Amberdata Digital Assets Snapshot: BTC's Resurgence & CBDC Plans

Bitcoin is back! After crossing the $44k price point, BTC has made headlines once again.

The BRICS organization, an intergovernmental partnership between Brazil, Russia, India, China, and South Africa, is reportedly moving to develop a CBDC (Central Bank Digital Currency) in 2024. Per the Atlantic Council, there are reportedly 130 countries exploring digital assets. In addition, Argentina has elected its next President Javier Milei, a major proponent of Bitcoin.

After the fallout from Binance’s settlement which saw CEO and founder Changpeg “CZ” Zhao step down, Binance is set to end support for the Binance USD stablecoin BUSD on December 15th. In addition, news that Binance will delist Tornado Cash token TORN caused a sudden price crash of over 50% within an hour of the announcement.

With the case against Tornado Cash ongoing, in a separate trial, a US federal judge has hit back against the SEC for apparent deception in their case against Digital Licencing Inc (DEBT Box). SEC lawyer Michael Welsh claimed that the company was actively closing bank accounts and moving overseas in a petition for an ex parte application – a restraining order and asset seizure. This claim proved to be false and the judge concluded that the SEC had possibly deceived the courts to justify the orders.

In other news, a French criminal court cleared two hackers of a DeFi protocol that stole over €8.3M from the Platypus protocol using the “code is law” theory. This dangerous president states: “𝘶𝘯𝘦 𝘮𝘢𝘤𝘩𝘪𝘯𝘦 𝘲𝘶𝘪 𝘥𝘰𝘯𝘯𝘦 𝘱𝘭𝘶𝘴 𝘲𝘶𝘦 𝘤𝘦 𝘲𝘶’𝘦𝘭𝘭𝘦 𝘥𝘰𝘪𝘵 𝘥𝘰𝘯𝘯𝘦𝘳” – “a machine that gives more than it should give.”

Spot Market

-3.png?width=1080&height=808&name=(Ingl%C3%A9s)-3.png)

Centralized Exchange (CEX) comparisons from weeks 11/28/2023 and 12/5/2023

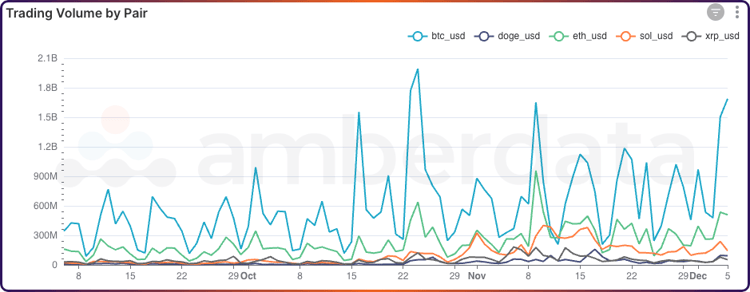

Centralized Exchange (CEX) trading volumes for the top five tokens between 9/9/2023 and 12/5/2023

Trading volumes on each of the top five traded tokens have been steadily rising since September 2023. Daily transaction volume for BTC/USD is over twice the volume as a quarter earlier and continues to show positive support for the price growth over the same period.

.png?width=750&height=300&name=Amberdata%20API%20Net%20unrealized%20profitloss%20(NUPL).png)

Bitcoin Net Unrealized Profit/Loss (NUPL)

Looking at the Bitcoin Net Unrealized Profit/Loss, used as an indicator of sentiment and a proxy for the market stage, we appear to be entering a state of “optimism.” This metric, often referred to as NUPL, is a ratio of “Unrealized Profit/Loss” – total paper profit/losses from Bitcoin held by on-chain addresses – and the market capitalization of Bitcoin.

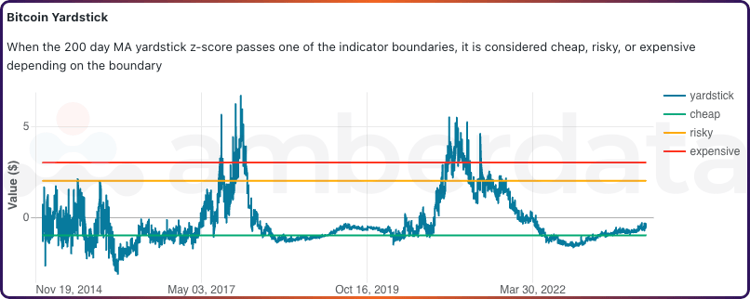

Bitcoin Yardstick

In addition, we can gauge the price indicators using the “Bitcoin Yardstick” metric – a z-score on the 200-day Moving Average. Current indicator shows that Bitcoin has recently emerged from the “cheap” range which has historically been a precursor to the bull cycles in 2017 and 2020. With the Bitcoin halvening expected in April 2024, sentiment is very positive at the moment.

DeFi DEXs

-5.png?width=810&height=475&name=CEX%20weekly%20update%20(1024%20x%20475%20px)-5.png)

Decentralized Exchange (DEX) protocol from weeks 11/28/2023 and 12/5/2023.

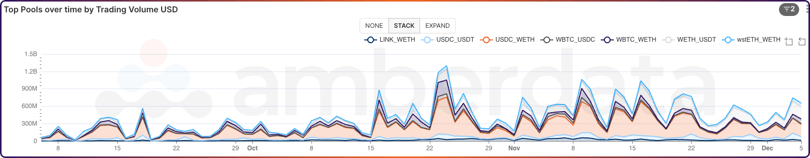

Top DEX pool trading volumes over the last 90 days.

DEX trading has been holding steadily over the last two months across several trading pairs with USDC/WETH and USDT/WETH continuing to drive the largest demand onchain. Interesting pairs to keep an eye on include the main WBTC trading pairs (with WETH, USDC, and USDT) which have been higher than usual with the ongoing Bitcoin wave. This pair shows that Ethereum users are interested in getting price advantages of Bitcoin while staying native to their network – a bullish sign that Ethereum users are not maximizing on a single token (ETH).

DeFi Borrow / Lend

-6.png?width=810&height=475&name=CEX%20weekly%20update%20(1024%20x%20475%20px)-6.png)

DeFi Lending protocol comparisons from weeks 11/28/2023 and 12/5/2023.

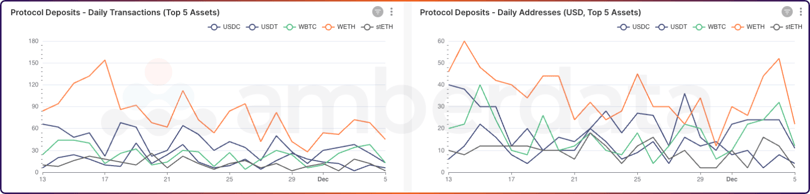

DeFi Lending deposit transaction count and unique daily addresses by token over the last 30 days.

DeFi lending protocols have been seeing a decline in deposit volumes over the last 30 days despite borrowing being way up from earlier in the year. With the recent run-up in token prices, primarily Bitcoin and Ethereum, the market seems to be turning a corner and finding yields through token trading once again leading to decreased deposits.

When token prices remain flat or decline, borrowing volumes tend to dive. This is because it is easier to earn passive lending yields by swapping altcoins for ETH/BTC or lending tokens rather than actively trading or holding altcoins. With Bitcoin breaking through $44k, and ETH breaking through $2.2k, the yields earned through holding and trading are much higher than passive earnings and the cost to borrow, allowing token prices to continue their run.

We’ve also been seeing a lot of borrow volumes in USDC, USDT, and DAI rather than WETH and WBTC, which signals that borrowers are using their leverage actively rather than simply holding their assets.

Networks

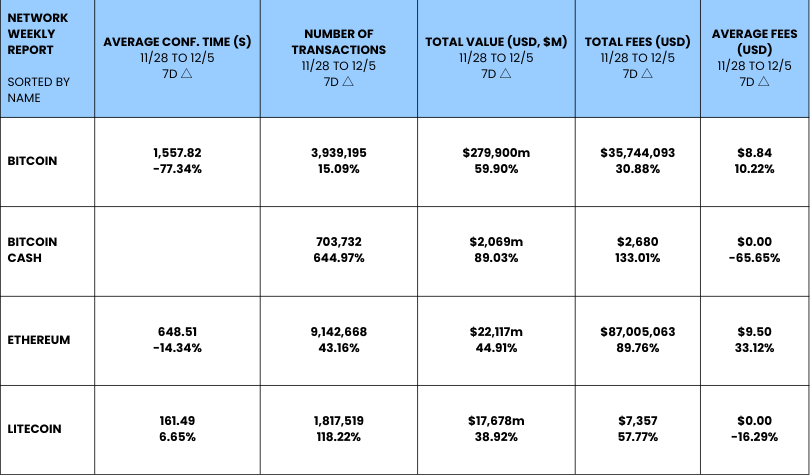

Network comparisons from weeks 11/28/2023 and 12/5/2023.

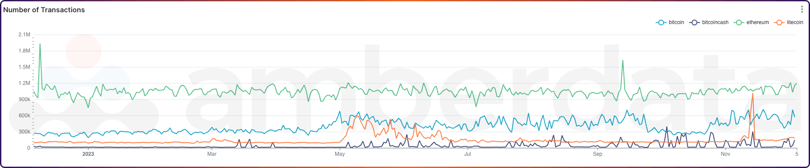

Network transaction counts on Bitcoin, Ethereum, Litecoin, and Bitcoin Cash over the last year.

Network activity has slightly increased with the price action over the last few months. Bitcoin and Ethereum have shown an upward trend since October, while Litecoin has lagged and shows a slight upward trend starting mid-November. Network activity can often be a leading or lagging indicator of price, but more often than not activity can often be attributed to major on-chain events, for example, the introduction of Bitcoin Ordinals, or a new exciting protocol on Ethereum. With the latest price growth and slight increase in network activity lagging, we expect that this is an organic increase in activity which doesn’t indicate anything new on-chain, but could be an indicator of network adoption.

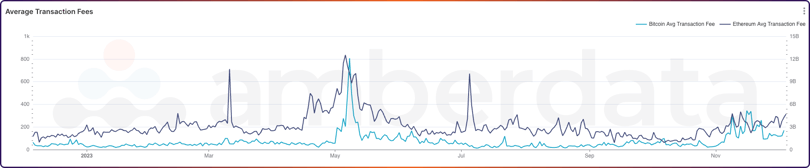

Average on-chain transaction fees for Bitcoin and Ethereum networks over the last year.

Increases in on-chain activity often come at the expense of fees, which, to no surprise, have seen a steady increase since October.

Links

Recent from Amberdata

- Amberdata: Amberdata Announces Digital Asset Reference Rates

- Decrypt: What Will a Post-CZ Binance Look Like?

- Cryptocoin.news: The Bitcoin Accumulation Mystery

- Decrypt: Is Bitcoin Poised for Another Bull Run? Experts Weigh In

- Coindesk: CoinDesk Market Index Week in Review

- Coindesk: Bitcoin Tops $42K as Crypto Market Recovers to Pre-Terra Levels

- CBS: The crypto industry is in the dumps. So why is bitcoin suddenly flying high?

- Kitco: Bitcoin and Ether hit 2023 highs as crypto bull market ramps up

- Decrypt: Bitcoin Is Surging—Is It Up Only From Here?

Spot Market

Spot market charts were built using the following endpoints:

- https://docs.amberdata.io/reference/market-metrics-exchanges-volumes-historical

- https://docs.amberdata.io/reference/market-metrics-exchanges-assets-volumes-historical

- https://docs.amberdata.io/reference/get-market-pairs

- https://docs.amberdata.io/reference/get-historical-ohlc

Futures

Futures/Swaps charts were built using the following endpoints:

- https://docs.amberdata.io/reference/futures-exchanges-pairs

- https://docs.amberdata.io/reference/futures-ohlcv-historical

- https://docs.amberdata.io/reference/futures-funding-rates-historical

- https://docs.amberdata.io/reference/futures-long-short-ratio-historical

- https://docs.amberdata.io/reference/swaps-exchanges-reference

- https://docs.amberdata.io/reference/swaps-ohlcv-historical

- https://docs.amberdata.io/reference/swaps-funding-rates-historical

DeFi DEXs

DeFi DEX charts were built using the following endpoints:

- https://docs.amberdata.io/reference/defi-dex-liquidity

- https://docs.amberdata.io/reference/defi-dex-metrics

DeFi Borrow/Lend

DeFi lending charts were built using the following endpoints:

- https://docs.amberdata.io/reference/defi-lending-protocol-lens

- https://docs.amberdata.io/reference/defi-lending-asset-lens

Networks

Network charts were built using the following endpoints:

Amberdata

Amberdata is the leading provider of global financial infrastructure for digital assets. Our institutional-grade solutions deliver data, analytics and comprehensive tools and insights that empower financial institutions to research, trade, and manage risk and compliance in digital assets. Amberdata serves as a...