Amberdata Announces S3 Data Delivery for DeFi & Crypto Market Data

Amberdata, the leader in digital asset data and analytics for institutional customers, is excited to announce the upcoming launch of DeFi, Market, and Blockchain data delivery in the analytics-friendly Apache Parquet format, as well as CME derivatives data. These products allow users to download vast amounts of data via AWS S3 or CME (with the necessary license) and provide institutions with the necessary foundation to scale. Available now in S3 delivery are DeFi Lending Protocols, Spot and Futures Market data, Blockchain Mempoool, and CME data, with DEX Trades and Liquidity being released throughout April 2023.

DeFi Data Delivery in S3

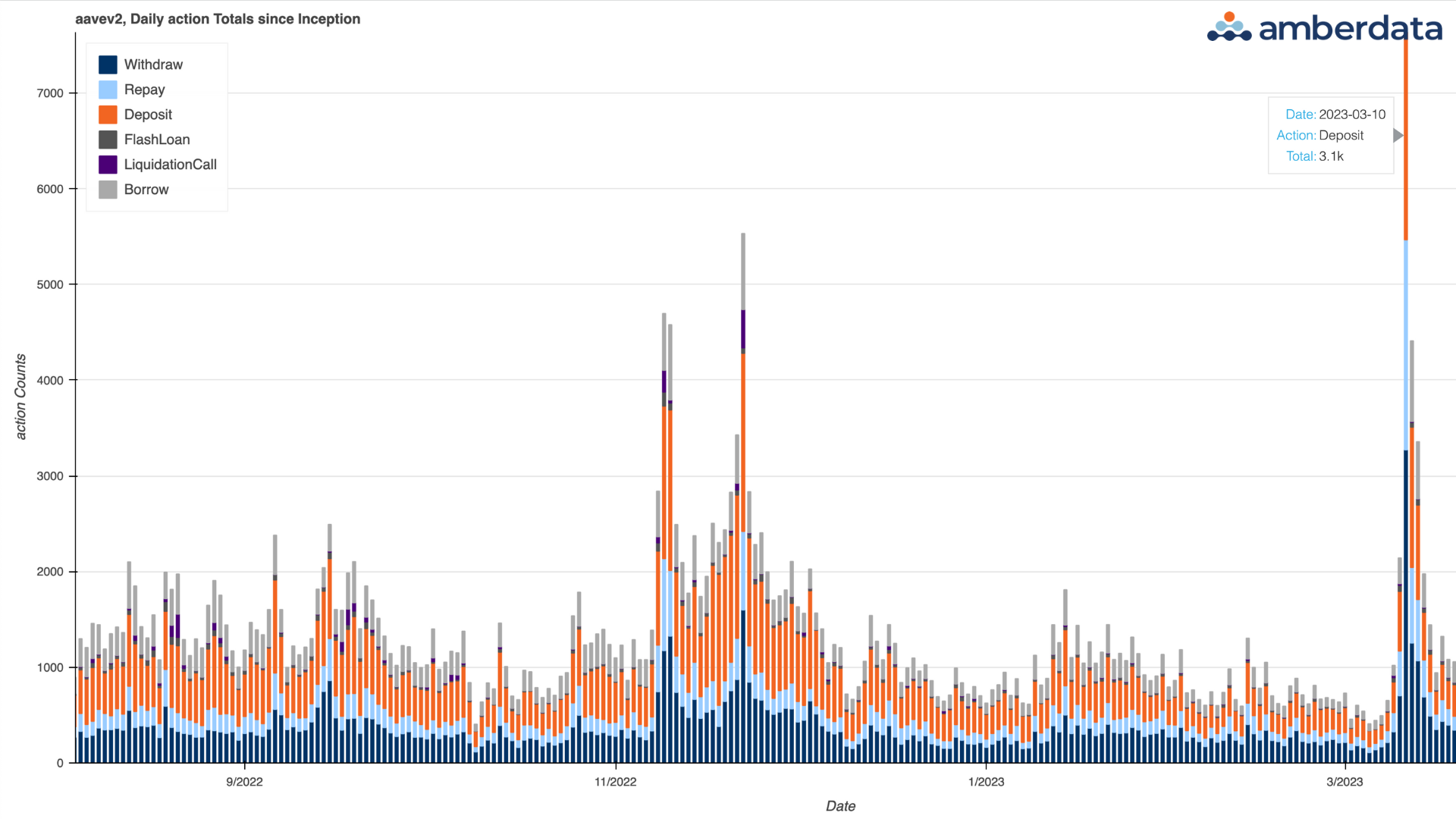

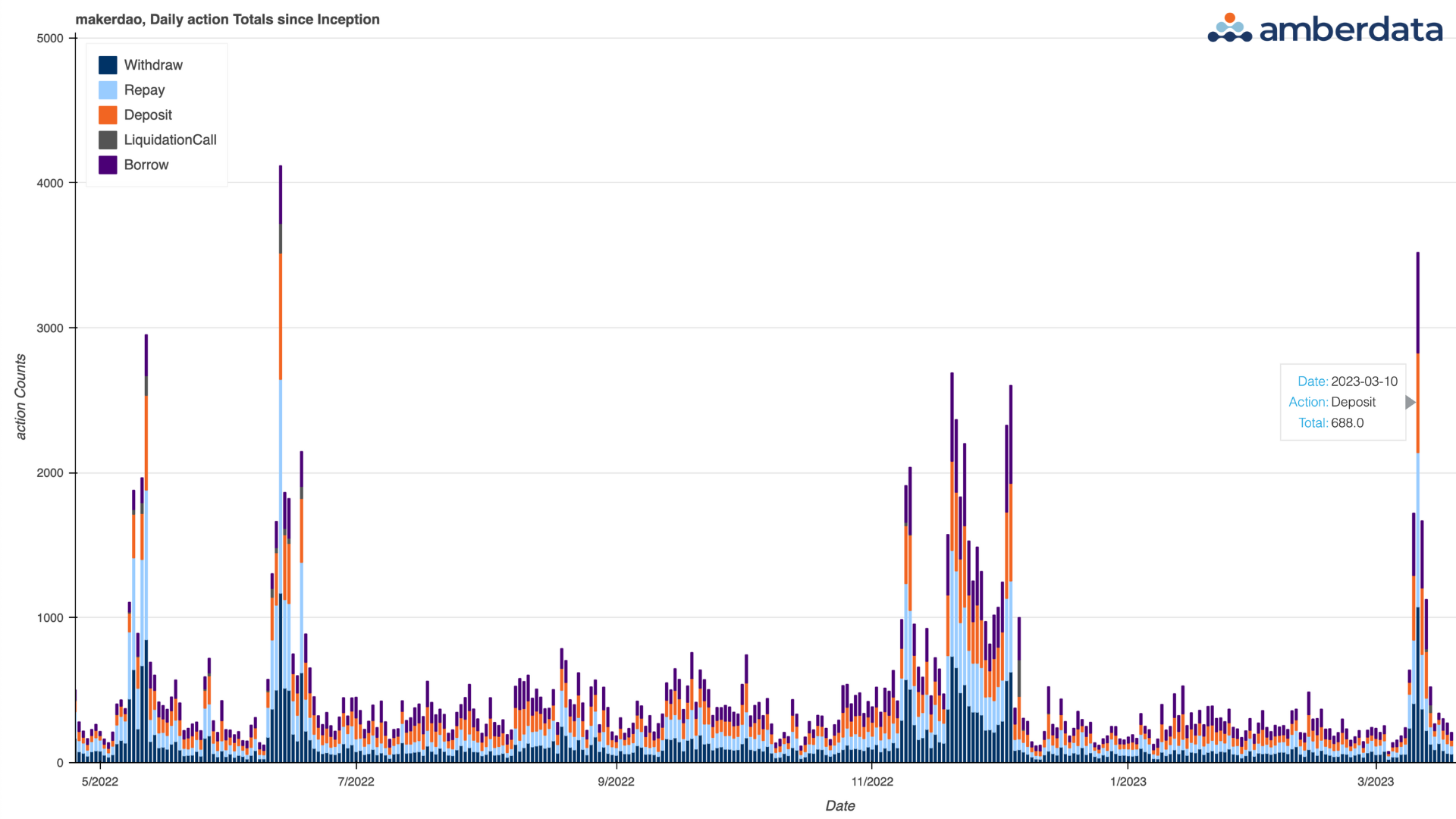

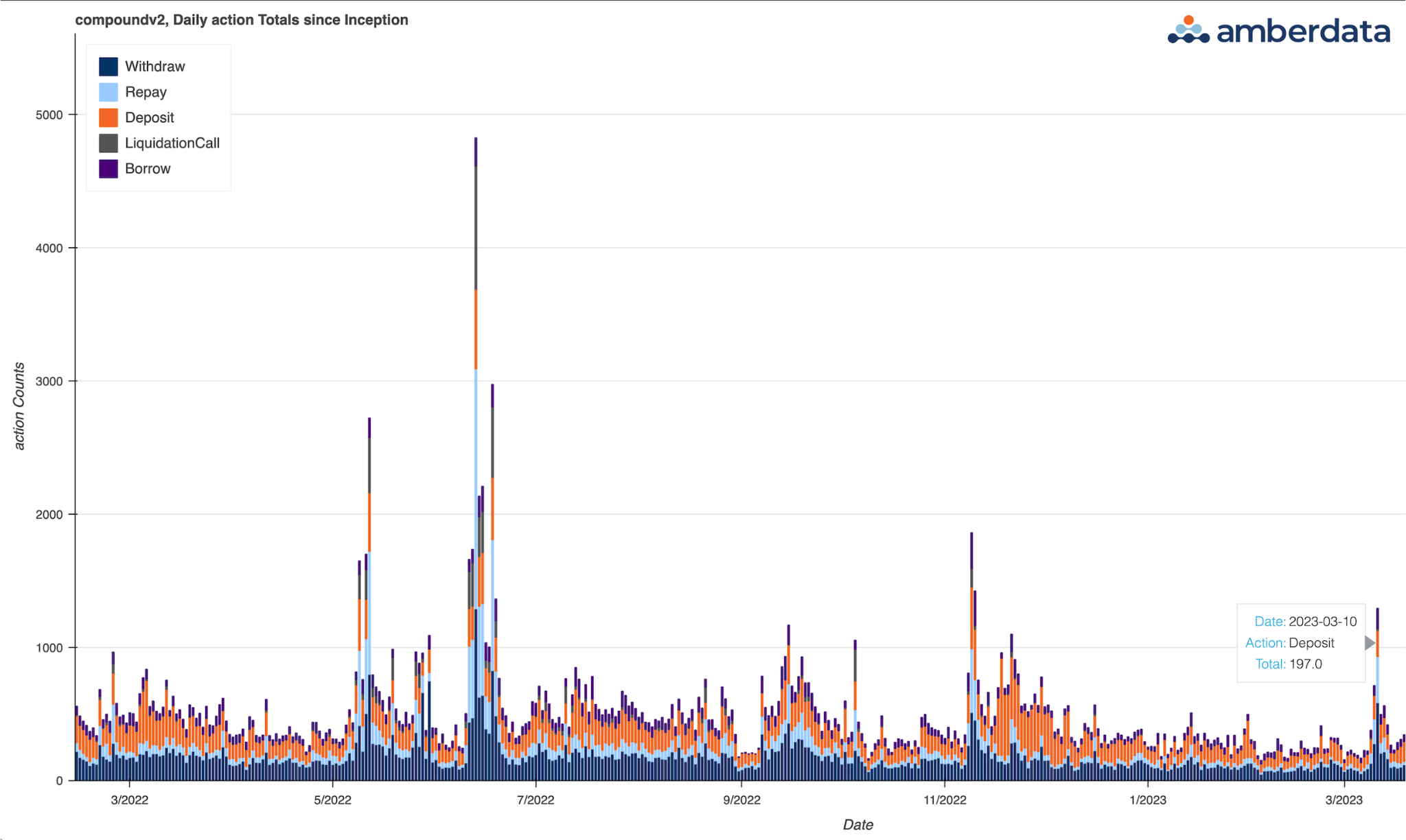

Amberdata now delivers DeFi Ethereum data, empowering clients to elevate their research and backtesting strategies by leveraging DEX Trades. With Liquidity Data, users can see the movement of liquidity prices and distributions for pairs over time. Institutions can also analyze prices over time and generate research on the in-flows and out-flows of token reserves within decentralized exchanges. Finally, institutions can investigate history as far back as the initial deployment of each lending protocol with data in S3, allowing them to generate research into activity on Aave v2, MakerDAO, and Compound v2, including deposits, borrows, repayments, liquidations, and withdrawals.

On-Chain Data Delivery in S3

Blockchain mempool data is ephemeral, and leveraging the mempool requires deep historical collection of blockchain transactions. Amberdata now offers historical on-chain mempool data in S3 across Ethereum, Litecoin, and Bitcoin chains, allowing users to understand transactions’ time-to-block inclusion, analyze MEV and sandwich attacks, and investigate historical gas prices.

Market Data Delivery in S3

Amberdata continues to pave the way in delivering institutional-grade crypto-economic data. Crypto Market Data is an indispensable tool for trading, research, and backtesting. Amberdata’s Crypto Spot and Futures market data provides historical and latest data, enabling clients to research and backtest spot and derivatives trading strategies across all supported centralized exchanges.

CME Data Delivery in S3

CME is a diverse marketplace and data is crucial for crypto derivatives trading. Amberdata now provides historical and latest CME Options and Futures data beginning from February 2023, allowing traders to manage their risk and research CME-specific strategies.

With Amberdata’s CME, DeFi, Blockchain, and Crypto Market data available via S3 delivery, institutions can harness the power of large historical datasets to inform decision-making, optimize their trading strategies, and generate alpha.

DeFi Lending Protocol Data in S3

Generate research into activity since protocol inception on Aave v2.

Backtest every historical event on MakerDAO.

Understand an entire history of a lending protocol like Compound v2.

Amberdata is the leading provider of digital asset data, market intelligence, and risk analytics. We deliver comprehensive data and insights into blockchain networks, crypto markets, and DeFi, empowering financial institutions with data for research, trading, risk, analytics, reporting, and compliance. Amberdata is a critical infrastructure for financial institutions entering digital assets.

For more information on Amberdata’s S3 data delivery, please reference our Data Dictionary or request a demo of our offerings. For current customers, please reach out to your customer service representative to learn more.

Amberdata

Amberdata is the leading provider of global financial infrastructure for digital assets. Our institutional-grade solutions deliver data, analytics and comprehensive tools and insights that empower financial institutions to research, trade, and manage risk and compliance in digital assets. Amberdata serves as a...