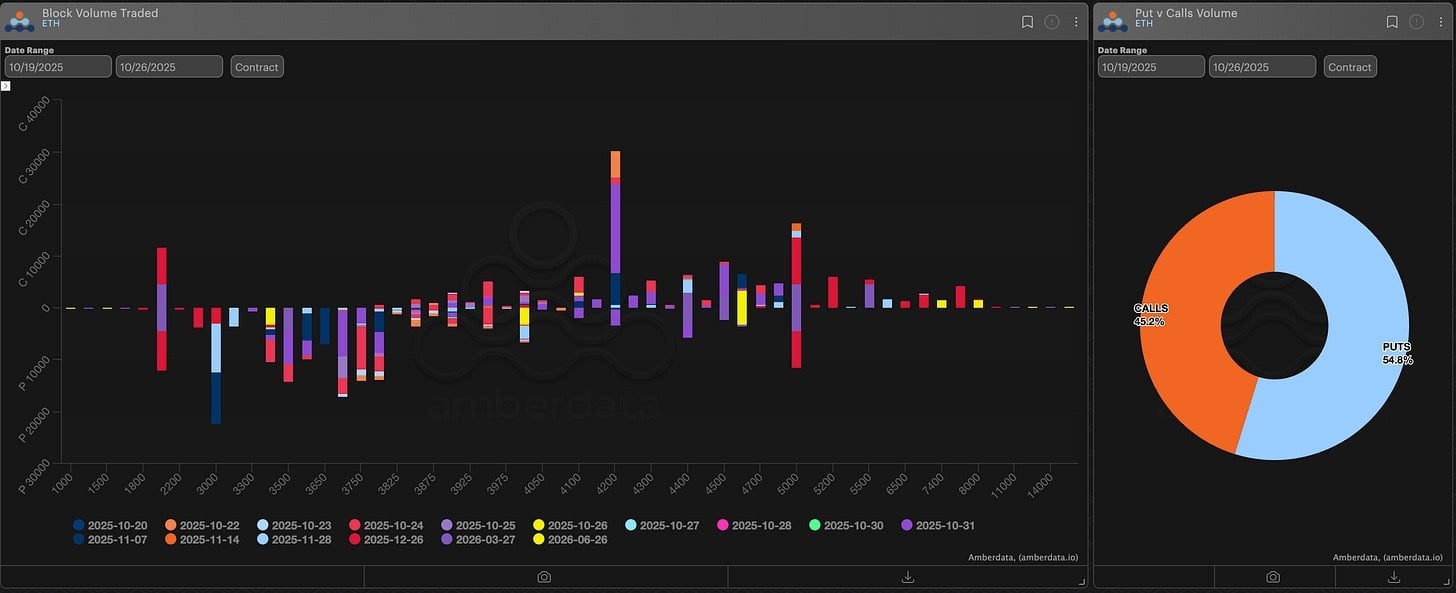

BTC

ETH

AMBERDATA DISCLAIMER: The information provided in this research is for educational purposes only and is not investment or financial advice. Please do your own research before making any investment decisions. None of the information in this report constitutes, or should be relied on as a suggestion, offer, or other solicitation to engage in, or refrain from engaging, in any purchase, sale, or any other investment-related activity. Cryptocurrency investments are volatile and high risk in nature. Don’t invest more than what you can afford to lose.

Thanks for reading the Amberdata Derivatives Newsletter!

Subscribe for free to receive new posts and support my work.

Greg Magadini

Greg Magadini is the Director of Derivatives at Amberdata. Previously, he co-founded Genesis Volatility (later acquired by Amberdata). Greg Magadini started his career as a proprietary trader for DRW and Chopper Trading in Chicago IL. Greg has nearly 15-years of options trading experience and has been active in the...