Amberdata Crypto Snapshot #1: Futures, DeFi Lending & Blockchain Trends

Amidst the background of regulatory veracity, with the CFTC charging Binance and allegations against former FTX CEO Sam Bankman-Fried of bribing Chinese officials, DeFi Lending protocol Euler has had almost all funds returned to the Treasury after suffering a massive $200m exploit just weeks before. The Euler exploiter made a series of odd transfers following the attack against the protocol, among them a return of half of the stolen funds after a prolonged negotiation. Subsequently the remaining ETH and DAI were moved to new addresses. Negotiations continued over the next few days, when (finally) the exploiter returned most of the remaining balances back to the Euler treasury.

A great way to track these flows of funds would be to leverage our previous one-pager, using the Euler Exploiter (2) address: 0xb66cd966670d962c227b3eaba30a872dbfb995db

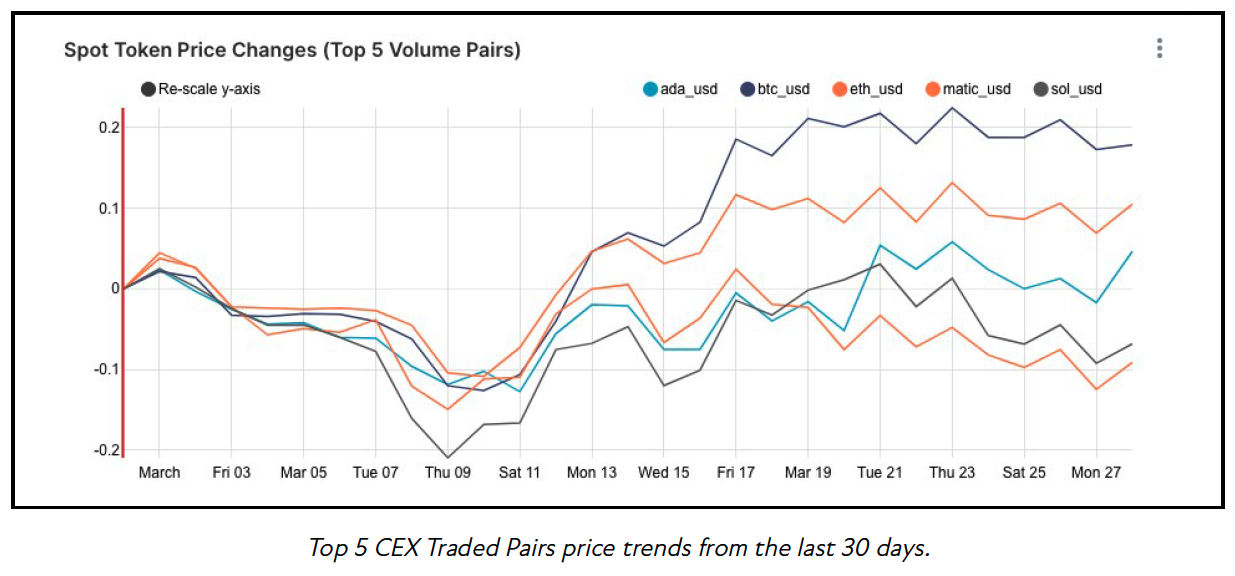

Despite the challenges of the last few weeks, both BTC and ETH have rallied well over the last 30 days with BTC up 17.88% and ETH up 10.5% since February 28th. Not all tokens have rallied however as MATIC remained down 9.11% and SOL down 6.82% over the same time horizon.

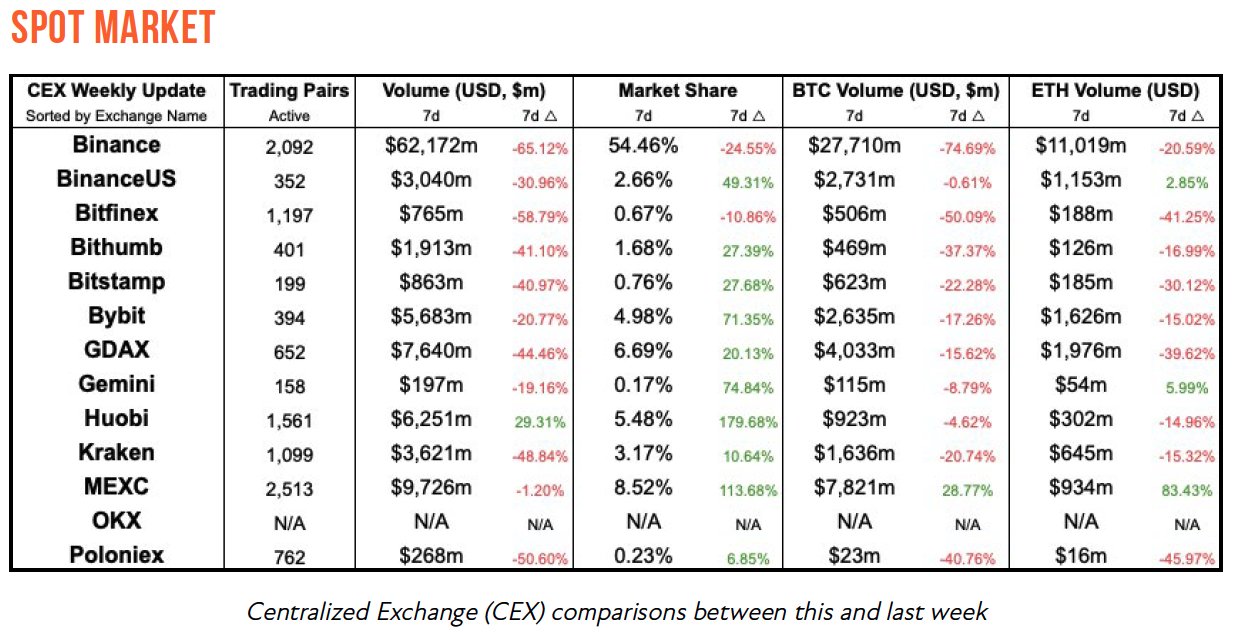

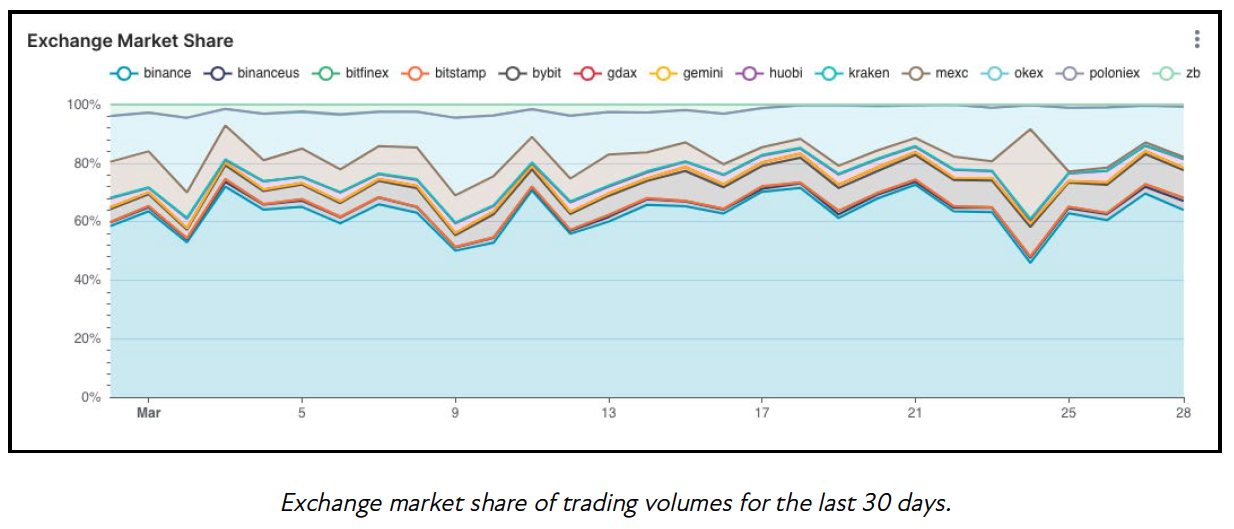

Binance continues to hold a significant market share over other major centralized exchanges ending the week with over 60% of trading volumes over exchanges. It’s yet to be seen if the CFTC charges against Binance will play a significant role in the overall landscape.

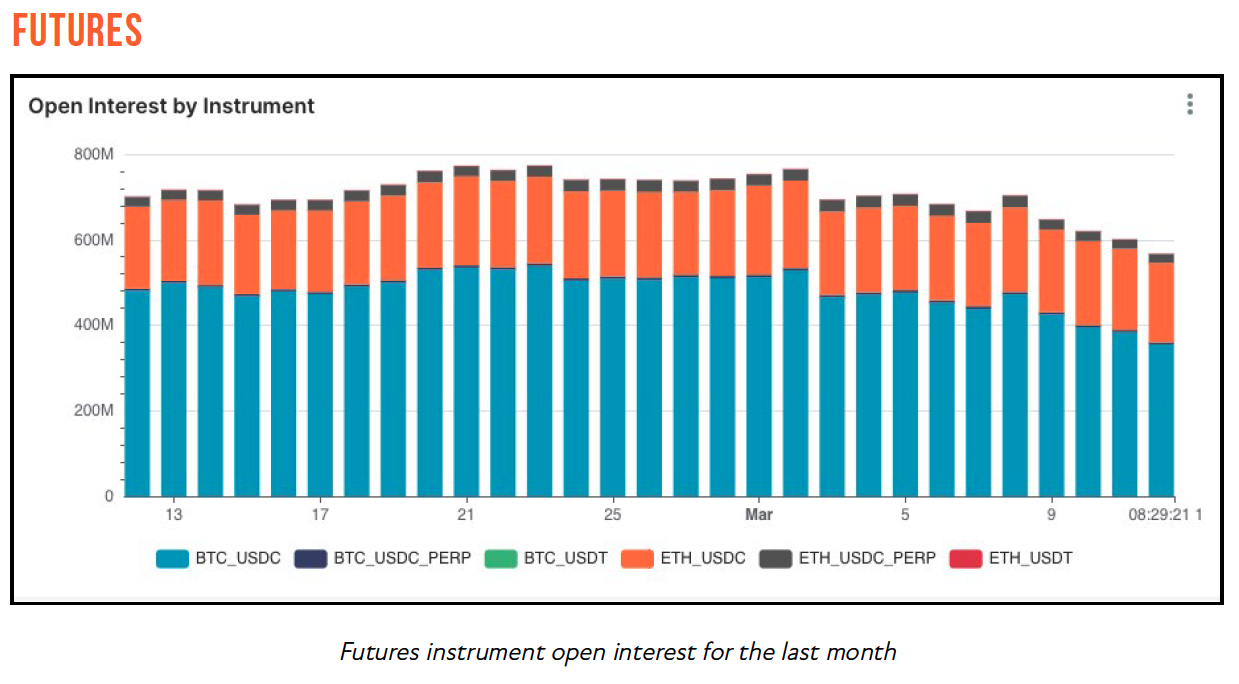

Crypto futures markets slightly trended downwards in the last few weeks with BTC / USDC and ETH / USDC keeping steady dominance in the futures markets. Crypto futures trends such as these often correlate with spot trading volumes, where BTC maintains its dominance in spot trading markets with ETH following behind. There’s no consistent trend as of yet to be seen if spot market dominance will eventually flip (with ETH trading taking dominant market share over BTC).

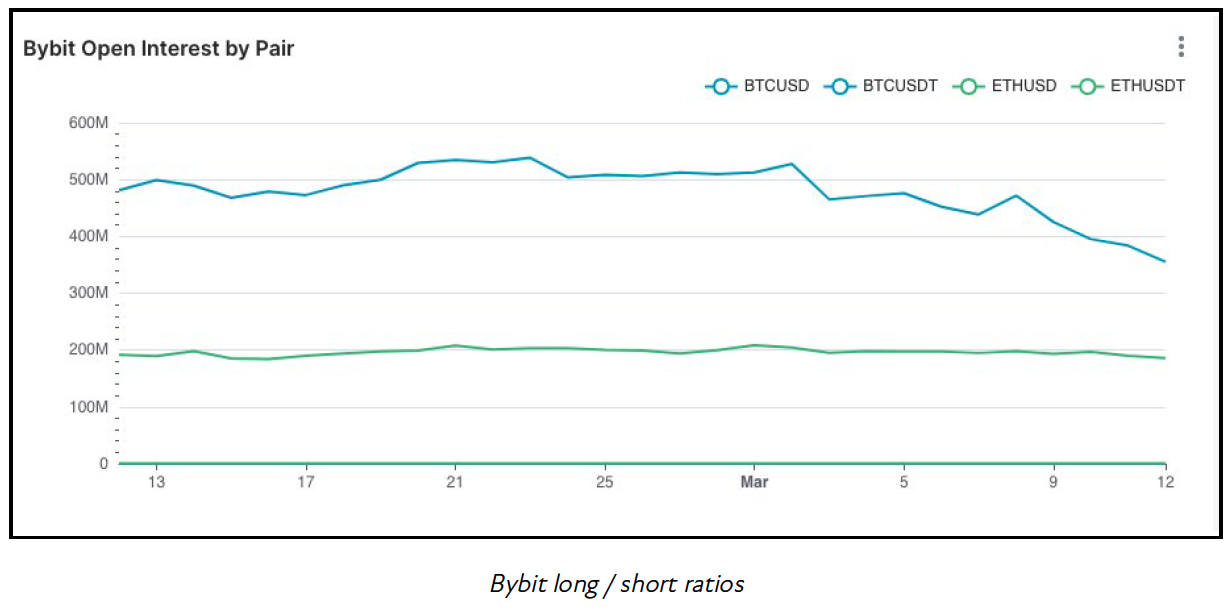

Two charts to keep an eye on though are the exchange long / short ratios and open interest charts, where Binance showed an even amount of interest between BTC / USDT and ETH / USDT pairs, but in the last few weeks BTC traders on Binance have begun taking longer positions than those trading ETH. On Bybit, open interest in BTC is extremely strong, however in the last few weeks this dominance has declined significantly while ETH futures open interest remained steady throughout the last 30 days.

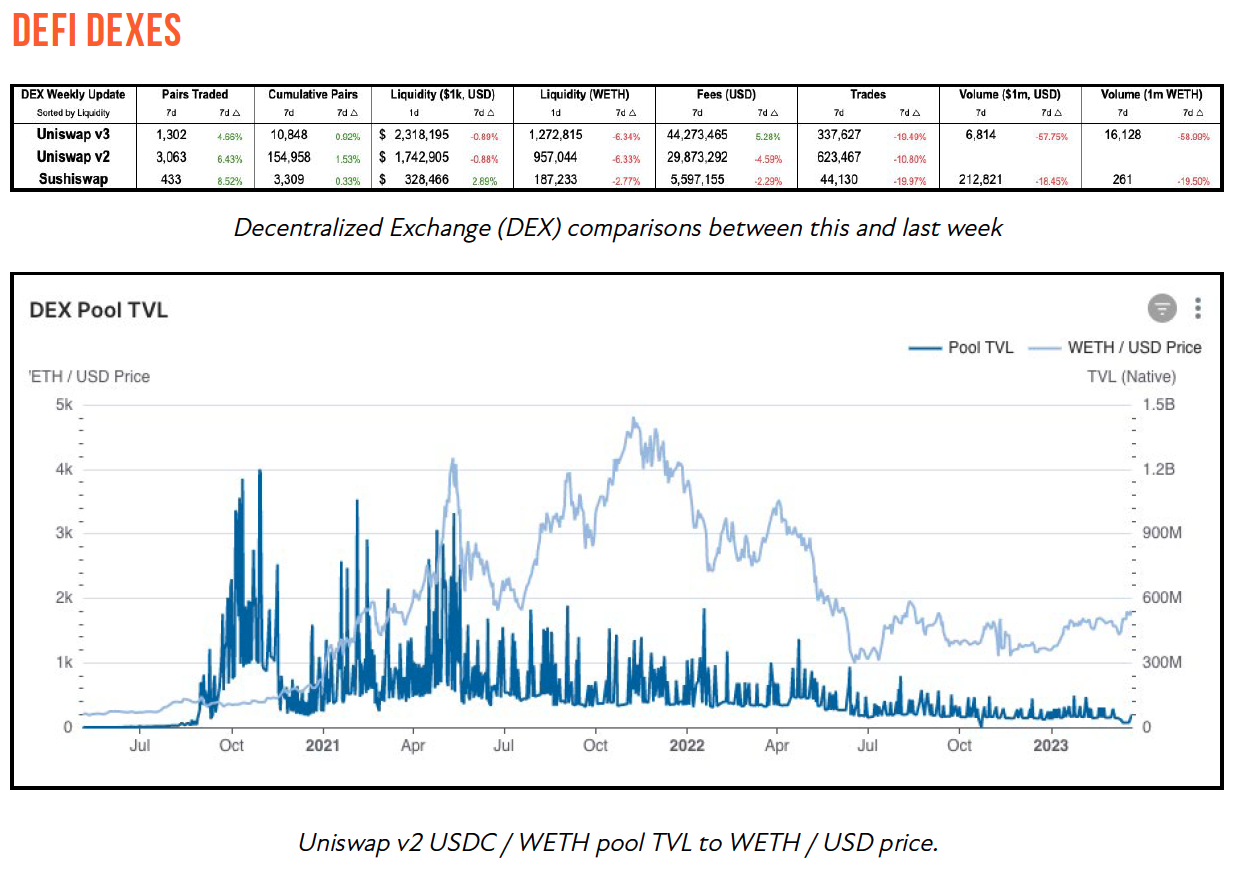

Looking into the Uniswap v2 USDC / WETH pool, TVL has yet to climb back to all-time highs. Currently though, the pool has returned to its August 2022 levels. Some perspectives to consider for this drop in TVL are:

- liquidity providers in DeFi moving funds into new protocols since 2011 (such as Uniswap v3)

- the growth of long-tail token pools as LP’s look to grow their yields in riskier pools

- new ETH derivatives (such as sETH and cbETH) anticipating the upcoming Ethereum Shanghai upgrade.

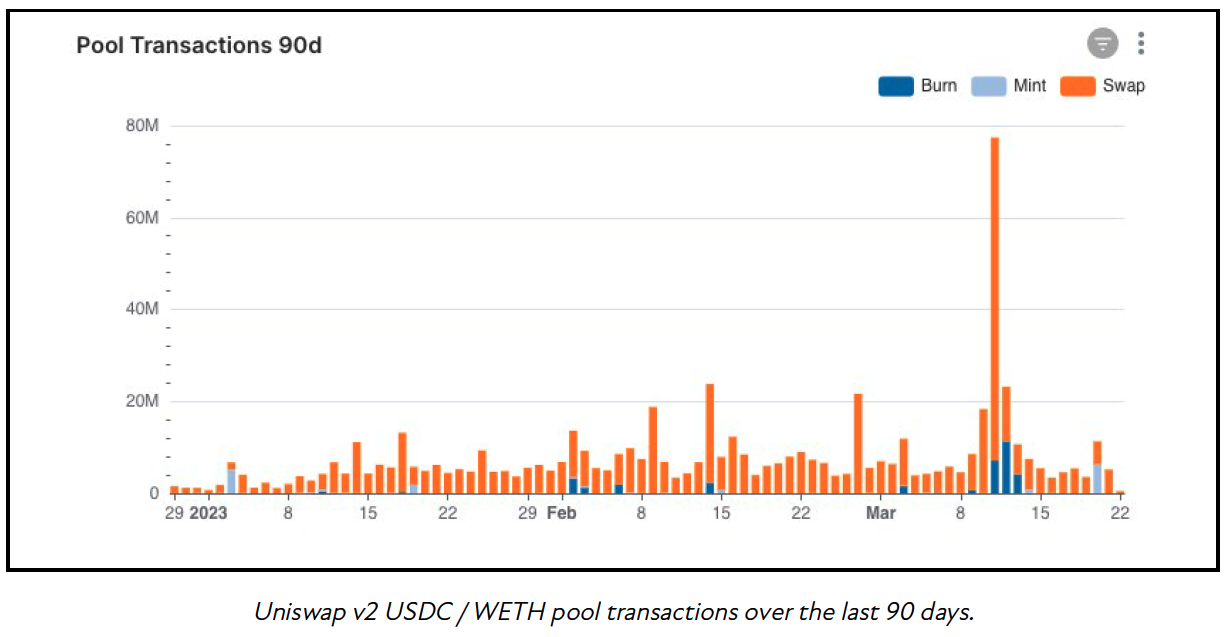

Since the beginning of 2023, daily swap trading volumes have seen an uptick as traders are more frequently trading USDC for WETH and vice versa. Another interesting item here is the volume of burns (USDC and ETH being removed from the pool) largely occurring in the first half of March 2023 leading to a spike in mints (USDC and ETH being added to the pool) in the second half of March 2023 as LP’s look for safe havens (possibly some correlation with Euler pools being drained).

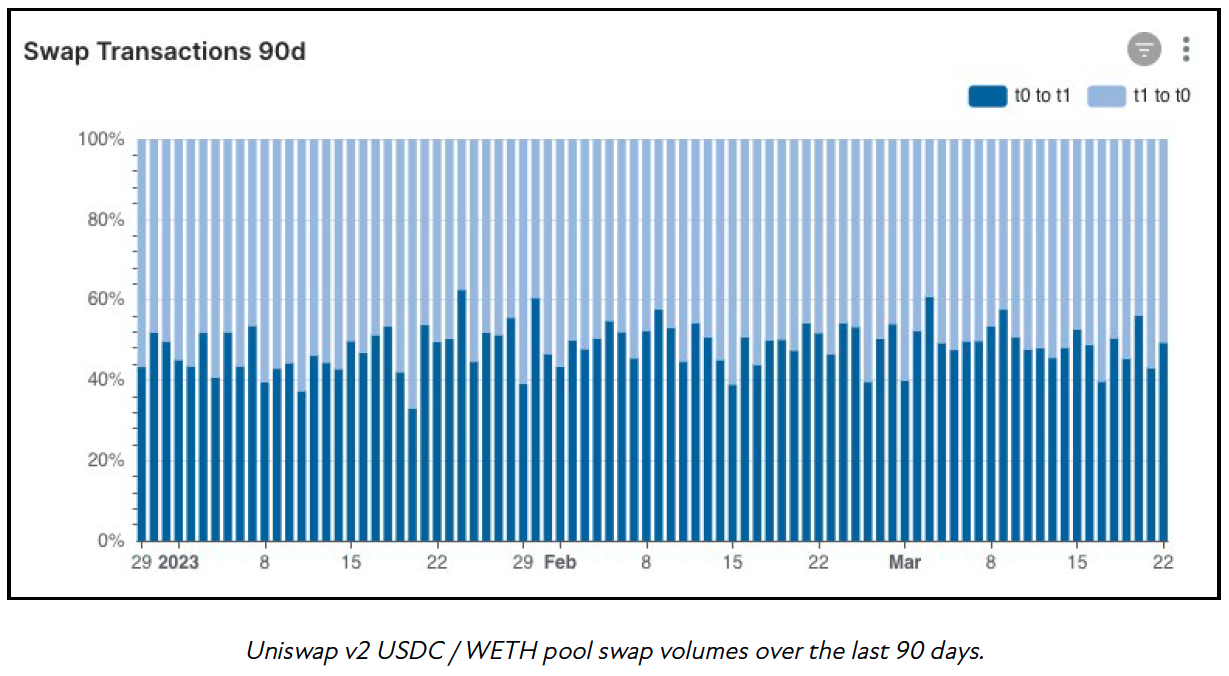

We can look deeper into these swaps and see that this pool generally consists of swaps from USDC (t0) to WETH (t1). This is a great indicator as to where on-chain volumes will flow, as well as gauging interest in/out of specific tokens.

To continue reading the report, click here.

Amberdata

Amberdata is the leading provider of global financial infrastructure for digital assets. Our institutional-grade solutions deliver data, analytics and comprehensive tools and insights that empower financial institutions to research, trade, and manage risk and compliance in digital assets. Amberdata serves as a...