Top 3 Takeaways Decoding Option Flows: Key Insights + Analysis into Crypto Volatility

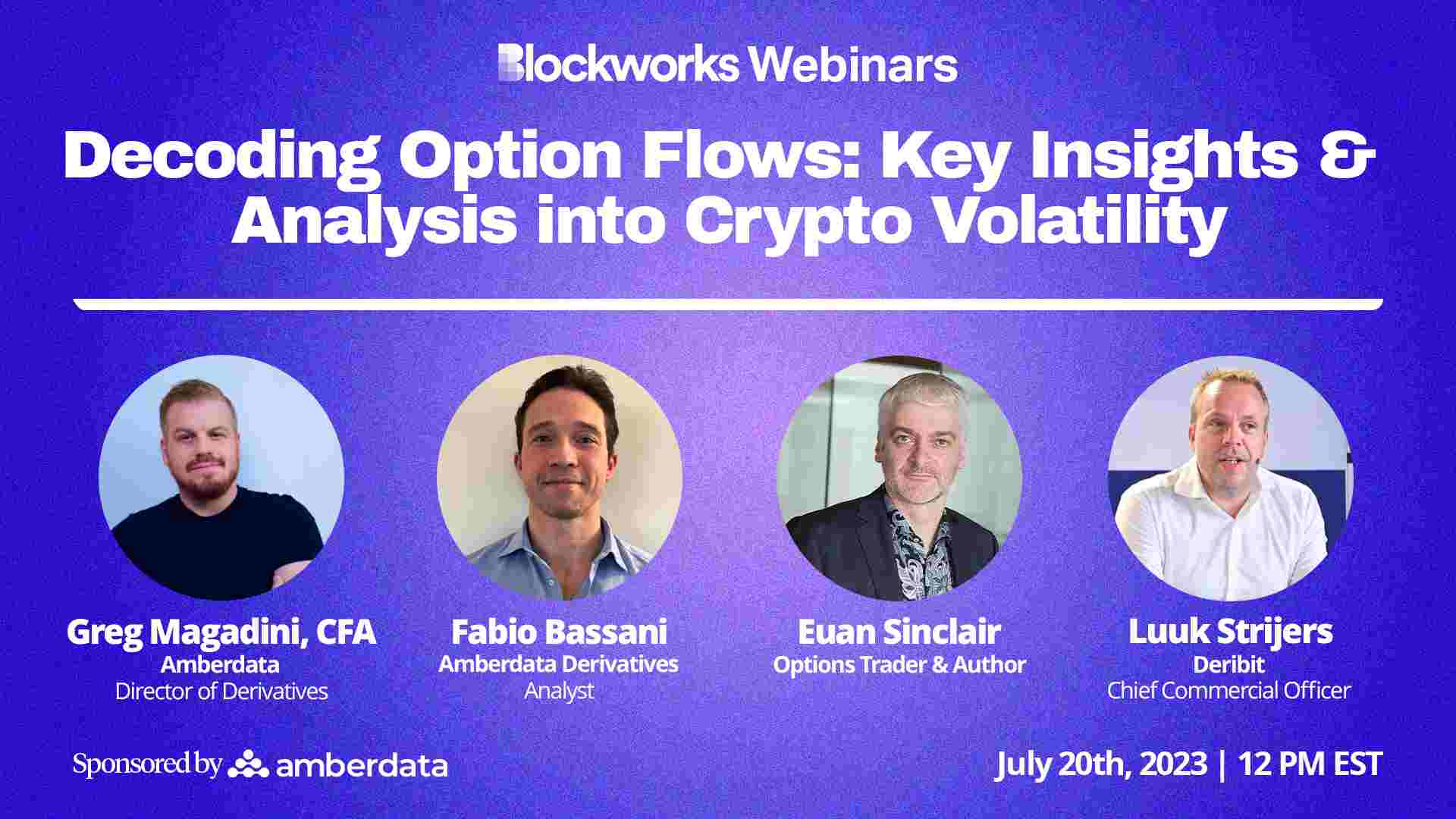

On Thursday, July 20th, Euan Sinclair (twenty years of professional option trading experience and the author of “Volatility Trading” and “Option Trading”) and Luuk Strijers (Chief Commercial Officer, Deribit) joined Greg Magadini and Fabio Bassani of Amberdata Derivatives to discuss the findings from the Q2 research report DECODING OPTION FLOWS: Q2 2023 Key Insights + Analysis into Crypto Volatility.

In this webinar, the team provided key insights into crypto volatility. Crypto volatility trading is still in its infancy and many of the “traditional” flows we’re used to seeing in equities and other markets have only begun to be replicated in the crypto volatility landscape.

The Amberdata team, including Tony Stewart and Euan Sinclair, has developed proprietary tools to tag the trade direction of aggressors. This has enabled us to glean subtle information found within option volumes and positioning.

3 Top Takeaways

- In 2022, both BTC and ETH had nearly identical relationships with each other - a decidedly negative spot/vol regime. This year, BTC displays a slightly positive spot/vol dynamic mostly due to outperformance over the SVB weekend, while ETH’s negative spot/vol relationship is much more muted (with the exception of the Shanghai upgrade). Fundamentally speaking, many view BTC as more of a pure play on monetary policy, while ETH is often viewed as a crypto “tech-play”.

- When the team started to analyze option flows they realized that the taker direction of trades calculated by the Deribit engine wasn’t enough to determine dealer positioning alone, given certain scenarios. They created a more nuanced calculation for taker direction, one that could take into account all the types of trades hitting the order book. For example, some different and more complex rules needed to be used for block trades or spotting resting orders in the orderbook. With that goal in mind, the team released a new tool that has a unique algorithmic approach to direction detection. In the end, they finished their algorithm with around 30 heuristics (high probability rules), to assess the real initiator’s trade direction.

- The team used the DVOL index to give a clean and normalized view of the implied volatility market. One of the clearest phenomena they observed is the general tendency for Bitcoin options to be overpriced relative to realized volatility. Only 25% of the time is the VRP less than +1.80 IV points and although the minimum and maximum VRP are both around the +/-70 IV point range, only 5% of the time is VRP -20 points or less. Alternatively, the median VRP value is +14 IV Points. This clear trend suggests that the “base case” for crypto option traders is to lean towards short-vol strategies in crypto.

This was truly an interesting session leveraging the Q2 research report DECODING OPTION FLOWS: Q2 2023 Key Insights + Analysis into Crypto Volatility.

A recording of the full discussion is available here.

The Q2 2023 report was collectively written by Greg Magadini, Director of Derivatives, Amberdata; Fabio Bassani, Analyst, Amberdata; Tony Stewart, Strategic Advisor, Amberdata; Euan Sinclair, Strategic Advisor, Amberdata; and Samneet Chapel, Quantitative Researcher, LedgerPrime.

Amberdata

Amberdata is the leading provider of global financial infrastructure for digital assets. Our institutional-grade solutions deliver data, analytics and comprehensive tools and insights that empower financial institutions to research, trade, and manage risk and compliance in digital assets. Amberdata serves as a...