Welcome to Amberdata Derivatives Fresh New Features where we go in-depth on features that have recently been built for our ADD customers. Analyzing the Volatility Smile in both Strike View & Delta View

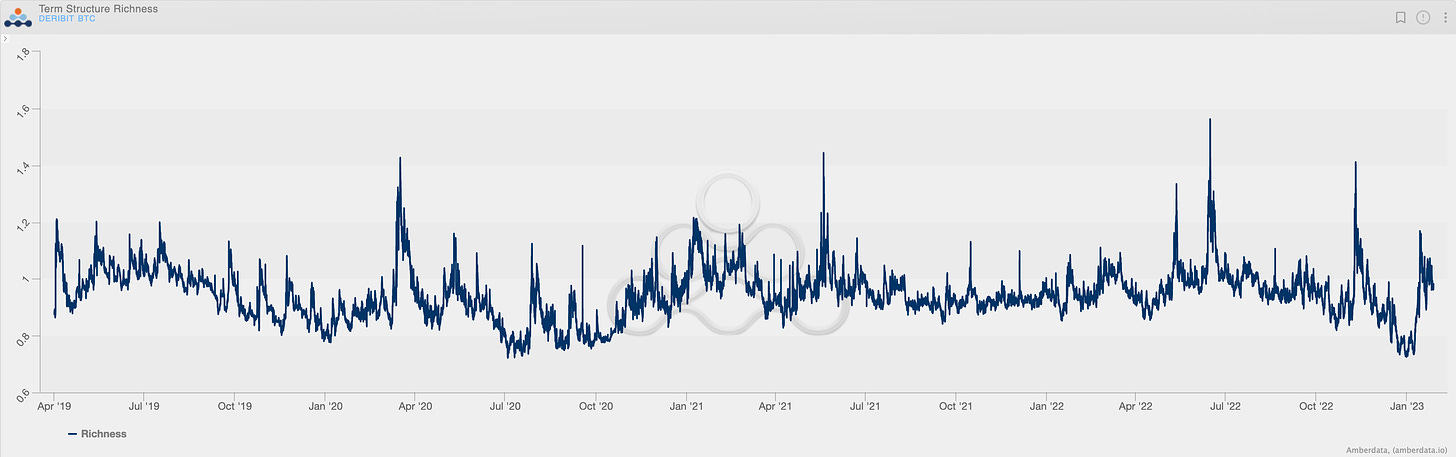

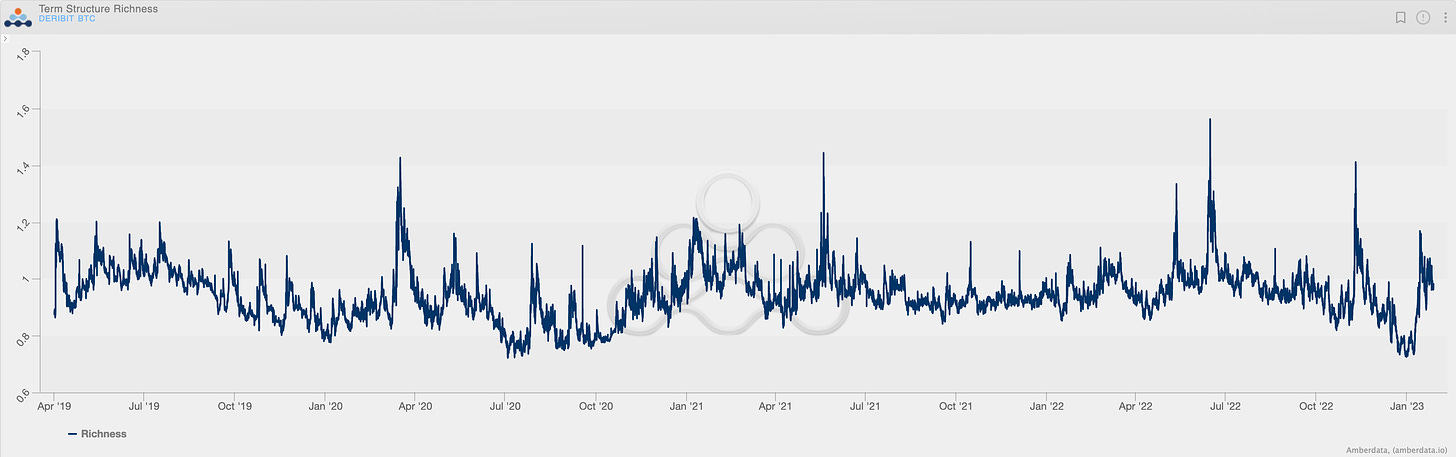

Term Structure Richness

The “Term Structure Richness” is the relative “level” of the Contango or Backwardation shape. A reading of 1.00 would be a perfectly flat term structure - as measured by our method - while readings below/above represent Contango/Backwardation respectively. Using the term structure levels enables us to quantify how extended the term structure pricing currently is, at any point in time.

Straight out from our recently released report, link here, the extent of Contango/Backwardation is measured using the relative spreads of 7-day, 30-day, 60-day, 90-day, and 180-day ATM volatilities.

How to find this chart? Options → Deribit → Historical

Find the chart HERE:

Click here to learn more about Amberdata.

Amberdata

Amberdata is the leading provider of global financial infrastructure for digital assets. Our institutional-grade solutions deliver data, analytics and comprehensive tools and insights that empower financial institutions to research, trade, and manage risk and compliance in digital assets. Amberdata serves as a...