Amberdata Provides Data Infrastructure for MAS Project Guardian and Project Orchid DLT-based FMI

Amberdata has been participating on two projects with the Monetary Authority of Singapore, known as Project Guardian and Project Orchid. As part of prototypes being demonstrated at the Singapore Fintech Festival this week, Amberdata is providing the data infrastructure and visualizations for the DLT-based, financial market infrastructure (FMI) underlying the projects.

The Monetary Authority of Singapore has initiated Project Guardian and Project Orchid to expand the use of DLT-based FMI in support of Real World Asset (RWA) tokenization and programmable payments and money. Both projects aim to develop prototype digital asset networks that are interoperable, both with each other and with traditional FMIs, eliminating fragmentation that would reduce the network benefits and create frictions such as inaccessibility, increased liquidity requirements due to separation of liquidity pools, and pricing arbitrage.

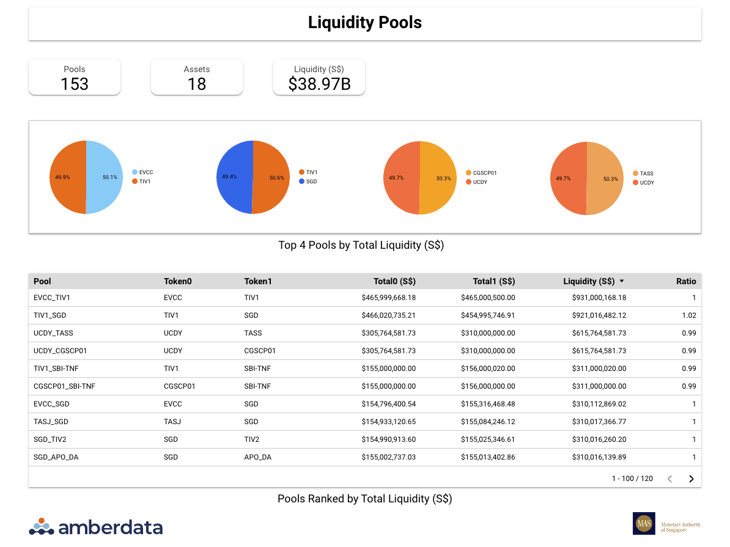

Project Guardian's mission is to expand asset tokenization initiatives and develop foundational capabilities to scale tokenized markets. Developments under Project Guardian will catalyze the institutional adoption of digital assets, with the aim of freeing up liquidity, unlocking investment opportunities, and increasing the efficiency of financial markets. Project Guardian’s industry group of 17 financial institutions (including Citi, T. Rowe Price Associates, Inc., Fidelity International, BNY Mellon, OCBC, Ant Group, Franklin Templeton, J.P. Morgan and Apollo) has initiated industry pilots to test promising asset tokenization use cases on private DLT. This potentially paves the way for integration across the capital markets value chain including listing, distribution, trading, settlement, and asset servicing.

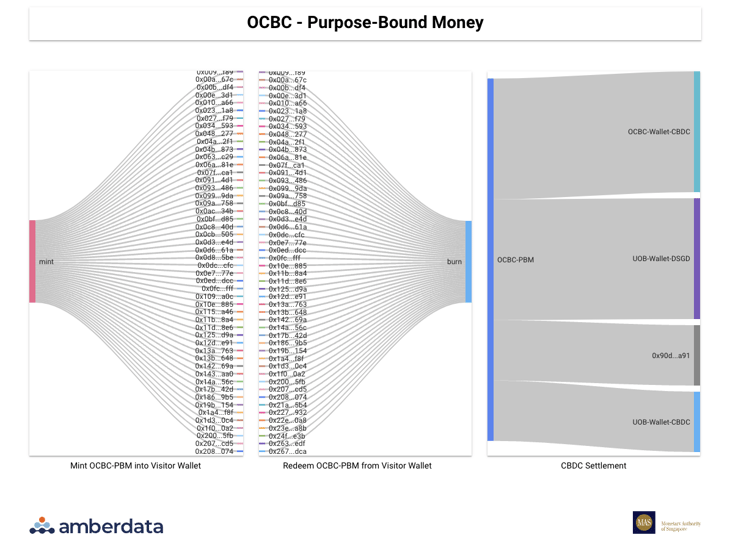

The overarching objective of Project Orchid is to build the foundational technology infrastructure and technical competencies necessary to issue a retail CBDC. Significant strides have been made in recent years in the development of programmable payments and more recently programmable money, popularized with the blockchain and peer to peer money movement. Project Orchid introduces the concept of Purpose Bound Money (PBM). PBM builds upon the concept and capabilities of both programmable payment and programmable money. PBM refers to a protocol that specifies the conditions upon which an underlying digital currency can be used. PBMs are bearer instruments, with self-contained programming logic and transferrable between two parties without intermediaries.

This week at the Singapore Fintech Festival, prototypes of both projects are being demonstrated. Amberdata is excited to announce that we are providing the data infrastructure, instrumentation of the DLT-based FMI, and visualizations of the activity on both projects. Amberdata is providing network activity, asset activity, token velocity and liquidity pool dashboards for Project Guardian and network activity, event streams and PBM dashboards for Project Orchid. Examples of the dashboards are shown below. Amberdata views these projects as essential for increasing institutional adoption of digital assets and is thrilled to showcase our ability to instrument and provide actionable insights into private DLT-based FMIs supporting tokenized RWA.

Amberdata

Amberdata is the leading provider of global financial infrastructure for digital assets. Our institutional-grade solutions deliver data, analytics and comprehensive tools and insights that empower financial institutions to research, trade, and manage risk and compliance in digital assets. Amberdata serves as a...