Amberdata Announces Multi-Chain Stablecoin Lending Metrics

.png)

Introduction

Amberdata is excited to launch Multi-Chain Stablecoin Lending Metrics. These comprehensive analytics provide invaluable insights into the world of stablecoin activity within lending and borrowing protocols across various blockchain networks. With detailed data available at both hourly and daily intervals since a protocol’s inception, gain deep visibility into stablecoin liquidations, depeggings, borrow and deposit ratios, and interest earned.

A Holistic View of the Lending Stablecoin Ecosystem

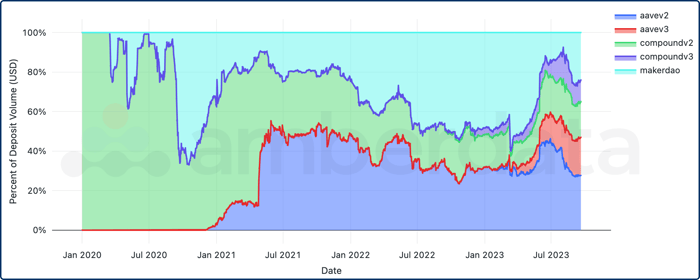

Our multi-chain Stablecoin Lending Metrics cover popular protocols, including Aave v2 and v3, Compound v2 and v3, and MakerDAO. We extend our reach across prominent DeFi networks like Ethereum, Arbitrum, Optimism, and Avalanche. This expansive coverage ensures that users gain a comprehensive understanding of the lending stablecoin landscape.

Flexible Data Delivery

We offer flexible data access options:

- REST API: Utilize our REST API to access hourly and daily stablecoin metrics, allowing you to integrate real-time data seamlessly into your applications.

- AWS S3 Datasets: For those looking for extensive historical data, our AWS S3 datasets provide bulk downloads. You can access an example S3 file here.

Use Cases

Research:

Daily stablecoins deposit percentages in DeFi Lending protocols between January 2020 and September 2023 by protocol.

- Historical Insights: Gain access to historical stablecoin lending rates, loan-to-value ratios, and borrower profiles, enabling you to conduct in-depth research and make data-driven decisions.

- Emerging Patterns: Identify emerging trends and patterns in stablecoin utilization within lending protocols.

- Depeggings Analysis: Analyze stablecoin depeggings and movements to stay ahead of market dynamics.

Risk and Compliance:

..png?width=700&height=186&name=Breakdown%20of%20liquidations%20by%20month%20for%20stablecoin%20pools%20between%20April%202023%20and%20September%202023%20(up%20to%20September%2019th)..png)

Breakdown of liquidations by month for stablecoin pools between April 2023 and September 2023 (up to September 19th).

- Asset Stability Monitoring: Keep a close eye on the stability and value of collateral assets to ensure the safety of your lending activities.

- Real-time Risk Management: Monitor stablecoin fluctuations, depeggings, and liquidations for efficient risk management.

- Portfolio Efficiency: Optimize your portfolio efficiently with the insights provided by our metrics.

Providing Liquidity:

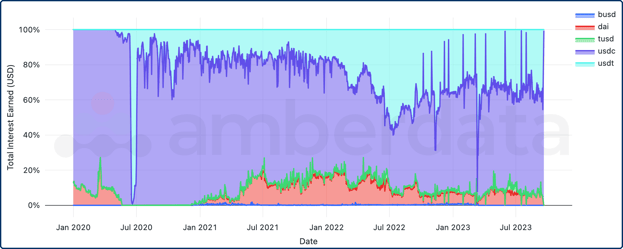

Total interest earned on stablecoin pools between January 2020 and September 2023 by token.

- Earnings Tracking: Keep track of your earnings from interest rates and fees and calculate potential returns.

- Risk Assessment: Assess the risks associated with providing liquidity and allocate your funds strategically across different pools.

- Optimized Capital Allocation: Optimize capital allocation to contribute to the overall liquidity and stability of a lending protocol.

The DeFi Lending Ecosystem is Powered by Stablecoins

The DeFi lending ecosystem hinges on stablecoins, serving as the cornerstone for entering and exiting positions. Discover how you can leverage Amberdata's Stablecoin Lending Metrics endpoints to analyze stablecoins across popular DeFi lending protocols and networks.

Unlock the power of data and gain a competitive edge in the DeFi lending space with Amberdata's Multi-Chain Stablecoin Lending Metrics.

To learn more, schedule a demo here.

Amberdata

Amberdata is the leading provider of global financial infrastructure for digital assets. Our institutional-grade solutions deliver data, analytics and comprehensive tools and insights that empower financial institutions to research, trade, and manage risk and compliance in digital assets. Amberdata serves as a...