How Amberdata Builds on AWS to Unify Digital Asset Data for Institutions

Informed decision-making is a valuable process to which many startup founders relate. Whether during product development, assessing market fit, or meeting customer needs, timely and accurate information can be the difference between success or failure.

Web3 startup Amberdata—who recently closed a $30 million series B funding round—is taking the value of informed decision-making and scaling it across an emerging sector: digital asset data.

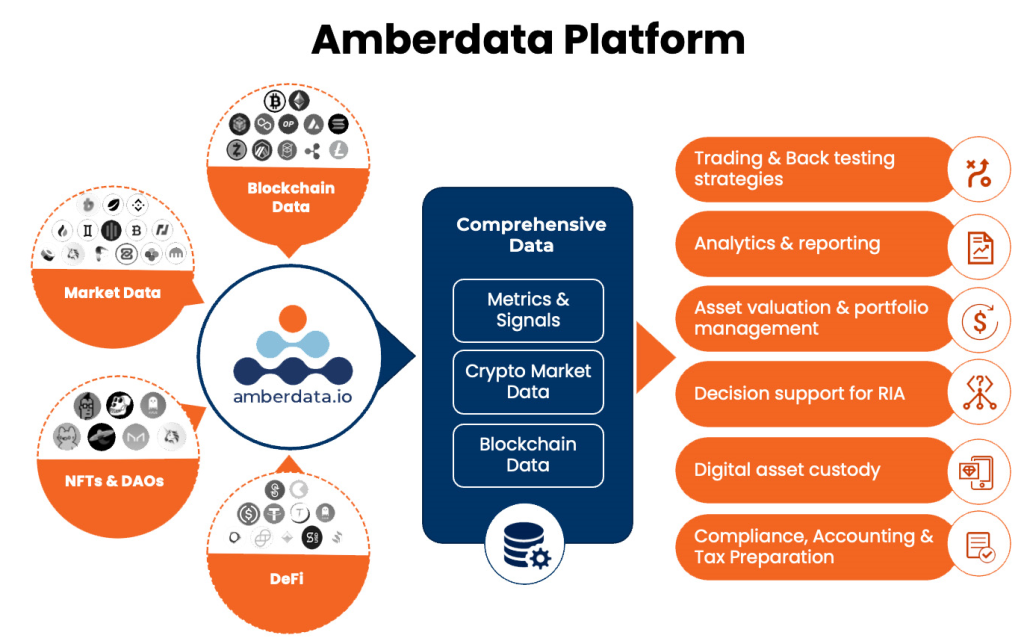

Digital asset data includes:

- Cryptocurrency (crypto) market data, such as live and full historical prices for specific crypto assets.

- Blockchain data, which includes records of network data, contracts, events, and logs for every digital asset.

- Decentralized finance (DeFi) data, which provides insights ranging from digital wallet earnings and losses, transactions, and balances to DeFi asset level data including trading pairs by volume, price, and time.

With 16% of US adults using cryptocurrency—whose market value sat just above $2 trillionearlier this year—and the US government unveiling a plan to regulate digital assets, it is understandable that institutions see digital asset data as “mission critical” to their success.

Amberdata provides institutions with a unified data integration point from which to glean up-to-date insights about crypto markets, blockchain networks, and decentralized finance.

Becoming the leading provider of digital asset data to financial institutions

The inspiration to found Amberdata in 2017 was the initial coin offering (ICO) hype, when co-founders chief executive officer (CEO) Shawn Douglass, chief operations officer (COO) Tongtong Gong, and chief technology officer (CTO) Joanes Espanol—who are all former colleagues—became intrigued by the crypto world.

COO Tongtong Gong recalls, “We started reading a lot about Ethereum, smart contracts, and tokenization,” which led to, “going down the rabbit hole of wanting to learn more about the crypto industry.”

She and her co-founders, “realized there was not enough data and tooling to enable access to clean, normalized, easy-to-ingest and understand data to help people in the digital asset space.”

They began building a platform to provide institutions with the tools and data necessary to adopt crypto offerings and meet clients’ demands for an alternative asset class.

“When you start a company, all you have are your co-founders, six slides, and a dream, right?” says Tongtong with a laugh.

Fast-forward five years and Amberdata is now the leading provider of digital asset data to financial institutions, who use the platform to make informed decisions while accelerating their time to market.

The Amberdata platform (Figure 1) allows clients to leverage a broad, granular dataset to offer digital asset product and services to their customers, while sidestepping the significant hurdle of creating and managing an in-house data pipeline:

Figure 1. The Amberdata platform unifies digital asset data to support the needs of financial institutions.

Building their success with AWS

Choosing Amazon Web Services (AWS) to host Amberdata’s cloud-native platform, “was the easiest decision for us to make when starting the company,” says Tongtong. Along with the three co-founders’ prior experience building on the AWS tech stack, they also chose AWS because, “It’s easy to hire developers when AWS is your platform because so many of them already have the knowledge to use it.”

Amberdata joined AWS Activate, a free program designed for startups and early stage entrepreneurs that offers the resources needed to get started on AWS.

Continue reading "How Amberdata builds on AWS to unify digital assets for institutions"