BTC, ETH, SOL Outlook After Government Shutdown & NVDA Earnings

.png)

Markets are recalibrating after the government shutdown, with missing October data making December rate expectations uncertain. Crypto volatility is spiking, BTC may bounce toward $100K after NVDA earnings, and altcoins face higher risk. Traders and investors should watch for potential forced selling and market shifts.

-

Monday 8:30a - Empire State manufacturing survey

-

Tuesday 10:00am - Home builder confidence index

-

Wednesday 2pm - FOMC Minutes

-

Thursday 8:30a - US unemployment

-

Friday 9:45a - US Flash Manufacturing & Services

*Various Fed Governors Speak throughout the week*

MACRO Overview

After the government shutdown finally ended, the markets are now focused on the December rate cut and a spate of missed government data for October.

It’s now expected that the October inflation data and jobs data won’t ever be released.

The ADP release on Nov. 5th is likely the most reliable set of jobs data for October, which came in +42k (vs +32k expected) but September was revised down to -29k.

Unlike the payrolls data, the unemployment rate is determined from a house-hold survey, which requires government workers to “make calls” to collect the survey data.

The current US employment environment is unique, in the sense that payroll hiring has been weak while the unemployment level (currently 4.3%) has remained low.

(click here for chart)

This is likely a combination of weak hiring being offset by immigration tightness, which affects both job supply and demand… Creating some form of equilibrium between the two.

The FOMC minutes are going to be released this Wednesday and provide insights into how the Fed is divided between balancing inflation and employment.

Boston Fed governor Susan Collins last week said she thinks the bar for further rate cuts remains high.

Given that the Fed has been very data dependent over the past couple years, the lack of economic data (due to the government shutdown) tilts the December 10th FOMC towards a HOLD in my opinion.

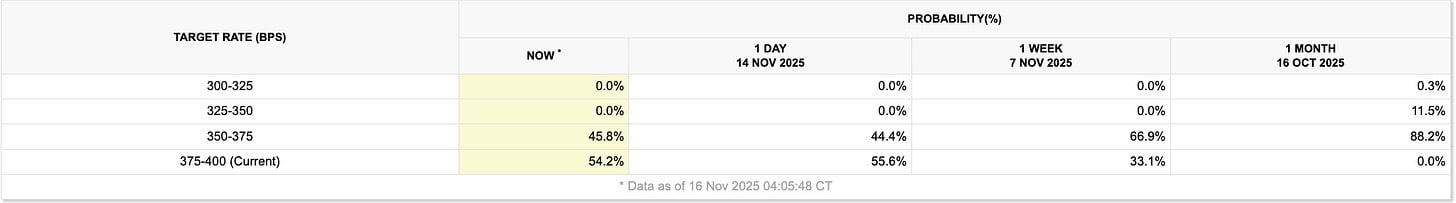

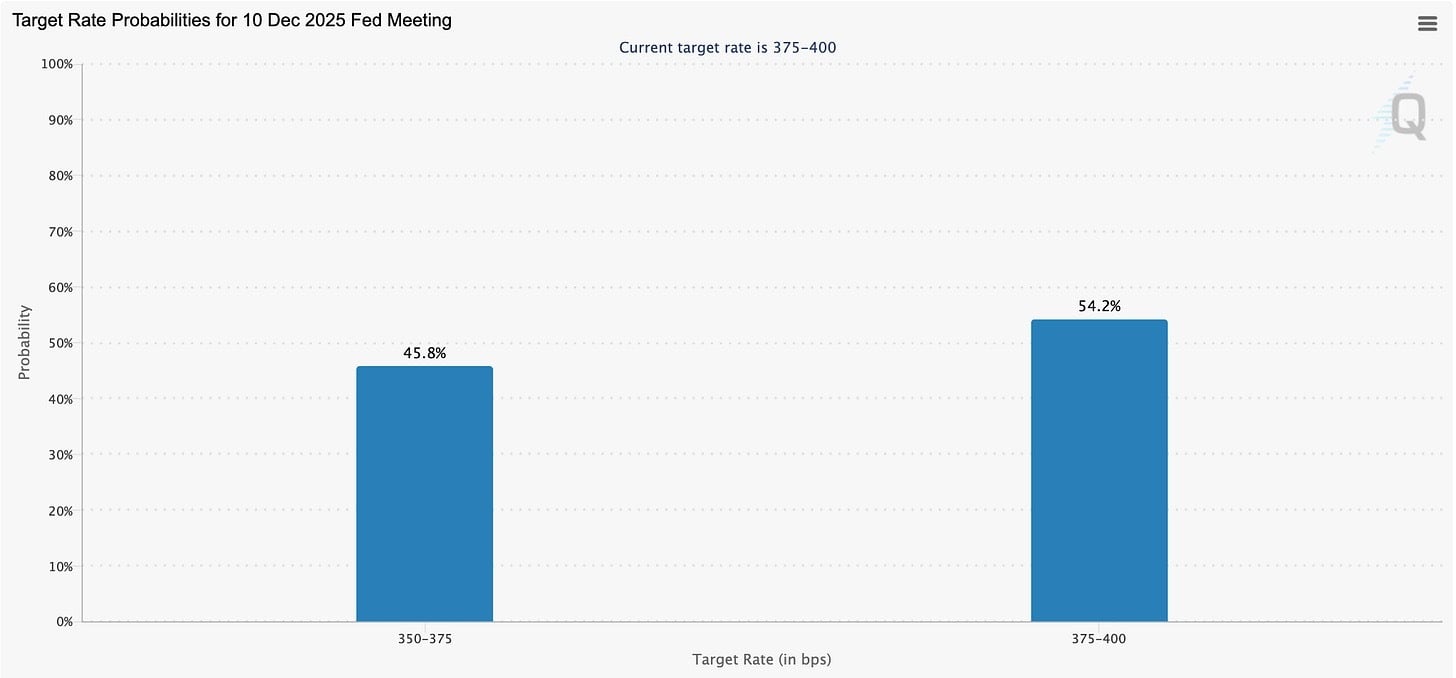

We can see the shift if DEC 10th cut probabilities has shifted a lot over the past few weeks.

One month ago the probability for a rate hold was 0%, today it stands at 54%.

(click here for link)

We see about 50/50 odds between a 25bps rate cut or a rate hold.

This brings us to the bigger picture for the crypto environment and the overall picture for risk-assets.

Today the S&P-500 has a large concentration risk in the AI bet. Something like 40% of the S&P-500 is exposed to AI Tech. A lot of the future of AI relies on CapEx buildout financed in large part by debt issuance.

This narrative is coming into question.

Bond supply is coming from AI and large government deficits. Where does that leave crypto DATs?

Crypto DATs have also issued fixed debt to enable crypto purchases, think MSTR issuing convertibles to finance BTC purchase… What happens if crypto drops and credit market simultaneously freeze?

DAT crypto buyers become net sellers? How does that impact the market, and does that cause a downward spiral?

Something to keep in mind!

BTC: $93,410 (-10.8% / 7-day)

ETH: $3,065 (-14.2% / 7-day)

SOL: $134.89 (-17.9% / 7-day)

Crypto Options Overview

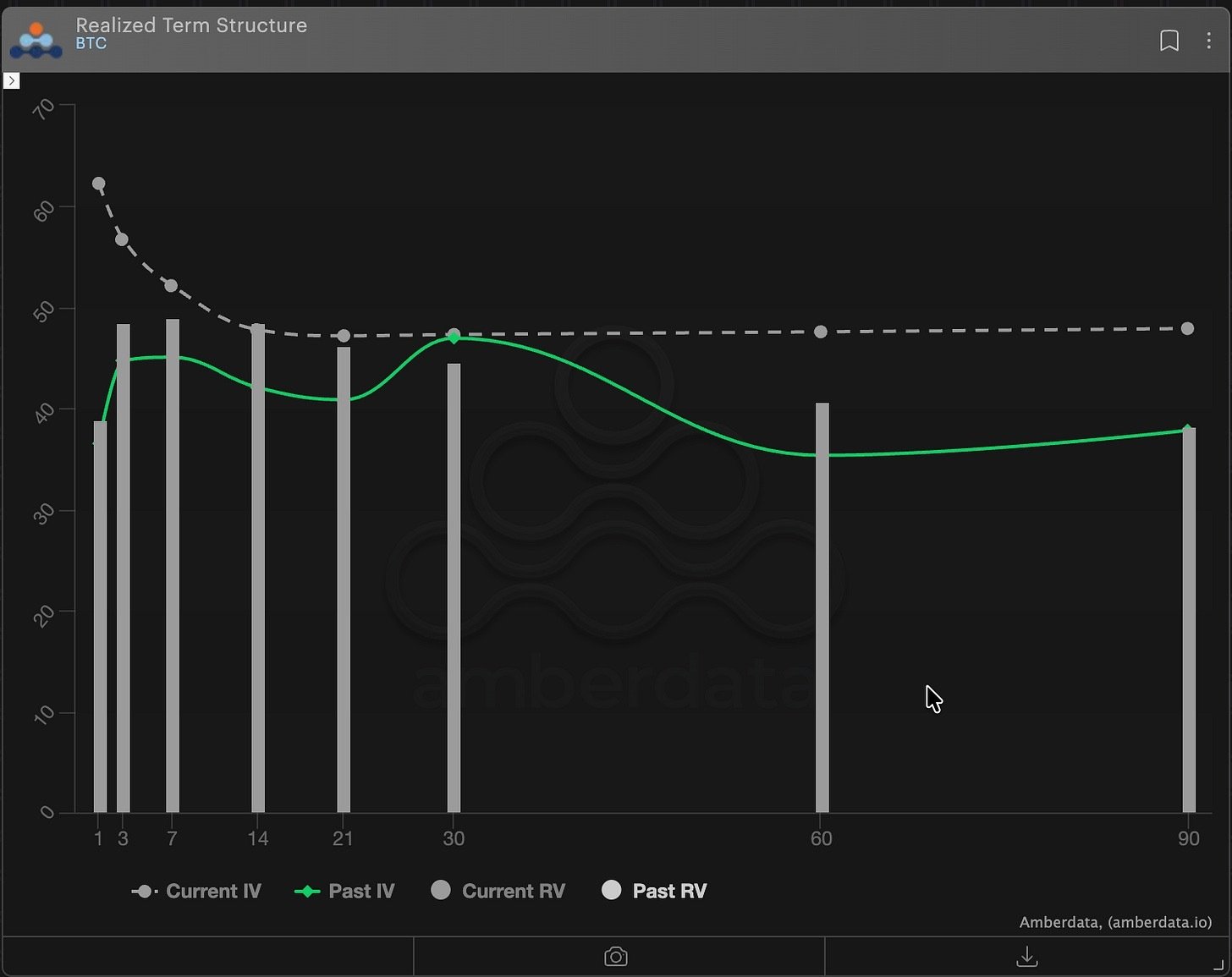

After last week's sell-off in BTC and risk assets, the current volatility environment is elevated.

The BTC term structure is in Backwardation as short-term option IV is elevated.

Chart: BTC Term Structure & RV (pro.amberdata.io)

This week we have NVDA earnings after market close on Wednesday. This equity vol. “event” is also going to affect BTC in my opinion.

Chart: BTC Term Structure Richness (pro.amberdata.io)

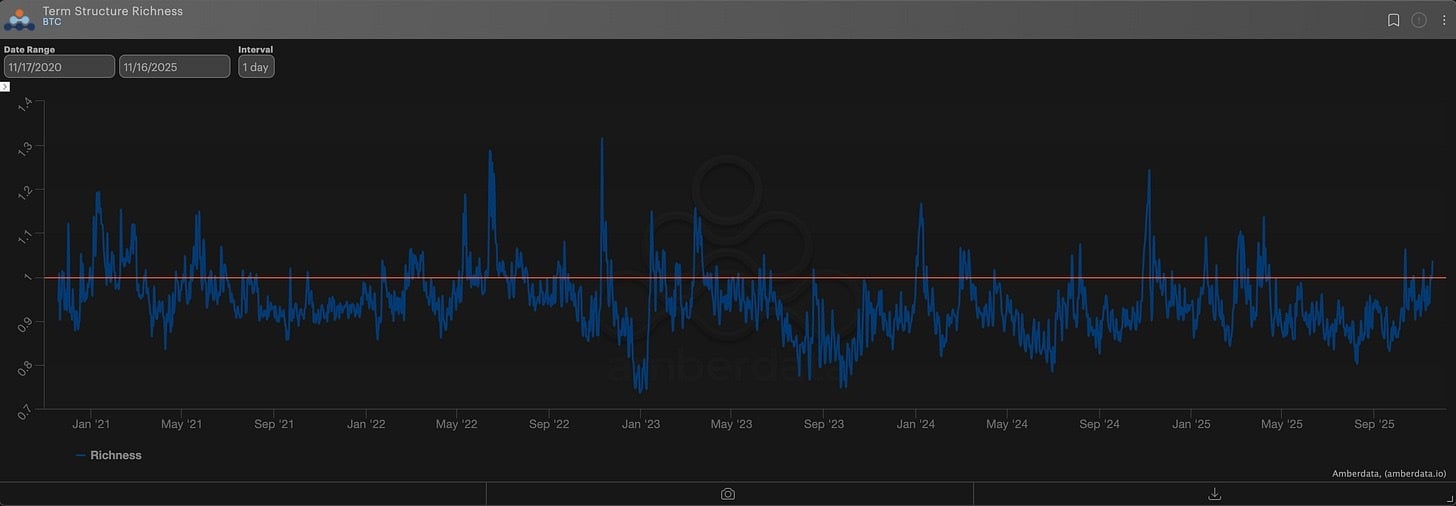

Given the volatility shape, levels and current spot prices, there’s likely a good trade around NVDA earnings that will enable some volatility normalization (and potential spot bounce in BTC).

An extended “term structure richness” chart lines up well for this thesis.

Chart: BTC ∆25 RR-Skew

It’s no surprise that the BTC RR-skew is very negative given the current spot/vol correlation, but this can provide an interesting play for the and NVDA upside (normalization) trade.

Something like a delta hedged RR-Skew Wednesday into NVDA earnings, given the vol is pricing a lot of the downside move already and spot likely attempts to test the $100k level again… Or an OTM call 1x2 structure has vol drops if spot rallies.

Beyond BTC I think ETH has a rough-road ahead. Unfortunately, ETH DAT buyers have gotten in later to the game. Companies like BitMine Immersion (BNMR) or ETHZilla (ETHZ) have average entry prices of $3600 and $3900 respectively.

MSTR has an average purchase price around $69k for BTC.

Therefore, ETH and other altcoins are going to me more susceptible to the downside spiral risk, should risk-assets break, as underwater holdings for volatile altcoins can create forced selling.

Paradigm Top Trades this Week

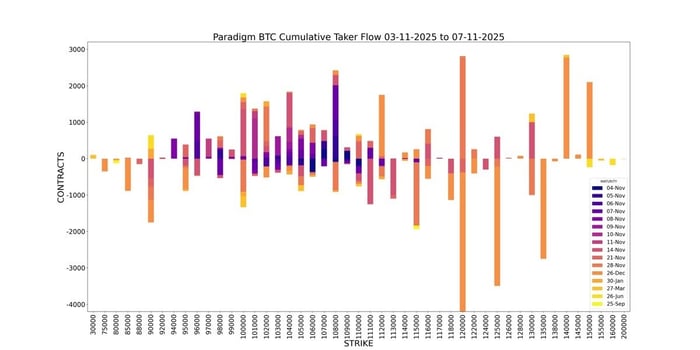

BTC Cumulative Taker Flow

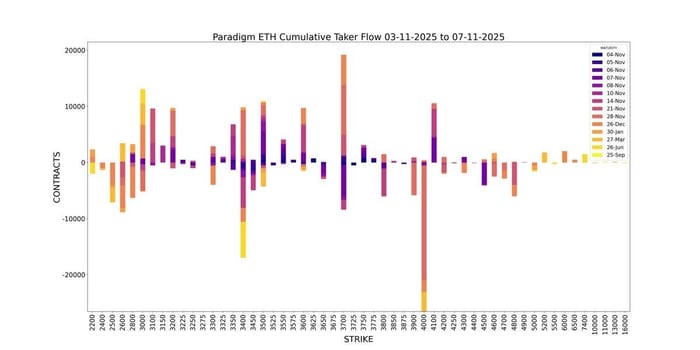

ETH Cumulative Taker Flow

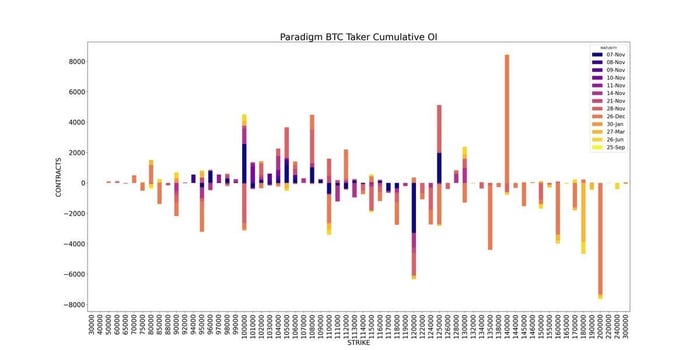

BTC Cumulative OI

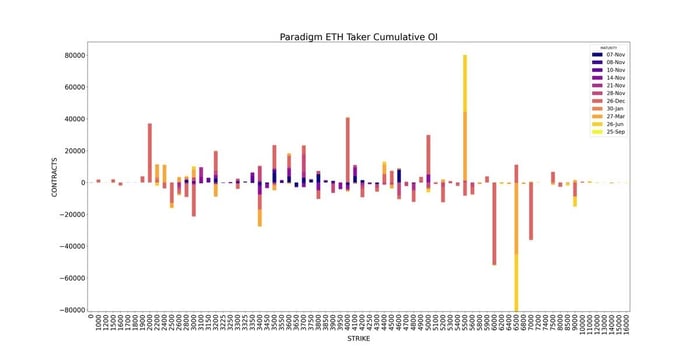

ETH Cumulative OI

BTC

ETH

Derive welcomes @FalconXGlobal as a market maker to help tighten spreads and deepen liquidity across our options markets. We’re building the best onchain options markets anywhere; now with institutional-grade participation starting to take shape.

Altcoin options are coming to Derive. After the recent market events, we’re listing altcoin options to give traders a smarter way to manage risk and hedge exposure. Let us know which alts you’d like to see first - get in touch.

AMBERDATA DISCLAIMER: The information provided in this research is for educational purposes only and is not investment or financial advice. Please do your own research before making any investment decisions. None of the information in this report constitutes, or should be relied on as a suggestion, offer, or other solicitation to engage in, or refrain from engaging, in any purchase, sale, or any other investment-related activity. Cryptocurrency investments are volatile and high risk in nature. Don’t invest more than what you can afford to lose.

Amberdata

Amberdata is the leading provider of global financial infrastructure for digital assets. Our institutional-grade solutions deliver data, analytics and comprehensive tools and insights that empower financial institutions to research, trade, and manage risk and compliance in digital assets. Amberdata serves as a...