Amberdata Derivatives Newsletter: Key Insights and Trends

- Monday 9:45a/10am ET - PMI & ISM

Disclaimer: Nothing here is trading advice or solicitation.

This is for educational purposes only.

Math-minded people here, pardon any typos.

MACRO THEMES:

Last week’s employment report came in mixed. The household survey showed a tick-higher in the headline unemployment rate (3.4% → 3.7%) while the payroll number beat expectations for job CREATION (+339k vs +190k expected)

(Check this video here for a recap on NFP methodology)

These mixed measures have Fed members talking about a June rate “skip” as opposed to a “pause”.

The Fed is clearly in a “wait-and-see” mode.

We also have a resolution to the Federal Debt ceiling, which seems to look like a lot of spending, essentially inflationary, essentially bullish.

All this combined with a slow week for US economic numbers and I can’t imagine a better set-up for “Theta Gang” traders to enjoy passage of time and lower vol.

TradFi vol is down a lot as well post economic numbers.

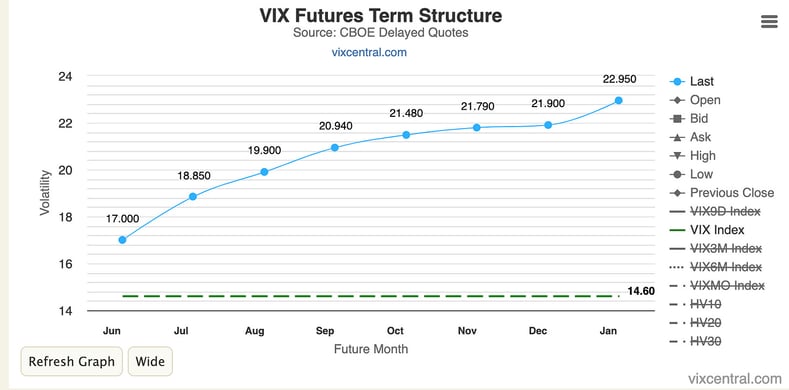

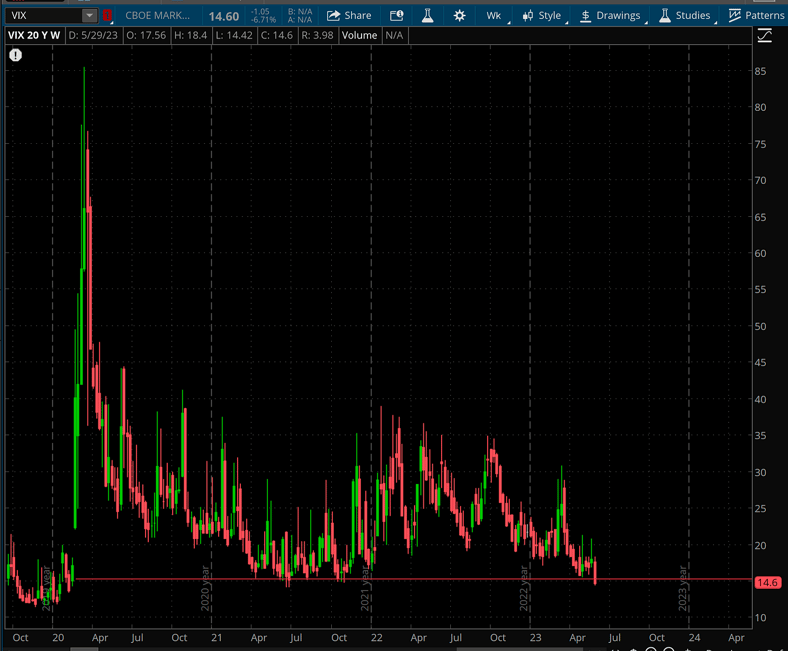

The VIX is now below pandemic levels, finally, and the VIX futures term structure continues to be in a steep Contango.

We’re looking at 11% “roll-down” yield for the front-month VIX future, while the CASH VIX breaks lower.

BTC: $27,307 (-2.7% / 7-day)

ETH :$1,908 (+1.1% / 7-day)

SOL: $21.96 (+5.9% / 7-day)

(BTC ATM 7-Day VRP)

(BTC ATM 7-Day VRP)

Traders sold down 7-Day ATM vol last week post economic numbers. This was enough to collapse the VRP down to 0.

Given this week’s lack of market-moving news and BTC consolidation, I’d expect VRP to widen due to RV dropping values lower this week, taking down previous lows.

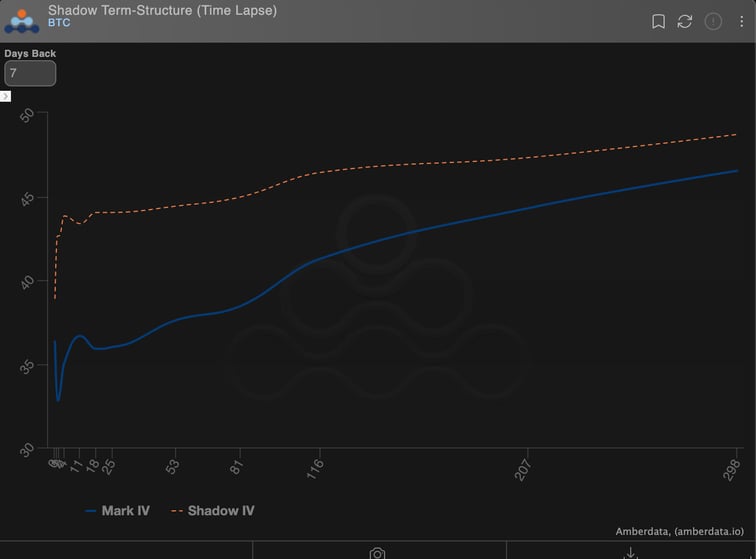

(BTC ATM term structure week-over-week)

(BTC ATM term structure week-over-week)

We can see the term structure finally dropped lower on the week.

We’ve had a stubbornly flat term structure recently, despite the dismal realized vol.

A Contango term structure makes much more sense.

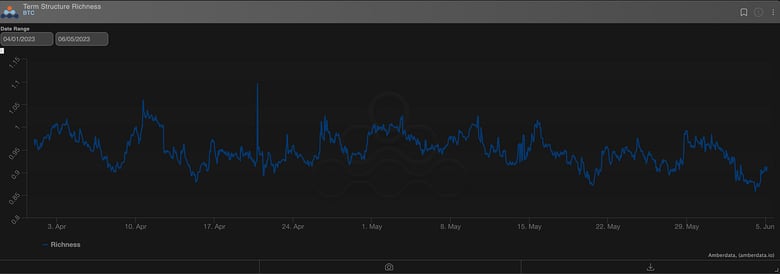

(BTC Term Structure Richness/Discount)

(BTC Term Structure Richness/Discount)

We can see the Contango structure steepened from May 29th to June 4th.

There’s still further room to steepen given Q4 2022 as context (See below).

(ETH & BTC Relative Vol DEC EXP)

(ETH & BTC Relative Vol DEC EXP)

For vol buying opportunity, long-dated ETH vol is still my favorite play.

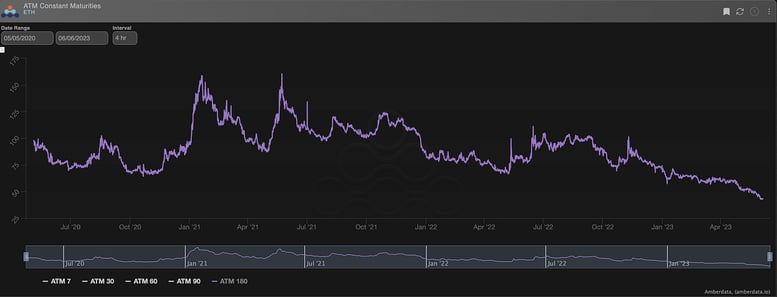

(ETH 180-day ATM IV 3yrs)

(ETH 180-day ATM IV 3yrs)

This chart looks dismal, and low vol isn’t cheap vol, but selling mid-range BTC stuff and buying long-term ETH stuff seems interesting to me.

People are sleeping on ETH vol I think, once we move again, I suspect things quickly reprice higher and this opportunity window closes.

Obviously, no one knows, but seems interesting to me.

PROPRIETARY “GVOL-DIRECTION” FLOWS - @Gravity5ucks

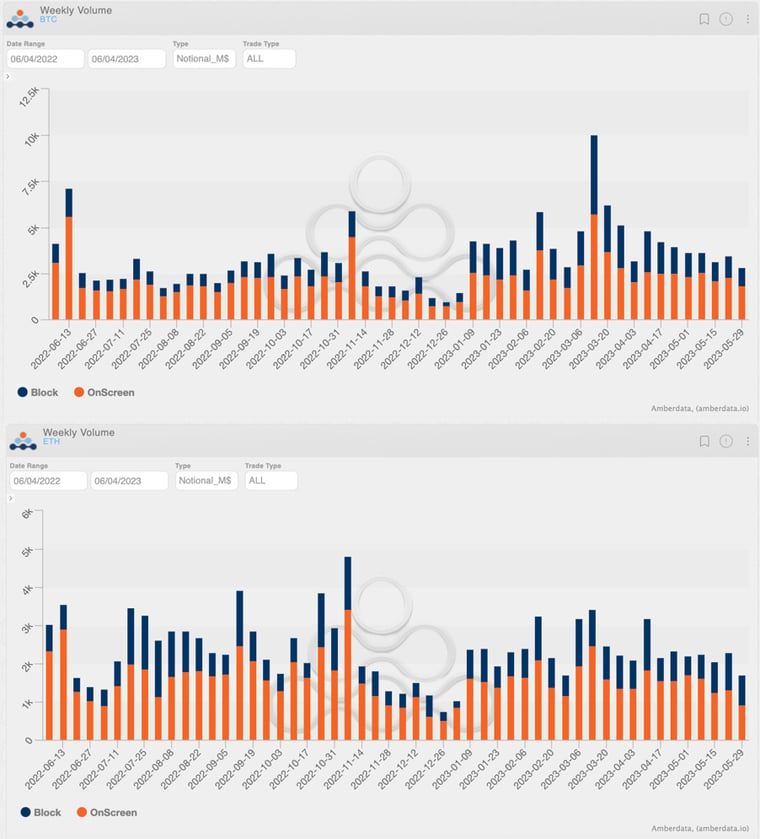

The weekly volumes record the absolute lows of 2023. The absence of volatility weakens the number of buyers each week.

(BTC ETH Deribit Weekly Volumes Contracts)

(BTC ETH Deribit Weekly Volumes Contracts)

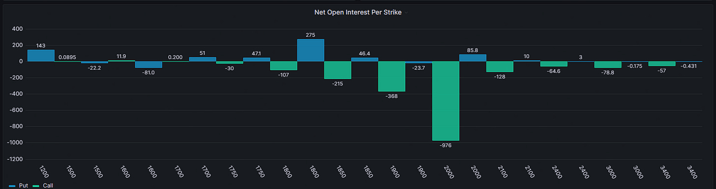

For weeks now, we have been witnessing rolls of short calls in June/September, and this week even September/December, with activity present in both Bitcoin and Ethereum.

These trades are often mistaken for calendar/diagonal spreads due to the combination of two legs, but upon analyzing the impacts of open interest, it appears more likely to be rolls.

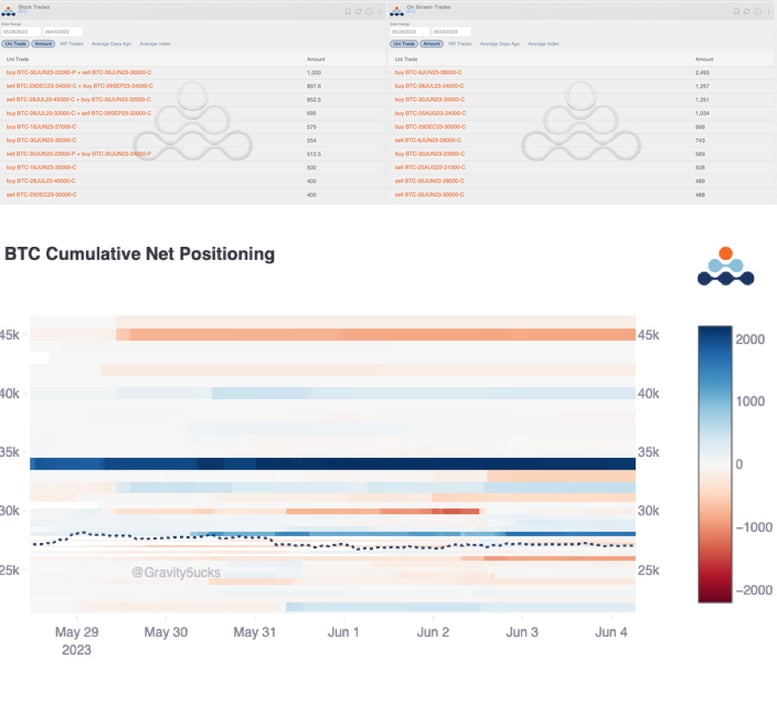

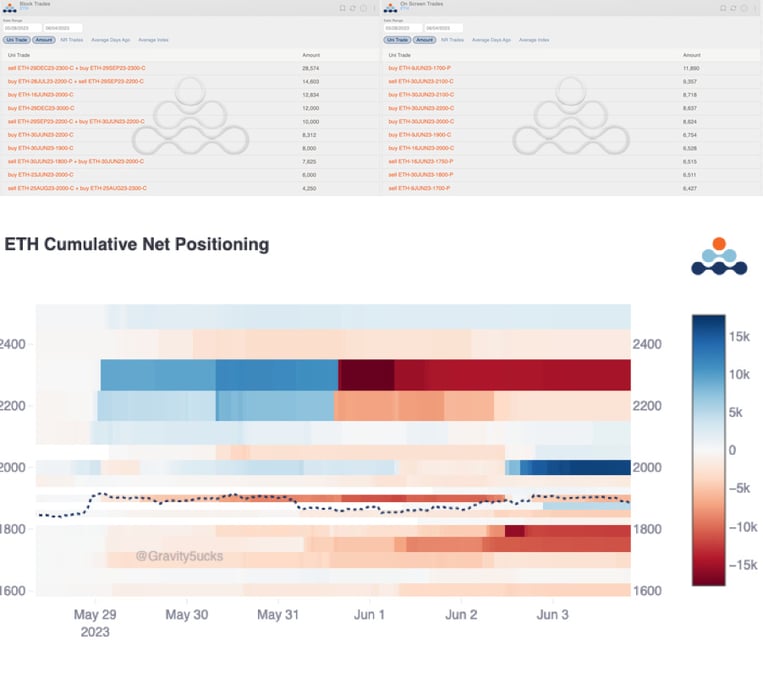

Therefore, it is more meaningful to analyze the newly created open interest cumulatively during the week rather than focusing on individual trades (see the heat map below for the cumulative positioning of this week)

Despite the subdued flow, screen purchases of $28k and $34k calls highlight interesting additions to the open interest.

(BTC Options Scanner)

(BTC Options Scanner)

Ethereum has been dominated from the rolls activity with $2.2k short call renovated in September and $2.3k in December.

(ETH Options Scanner)

(ETH Options Scanner)

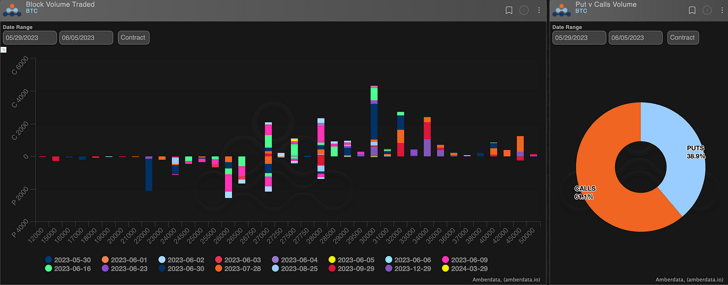

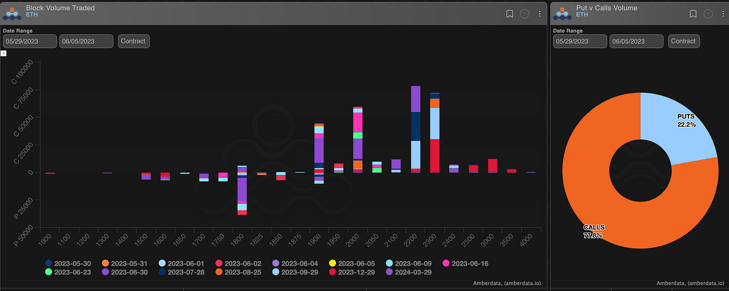

Paradigm Block Insights (29 May - 04 June)

Crypto majors wrap the week down slightly as market participant disinterest and lack of conviction leaves spot disappointingly range bound, weighing on demand for optionality.

BTC -3% / ETH unch. / NDX +0.50%

BTC

Muted flows in the options market continued for the most part given spot’s lack of enthusiasm lately.

Flows picked up Friday around the strong US Jobs data and consisted of upside buying and vol selling.

BTC Top Trades

1000x 30-Jun-23 22000/30000 Bear Risk Reversal bought

600x 16-Jun-23 27000 Call bought

450x 16-Jun-23 30000 Call bought

440x 9-Jun-23 28000/26000 Strangle sold

ETH

Largest ETH flows of the week included the ‘elusive’ overwrite blocking the below calendar rolls and outright calls w/ maker on Deribit directly.

ETH Overwrites:

28.5k 29-Sep-23 / 29-Dec-23 2300 Call Calendar sold

15k 28-Jul-23 / 29-Sep-23 2200 Call Calendar sold

Outright call bought against Dec overwrite above:

12k 29-Dec-23 3000 Call bought

Strong bid for ETH outright upside towards the end of the week. Takers executed via orderbooks and RFQ. Worth noting the majority of the 16Jun 2k Calls were lifted sub 40v.

10k 16-Jun-23 2000 Call bought

8k 30-Jun-23 2200 Call bought

8k 30-Jun-23 1900 Call bought

For those of you who don't know, we have officially launched our partnership with @ThetanutsFi.

So if you are interested in bidding (and getting the best price) on the vaults, we can help.

1/ For those of you who don't know, we have officially launched our partnership with @ThetanutsFi. 🚀

— Paradigm (@tradeparadigm) June 2, 2023

So if you are interested in bidding (and getting the best price) on the vaults, we can help. 💰 pic.twitter.com/ezTEDK8QV4

🚀 New favorite #ETH Opportunity: Our Latest Blog by @genesisvol is here!

📉 Unveiling Potential: Long Vol Strategies in ETH Trading

BTC

ETH

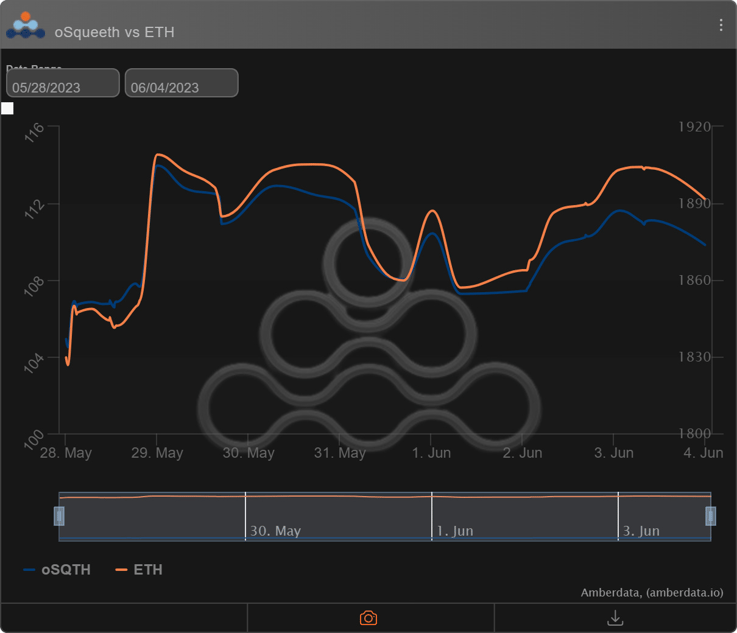

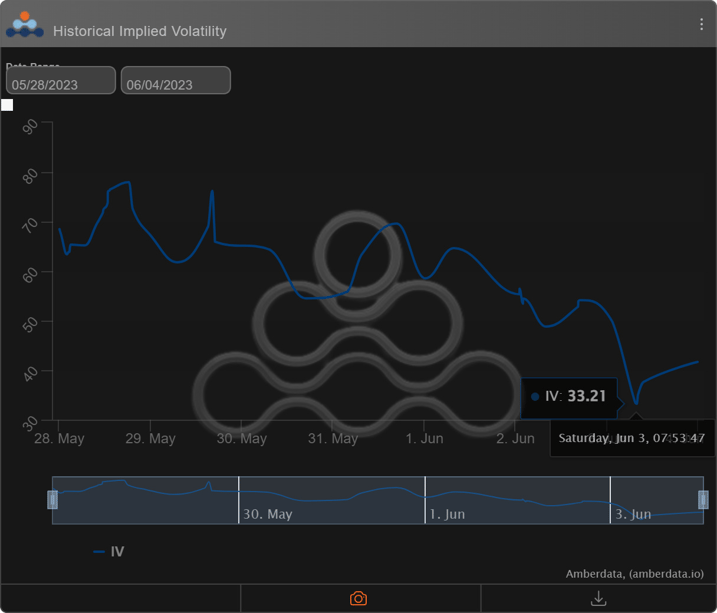

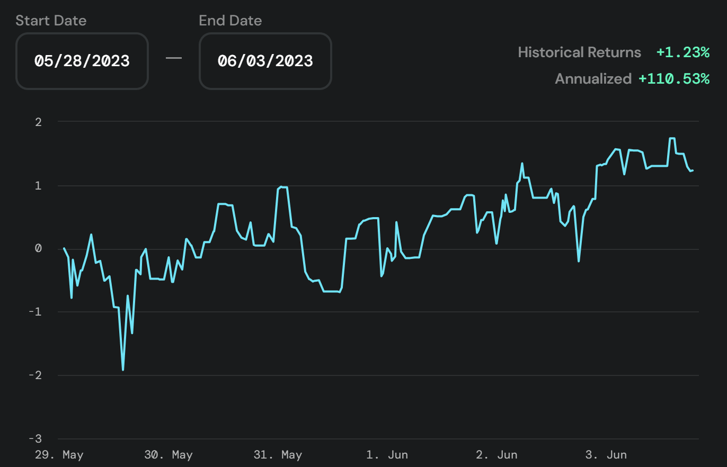

The Squeethcosystem Report (5/28/23 - 6/3/23)

Majors continue to remain directionless as we head into summer trading. ETH ended the week +3.38%, oSQTH ended the week +4.68%.

Volatility

oSQTH IV finally found it's way lower this week.

For those interested in the Squeeth vs. ETH vanilla option vol spread check out a quick write-up we did here.

Volume

The 7-day total volume for oSQTH via Uniswap oSQTH/ETH pool was $443.79k

May 29th saw the most volume, with a daily total of $128.19k traded.

Crab Strategy

Crab ended the week at +1.23% in USDC terms.

Twitter: https://twitter.com/opyn

Discord: discord.gg/opyn

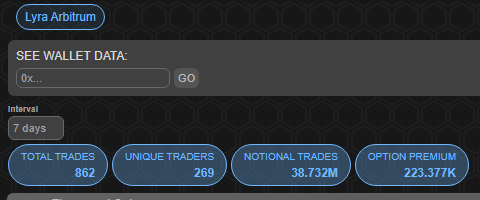

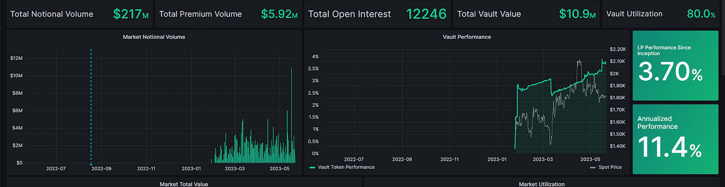

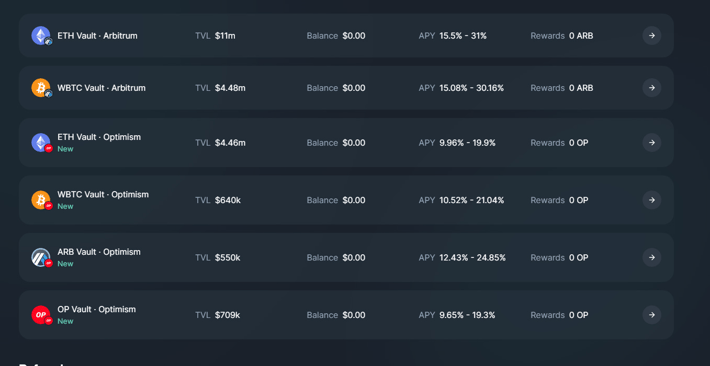

Lyra Weekly Review

Arbitrum:

Optimism:

Vaults on Optimism are under migration to a more capital-efficient version of the AMM. You can now trade WETH, WBTC, OP, & ARB options on Lyra!

Upgraded trading on @optimismFND is now live!

— Lyra (@lyrafinance) May 25, 2023

We've relaunched our OP deploy with a new AMM that:

📊 Increases the portion fees directed to LPs

💱 Can access 40+ new markets on @synthetix_io

🪙 Uses USDC to trade and LP

Learn more: https://t.co/yLu6broJrW

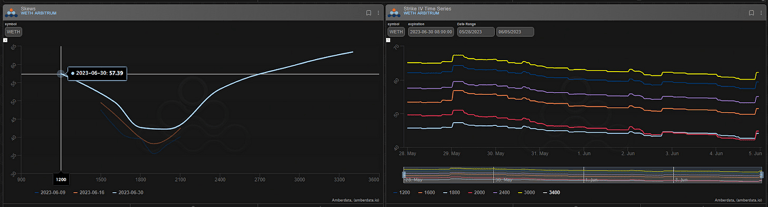

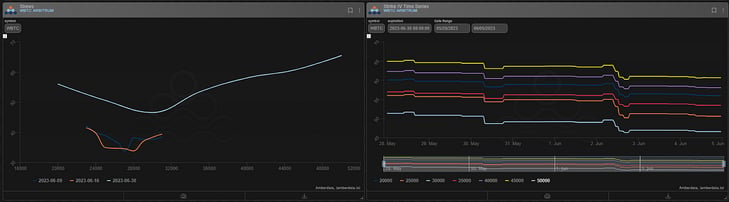

Volatility

Current ATM IV is ~35% in ETH, at some of the lowest levels seen historically. Term structure is sitting in contango with calls trading at a discount.

Trading

Lyra will observe a scheduled trading pause around Optimism’s Bedrock Upgrade.

📢 Important update for Lyra traders and LPs on Optimism.

— Lyra (@lyrafinance) May 29, 2023

From June 4th at 10:00 UTC, positions will be limited to "close only" and withdrawals from the MMVs will be unavailable leading up to Optimism's scheduled Bedrock upgrade.

Read more ↓https://t.co/2VgaWNIhgv

Market-Making Vault

ETH Arbitrum: +3.37% since inception, +9.28% annualized

Depositors earn an additional 9.96% rewards APY, boosted up to 31% for LYRA Stakers by depositing USDC to Lyra’s Market Making Vaults.

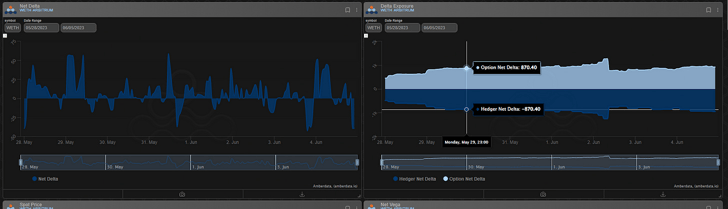

Net MMV Exposure:

ETH vault performance has been suffering, maintaining long Gamma and Vega with low Realized Volatility over the last few weeks.

ETH Arbitrum:

![]()

BTC Volatility

Net BTC MMV Exposure:

![]()

Learn more about Lyra in this GVOL explainer video!

Trade: app.lyra.finance

Twitter: https://twitter.com/lyrafinance

Discord://discord.gg/Lyra

Watch @itseneff and @GenesisVol talk options here

Greg Magadini

Greg Magadini is the Director of Derivatives at Amberdata. Previously, he co-founded Genesis Volatility (later acquired by Amberdata). Greg Magadini started his career as a proprietary trader for DRW and Chopper Trading in Chicago IL. Greg has nearly 15-years of options trading experience and has been active in the...