Amberdata Launches Profit and Loss Insights Across Uniswap v3 and Lending Protocols

Amberdata launches portfolio insights, breaks down significant barriers for institutions to capitalize on DeFi.

With event-level Uniswap v3 and lending protocol profit and loss analytics, capitalize on DeFi with trusted portfolio management and accurate accounting.

Amberdata has released all-new decentralized exchange and lending protocol analytics, eliminating a significant barrier for financial institutions to interact with DeFi. Designed to address compliance and portfolio management for financial institutions, tax and accounting firms, and regulatory bodies, these multi-chain comprehensive insights into a wallet are critical to understanding risks and calculating losses.

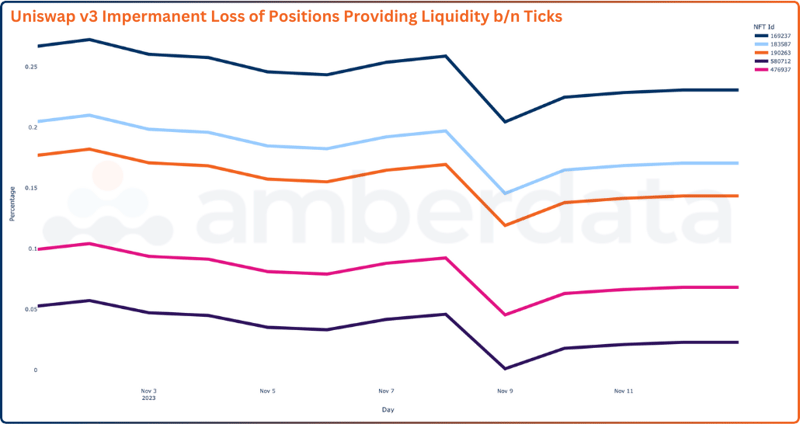

Uniswap v3 Fees and Impermanent Loss

Amberdata’s first-of-its-kind returns and impermanent loss on Uniswap v3 is here! See the returns for the wallet and liquidity pool in Uniswap v3, breaking down the claimed and unclaimed fees as well as impermanent loss.

Key Features

- View token prices claimed and unclaimed token fees, liquidity amount, and impermanent loss.

- Track the amount earned or paid in interest by a wallet for an asset

- Filter profit and losses by liquidity pool or protocol and impermanent loss across all wallet positions

Download Our Research: Strategies for Mitigating Impermanent Loss Across Uniswap v3

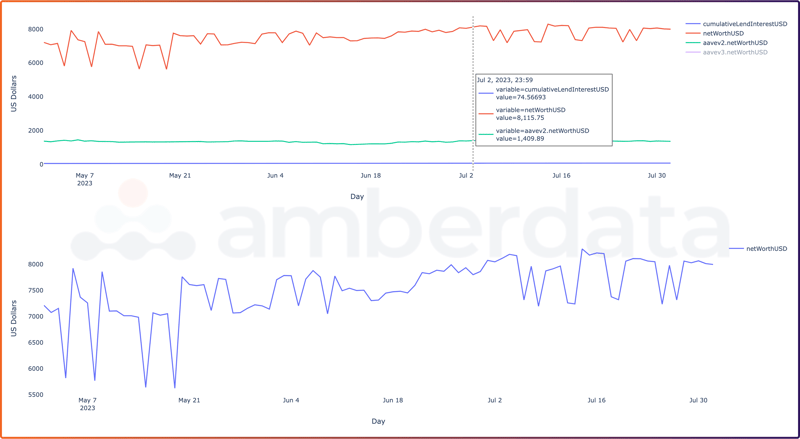

Lending and Borrowing Protocol Profit/Loss Analytics

With our lending and borrowing profit and loss insights, analyze the historical returns for an individual wallet across multiple DeFi lending protocols. Unlike unverified open-source calculations, our data can be trusted to make informed decisions, thanks to our rigorous aggregation methodology and analysis processes. While existing solutions compute yield only at the asset or protocol level, we provide granular insights at the wallet level.

Key Features

- Latest and full historical multi-chain data for a wallet on Aave v2 and v3, Compound v2 and v3, and MakerDAO

- See all wallet activity across lending protocols and blockchains and track a user's interest and net worth

- Analyze the historical returns for a wallet across multiple lending protocols and understand

performance over time

Use Cases

Portfolio Management: Seamlessly manage and optimize portfolios using the latest and historical performance data of individual wallets across multiple pools on DEXs or lending protocols

Accurate Asset Accounting: Easily account for assets. Provide accurate and comprehensive records of gains and losses for tax reporting and regulatory compliance.

Identify DeFi Opportunities: Gain valuable insights by analyzing the participation and behavior of other users within Uniswap v3 or popular lending protocols.

According to a survey by BNY Mellon, nearly all asset managers (93%) indicated plans to use advanced digital asset analytics and insights in portfolio management. With our unmatched depth of insights for DeFi spanning the most popular DEXs, lending protocols, and blockchains, Amberdata is the leader in accurate portfolio management and accounting in the decentralized finance space. Stay ahead of the curve and embrace the future of DeFi.

For more information, please reach out to hello@amberdata.io or schedule a demo here.

Amberdata

Amberdata is the leading provider of global financial infrastructure for digital assets. Our institutional-grade solutions deliver data, analytics and comprehensive tools and insights that empower financial institutions to research, trade, and manage risk and compliance in digital assets. Amberdata serves as a...