Welcome to Amberdata's Crypto Snapshots, your one-stop source for in-depth insights into the dynamic world of cryptocurrencies. Our comprehensive coverage includes spot, futures, and swaps trading, as well as DeFi DEXs (decentralized exchanges) and DeFi borrow/lend platforms. We also provide a detailed analysis of various blockchain networks, giving you a holistic view of the rapidly evolving crypto landscape. Stay ahead of the curve with Amberdata's Crypto Snapshots and unlock a deeper understanding of the crypto markets!

In the week of May 24, 2023, we have Amberdata's Crypto Snapshot #5!

In a collective sigh of relief, we begin to wave goodbye to the memecoin craze that took everyone by surprise earlier this month. PEPE volumes have dropped and scammers late to the party are starting to shill their next endeavors on Crypto Twitter (CT).

Meanwhile, Ledger is facing criticisms for their PR fiascos last week. The company behind the popular Ledger hardware wallet devices announced their latest product: Ledger Recover, an online seed phrase recovery tool. Seed phrases represent private keys and can be used to recover wallets. They essentially act as a wallet’s secure password, where sharing a seed phrase is the equivalent of sharing full access to all of your bank accounts and permissions to use them as if they were your own. When seed phrases are publicly available, it’s almost certain that funds will not be in the wallet for very long, and recovering those funds is next to impossible. As the saying goes: “Not your keys, not your crypto.”

Ledger’s Recover program faced immediate criticism as the company planned to split seed phrases across three different companies, allowing users to remotely recover it through a recovery process. The initial criticisms were followed by the fumbling of even more privacy concerns when a series of online “town hall meetings” with several members of the company, as well as CEO Pascal Gauthier, confirmed during an interview that the government could access clients’ private keys in the case of a subpoena.

In 2020, Ledger faced a data leak exposing the personal details of over 270,000 buyers of their devices.

Spot Market

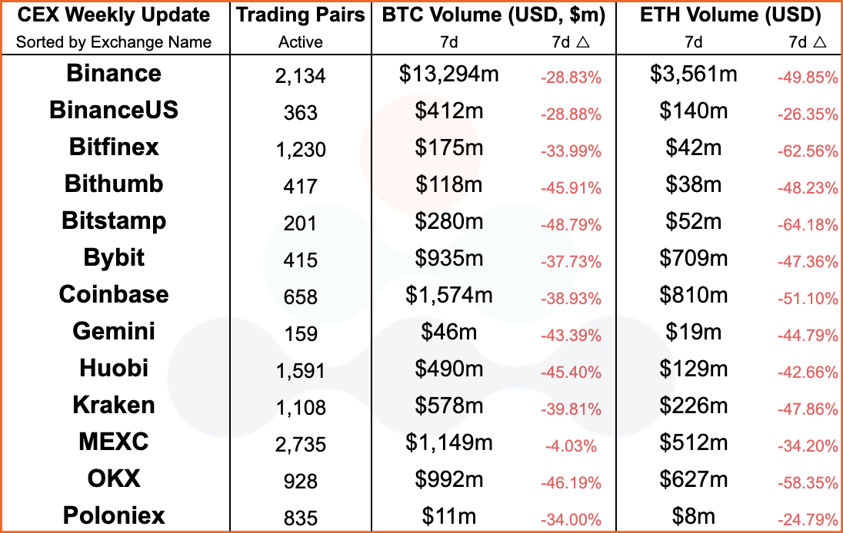

Centralized Exchange (CEX) comparisons between this and last week.

Centralized Exchange (CEX) comparisons between this and last week.

Unfortunately, centralized exchanges do not get the chance to breathe deeply after memecoins brought traders back to their platforms. Volumes across the board have dropped significantly since the previous week, reestablishing the bear market narrative and comparatively slow news cycle.

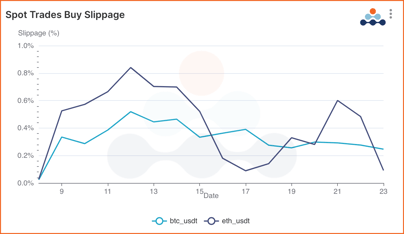

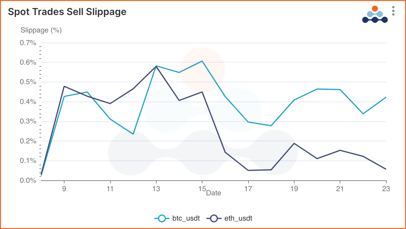

Average buy and sell slippage across all centralized exchanges

Average buy and sell slippage across all centralized exchanges

An upside to low volatility markets is slippage returning to more normalized levels, with both BTC/USDT and ETH/USDT slippage falling from local highs earlier in the month. Liquidity returned to centralized exchanges for key trading pairs, reducing slippage for buyers on BTC/USDT. Sellers of ETH/USDT have much less slippage concerns and are showing signs of higher demand for ETH/USDT than BTC/USDT in the trading price range.

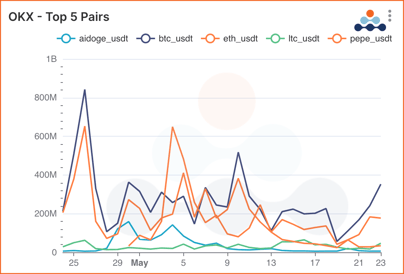

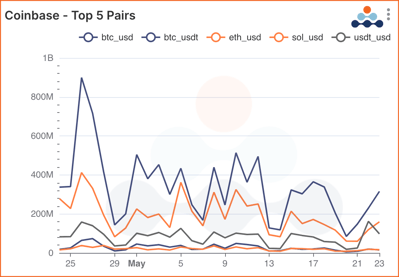

OKX and GDAX top traded pairs in the last 30 days

An interesting comparison between exchanges and user bases can be seen when looking at the top traded pairs on each exchange. For an exchange whose primary trading volume comes from the APAC region (OKX), two of the top five traded pairs are memecoins: AIDOGE and PEPE, with PEPE/USDT even outperforming BTC/USDT on some days.

While it’s not a fair comparison – Coinbase and OKX do not list the same tokens and fiat on/off-ramps – this perspective can present a lot of opportunities when it comes to trading: crypto markets are available 24/7 and traders prefer to trade during their daytime.

Futures & Swaps

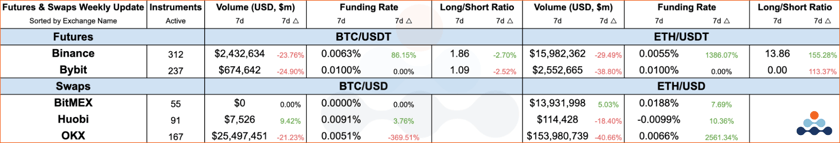

Futures and Swaps exchange comparisons between this and last week

Futures and Swaps exchange comparisons between this and last week

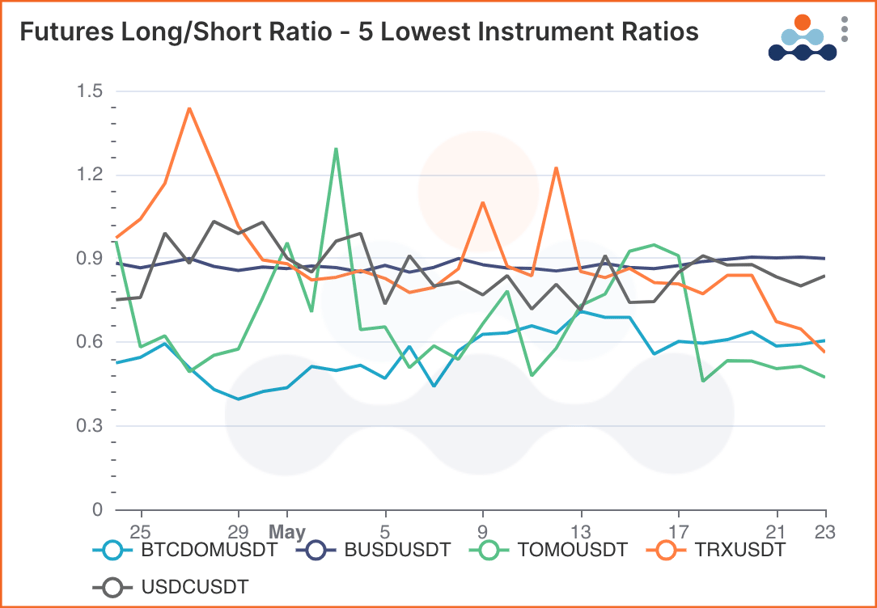

Lowest Futures long/short ratios over the last 30 days

Lowest Futures long/short ratios over the last 30 days

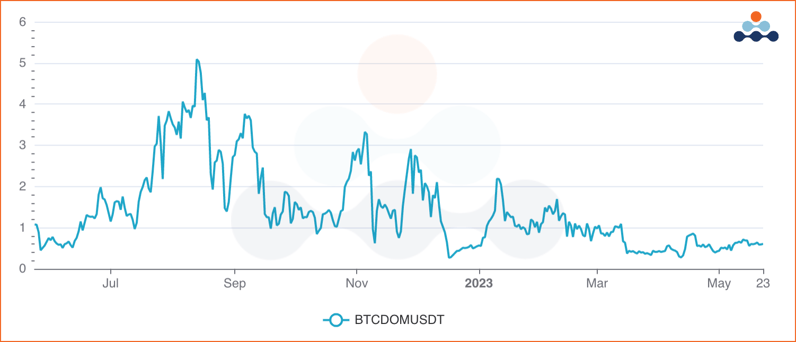

BTCDOM/USDT long/short ratio over the last year

BTCDOM/USDT long/short ratio over the last year

BTC Dominance (represented by the BTCDOM index) is a commonly discussed metric often comparing BTC market capitalization with ETH market capitalization. When it comes to futures, the BTCDOM/USDT perpetuals contract has held a consistently low long/short ratio since the end of December 2022 when it hit a ratio of 0.5 (meaning half as many long positions as short positions). While there are many potential reasons for the low ratio, one thing to keep an eye on is how BRC-20’s (discussed in the previous Crypto Snapshot) and Bitcoin L2’s can change the dynamic of the Bitcoin network, potentially bringing similar networks effects to the blockchain as ERC-721’s (NFTs built on the ERC-721 standard on Ethereum) and ERC-20’s (tokens built on the ERC-20 standard on Ethereum).

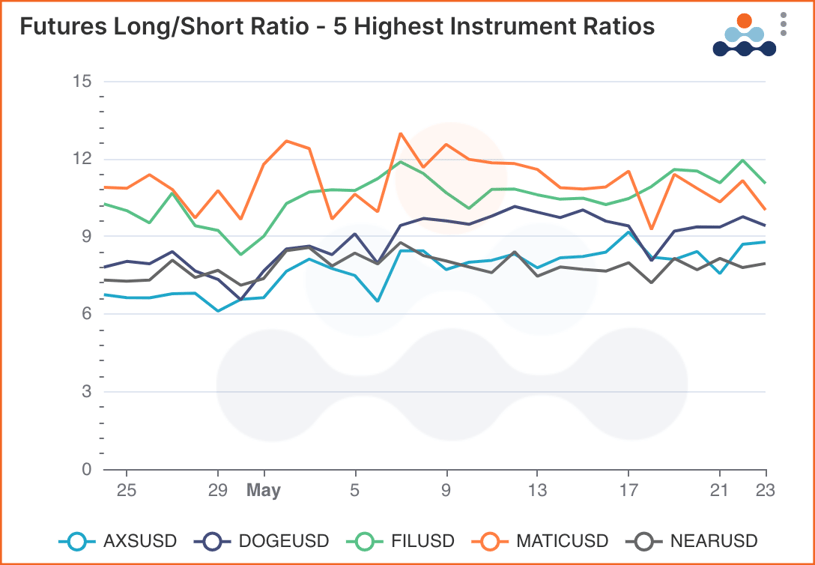

Highest Futures long/short ratios over the last 30 days

Highest Futures long/short ratios over the last 30 days

Recurring features on the highest futures long/short ratios list: MATIC (Polygon) and FIL (Filecoin) continue to have the highest ratios across centralized exchanges. AXS (Axie Infinity) makes its feature in the highest ratios list after (finally) breaking into the Apple Apps Store in some global markets with a card-based game from Sky Maxis (creator of the Axie Infinity game and the Ronin blockchain) called Axie Infinity: Origins. In addition to Origins, they also launched Mavis Market, a curated NFT marketplace on the Ronin. Axie Infinity paved a wave of NFT-based games for a while, but then the native blockchain Ronin suffered one of the largest exploits at the time, resulting in the theft of $625 million from the network.

DeFi DEXes

DEX protocol comparisons between this and last week

DEX protocol comparisons between this and last week

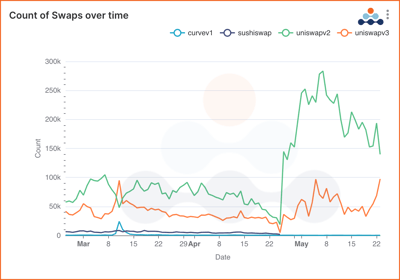

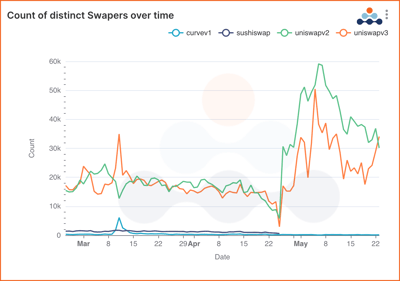

Uniswap V3 on the rise, with distinct traders passing Uniswap V2 for the first time since late April

Uniswap V3 on the rise, with distinct traders passing Uniswap V2 for the first time since late April

DEXes were the clear winner of the memecoin frenzy, with Uniswap v2 taking the lion's share of trading volume in May. Highest traded coins returned to the standard ETH-USD pools on both Uniswap v2 and v3. Interestingly, a surprising surge in distinct traders has raced onto Uniswap v3 this week driven by blurr.eth’s new pet project REFUND (RFD), with a whopping 39.7k trades in the past week. Blurr.eth is an infamous whale, known for his stunning move to purchase CryptoPunk #9998 for 124k ETH back in 2021. No one really knows what RFD is or if it will be anything of value (or if it's just a method to “refund” himself), but it is undeniable that there is some market out there speculating on the value of the meme of the month.

DeFi Borrow / Lend

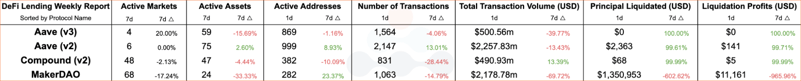

DeFi Lending protocol comparisons between this and last week

DeFi Lending protocol comparisons between this and last week

Aave v2 borrow and repayment volumes over the last 30 days

Aave v2 borrow and repayment volumes over the last 30 days

Borrow and Lend activity has also cooled in the last week, with borrow volume no longer consistently outpacing repayments. The significance of this comparison shows that the opportunity cost of borrowing is now starting to be higher than trading tokens outright. For example, during the wave of memecoin trading, users believed that they could earn more yield from borrowing funds to trade with than the cost of borrowing. If we say the rate for borrowing was 11%, traders would need to earn more than 11% from those funds to make it a profitable strategy. With the cost of borrowing being either higher than the expected return, or the expected return being lower than the cost of borrowing, traders prefer to trade with funds on-hand rather than pay the interest. Additionally, traders need to take into account the tokens provided for capital, as these tokens can fluctuate in price and can also affect the “implied” borrow rate.

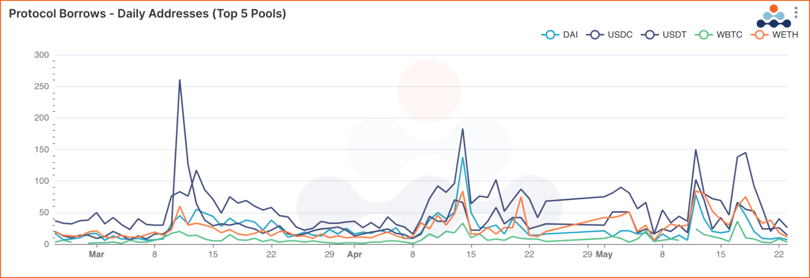

Aave v2 top five pools in daily address counts

Aave v2 top five pools in daily address counts

In terms of what users have been borrowing, USDT and USDC tend to be the most commonly borrowed tokens due to either the benefits of stablecoins (low volatility and implied peg) or the lower borrow rates – not to mention some DeFi lending protocols only allow for certain tokens to be borrowed. The thing to watch here, however, is the rise in the number of traders borrowing WETH in May, which is nearly equal to those of USDC/USDT.

Networks

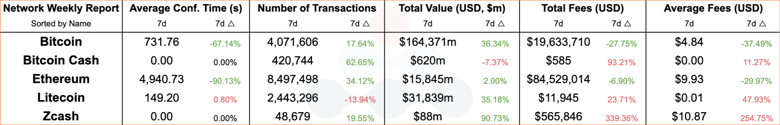

Network comparisons between this and last week

Network comparisons between this and last week

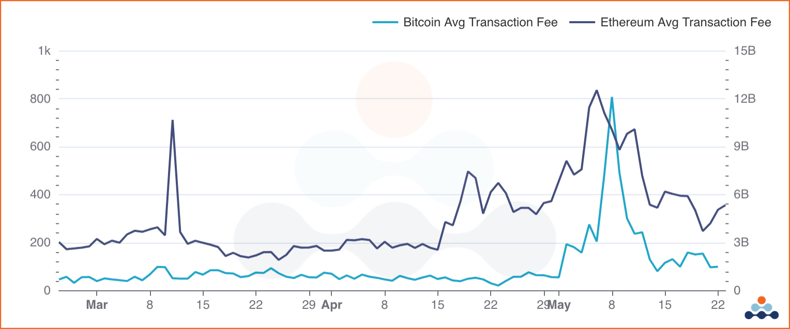

Bitcoin and Ethereum average transaction fees potentially returning to pre-May levels

Bitcoin and Ethereum average transaction fees potentially returning to pre-May levels

Users of the Bitcoin and Ethereum networks can also breathe a sigh of relief with transaction fees coming down from recent highs. On-chain transaction fees are showing signs of recovery, though still remain high for the previous three months.

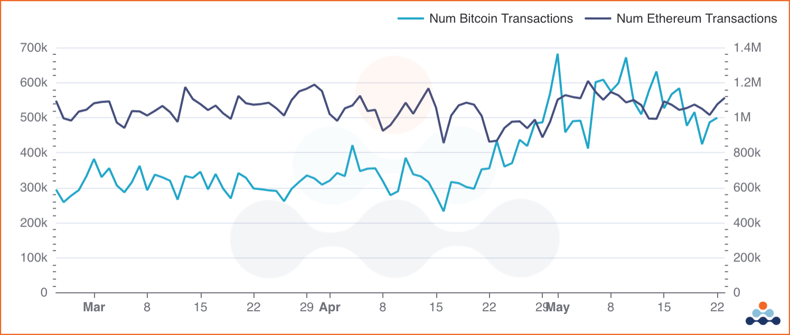

Bitcoin and Ethereum transactions over the last 90 days

Bitcoin and Ethereum transactions over the last 90 days

Meanwhile, transaction counts are also on a downward swing, saving users on-chain from the congestion caused by memecoin traders.

To download the report, click here.

Links

Spot Market

Spot market charts were built using the following endpoints:

- https://docs.amberdata.io/reference/market-metrics-exchanges-volumes-historical

- https://docs.amberdata.io/reference/market-metrics-exchanges-assets-volumes-historical

- https://docs.amberdata.io/reference/get-market-pairs

- https://docs.amberdata.io/reference/get-historical-ohlc

Futures

Futures / Swaps charts were built using the following endpoints:

- https://docs.amberdata.io/reference/futures-exchanges-pairs

- https://docs.amberdata.io/reference/futures-ohlcv-historical

- https://docs.amberdata.io/reference/futures-funding-rates-historical

- https://docs.amberdata.io/reference/futures-long-short-ratio-historical

- https://docs.amberdata.io/reference/swaps-exchanges-reference

- https://docs.amberdata.io/reference/swaps-ohlcv-historical

- https://docs.amberdata.io/reference/swaps-funding-rates-historical

DeFi DEXes

DEX charts were built using the following endpoints:

- https://docs.amberdata.io/reference/defi-metrics-exchanges-historical

- https://docs.amberdata.io/reference/defi-liquidity-historical

DeFi Borrow / Lend

DeFi lending charts were built using the following endpoints:

- https://docs.amberdata.io/reference/defi-lending-protocol-lens

- https://docs.amberdata.io/reference/lens-protocol-makerdao

- https://docs.amberdata.io/reference/lens-protocol-compound

Networks

Network charts were built using the following endpoints:

- https://docs.amberdata.io/reference/blockchains-metrics-latest

- https://docs.amberdata.io/reference/get-address-transactions

- https://docs.amberdata.io/reference/transactions-metrics-historical

- https://docs.amberdata.io/reference/blocks-metrics-historical

To download the report, click here.

Amberdata

Amberdata is the leading provider of global financial infrastructure for digital assets. Our institutional-grade solutions deliver data, analytics and comprehensive tools and insights that empower financial institutions to research, trade, and manage risk and compliance in digital assets. Amberdata serves as a...