Welcome to Amberdata Derivatives Fresh New Features where we go in-depth on features that have recently been built for our ADD customers. An API-exclusive feature analyzing Deribit Gamma Profiles!

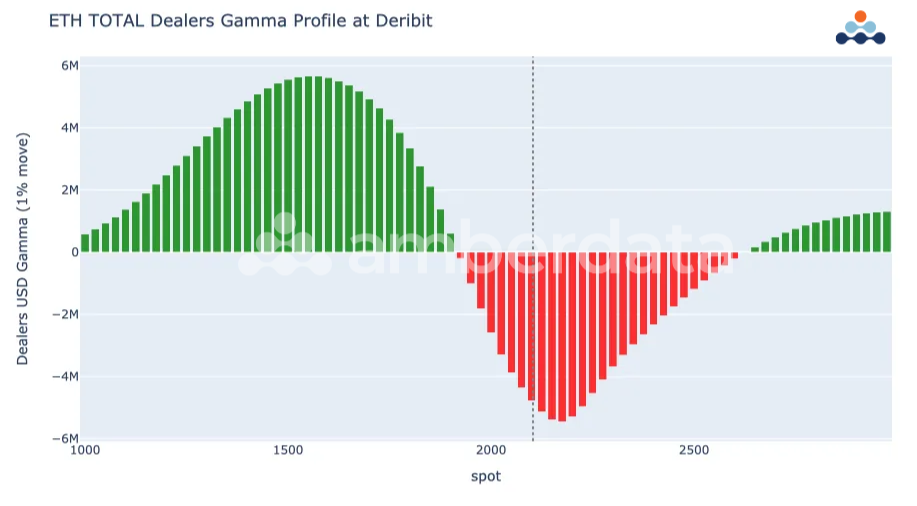

This fresh feature explores the gamma rebalancing dealers will need to execute as spot prices move around.

Remember, Gamma is the highest ATM (and near expiration), therefore our feature helps traders project the new gamma values that occur as options move from becoming OTM→ATM→ITM (and vice versa).

We can also highlight the specific gamma profile of dealers in a specific expiration cycle, to really understand how dealers are positioned at a granular level.

The above charts are especially telling given the recent “Shapella” upgrade and the massive 2400/2700 Call-Spread executed on Paradigm yesterday, 25,000 times!

More information

In this Jupyter notebook, we will utilize Amberdata endpoints to compute the gamma profile of dealers at Deribit. Unlike the conventional calculation of Gamma Exposure (GEX) used in Traditional Finance and other crypto platforms, Amberdata employs the actual positions of dealers for each instrument.

This is feasible due to the computation of the "initiator direction" of each individual trade (referred to as "gvol direction"), which depends on approximately 30 heuristics that compare the trade with the order book snapshot before and after the trade occurs within milliseconds.

(Further details can be found here)

1/n🧵

— AD Derivatives (formerly GVol) (@genesisvol) August 5, 2022

This week in gvol we launched "GVOL_GEX" which allows us to est. positioning of Market Makers (MMs): long gamma vs short gamma

Let's explain what the tool is, why it's different from all the others out there, and how it can be useful to integrate it into a trading system pic.twitter.com/vx8bhJFvXV

The net inventory of dealers is then continuously updated with every trade executed on Deribit.

Although there are certain limitations to this model, such as the failure to take into account cross-platform hedging by dealers or trades that are not settled on Deribit, it remains a robust tool. Its relevance is anticipated to increase as options gain more prominence in the future, similar to what occurred in equities.

This feature, like many others, is too valuable to be put into our General GUI.

Amberdata-Derivatives customers can access these pre-built features through our many PRE-BUILT Python notebooks, by providing their API key.

For more information on becoming an API customer, you can contact an Amberdata sales representative at (hello@amberdata.io)

Amberdata

Amberdata is the leading provider of global financial infrastructure for digital assets. Our institutional-grade solutions deliver data, analytics and comprehensive tools and insights that empower financial institutions to research, trade, and manage risk and compliance in digital assets. Amberdata serves as a...