Crypto Options Analytics, Sept 10th, 2023: Crypto Volatility Analysis

USA Week Ahead:

-

Wednesday 8:30am - CPI

-

Thursday 8:30am - PPI & Retail Sales

-

Friday 8:30am - Empire Manufacturing

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Authors have holdings in BTC, ETH and Lyra and may change their holdings anytime.

MACRO THEMES:

Last week, Canada’s CB left rates unchanged (at 5%) as said that the current level of interest rates was meeting the required affect to reach their 2% inflation target.

This week we have CPI and PPI releases, that will give us a good glimpse into future potential Fed reactions.

Next week, Sept 19th - Sept 20th, we have the FOMC rate decision, which is expected to be met with another “Skip”.

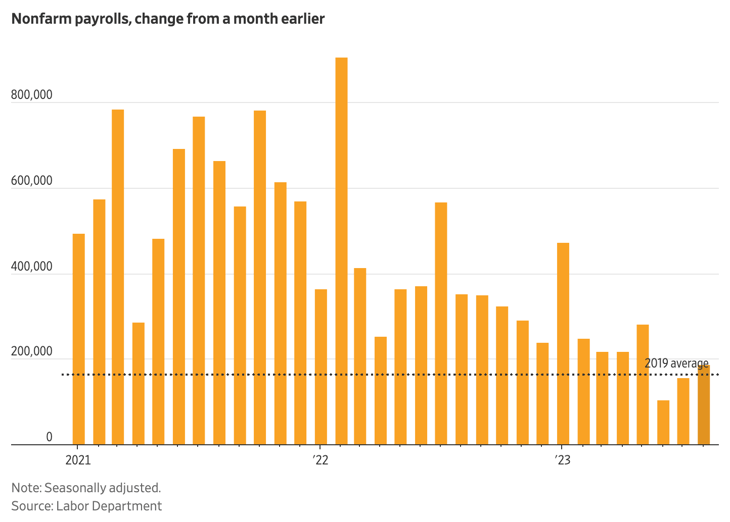

Slowing job growth in the US and a slowdown in the Chinese economy are good signs that next weeks FOMC will be met with a rate “Skip” and the Fed continues to “wait and see”.

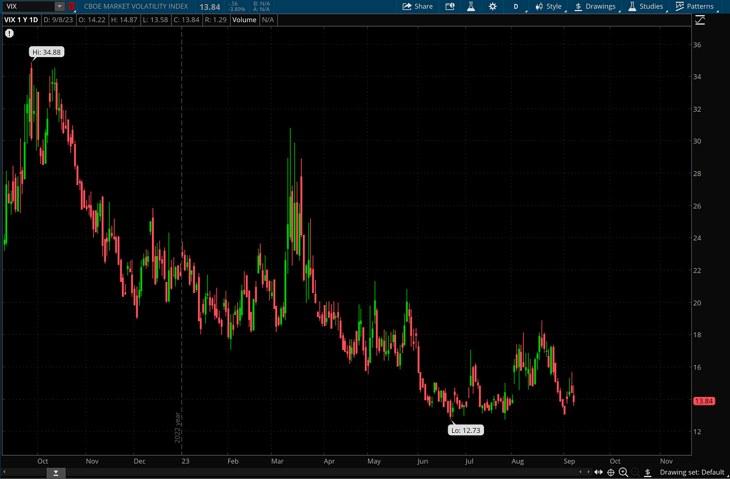

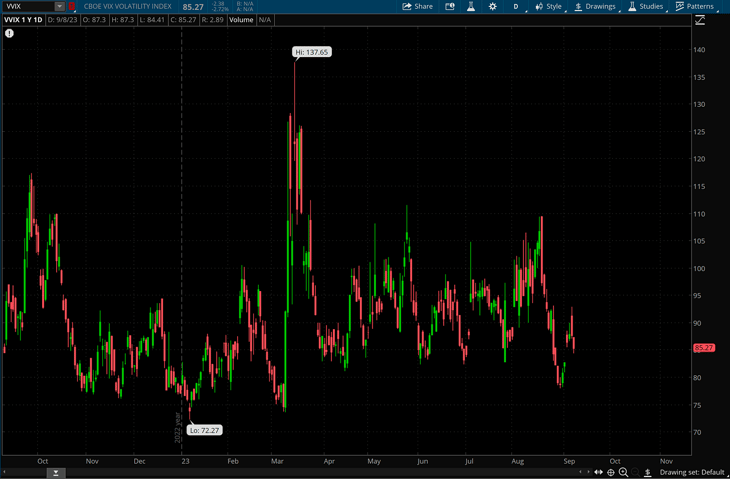

Equity volatility is back towards annual lows along with lower vol-of-vol.

All these things are signs of near-term tranquility of in Macro volatility, removing a potential source of vol for crypto.

That said, there’s still interesting value in the crypto vol. space.

BTC: $25,917 (-0.2% / 7-day)

ETH :$1,623 (-0.8% / 7-day)

Eyeballing this weekly chart doesn’t look great at a glance, spot prices look like they could easily drop lower.

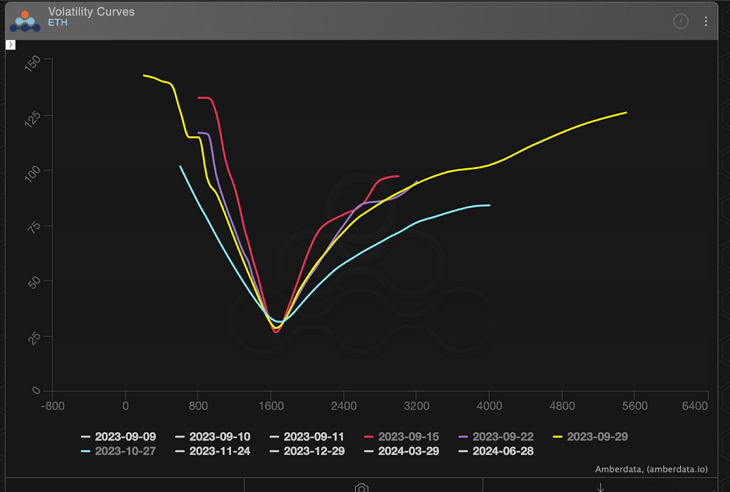

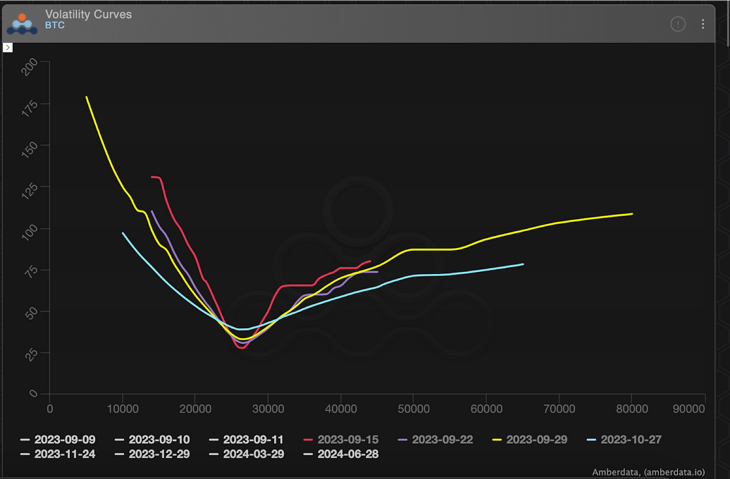

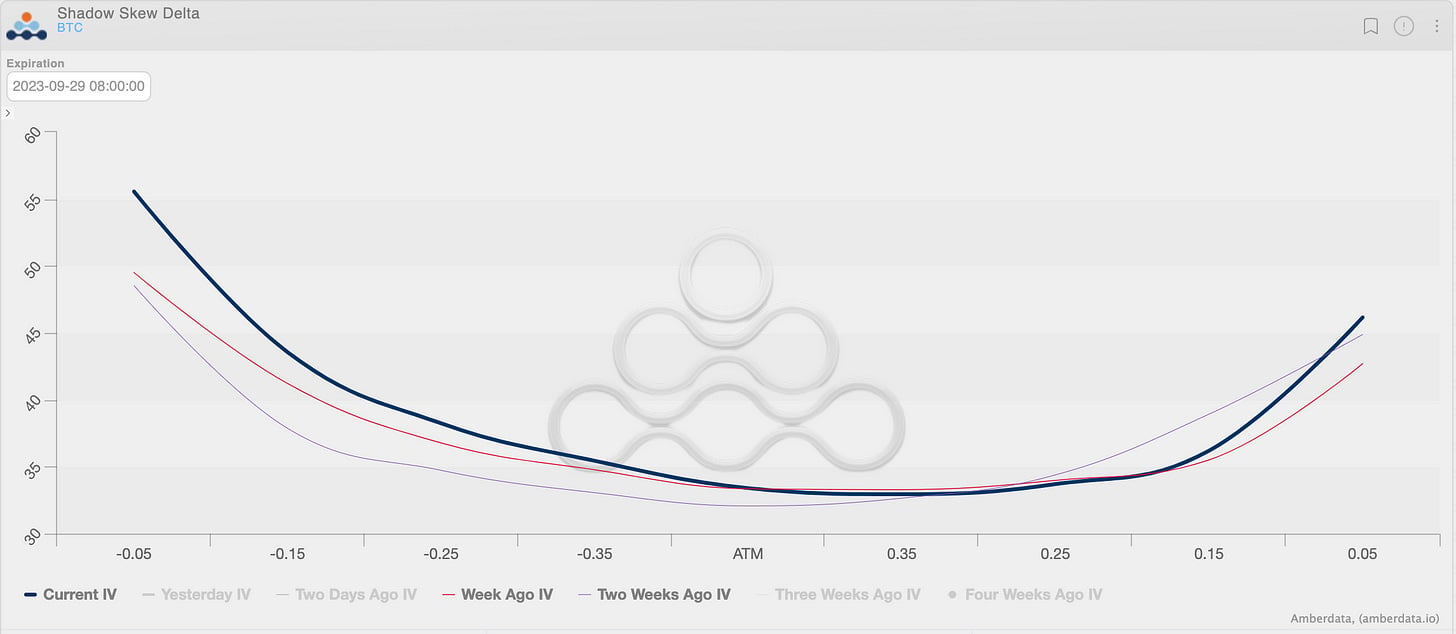

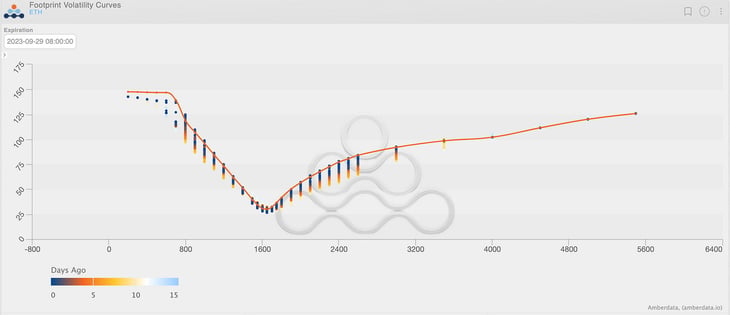

Looking at the near-term expiration, the Sept quarterly, we can see that over the past couple of weeks, there’s been a steady lift in the Put wing IV.

This is despite good news on the ETF/Grayscale developments.

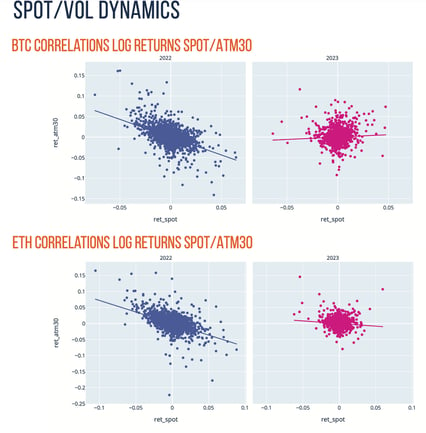

For vol buyers, looking to get long any put protection, ETH is still more interesting than BTC in my eyes, as the spot/vol dynamics have been more negative for ETH and positive for BTC.

Not to mention the currently lower price.

Although, the macro vol picture is likely to be quiet in the near future, buying spot protection (via ETH) interests me.

The steep wing/ATM relationship ETH also continues and provides good value for Put-Spread buyers, given the sharply higher wing.

Even looking at the gamma profile, it just seems like the street is “too confident” selling optionality to dealers.

TL:DR (In order of importance)

-

ETH Wings/ATM skew is steep

-

ETH Spot/Vol dynamics are slightly more negative YTD

-

ETH Relative Vol is historically low

-

ETH absolutely vol is historically low (not necessarily cheap)

-

Crypto Spot prices not reacting favorably to good news

-

Crypto Spot chart looks “heavy”

Anyways, just some thoughts of where I see “value”.

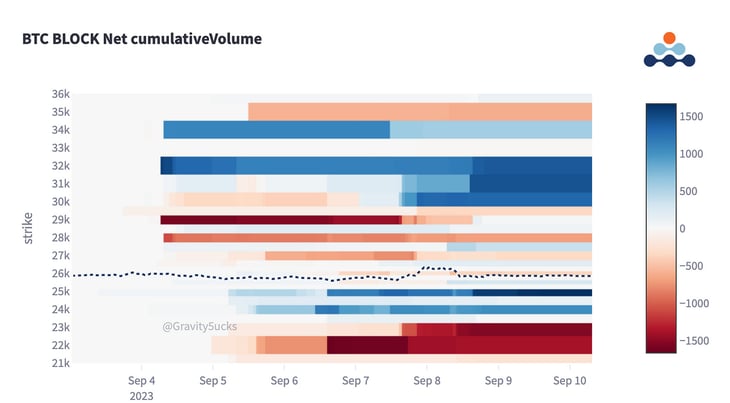

PROPRIETARY “GVOL-DIRECTION” FLOWS - @Gravity5ucks

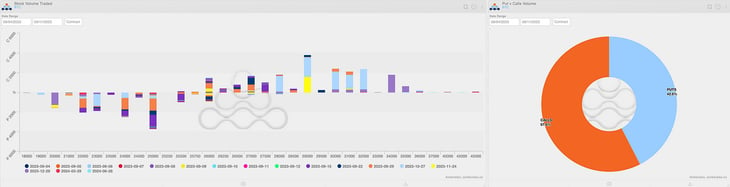

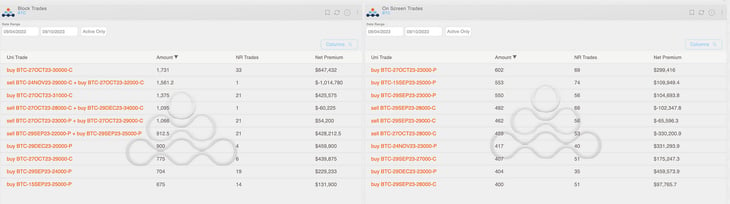

Despite the low volume week, some interesting trades happened.

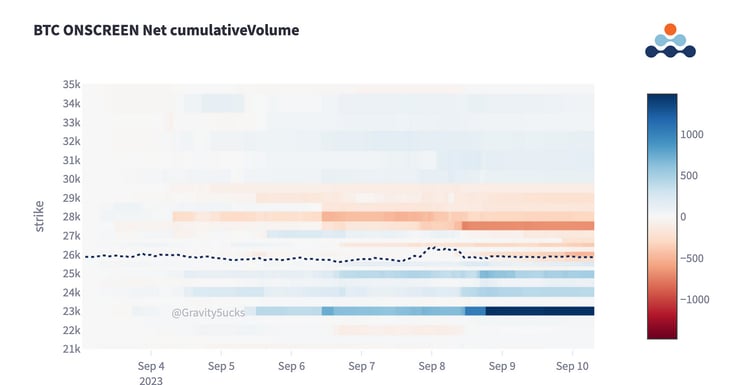

Some divergent takes between blocks and onscreen.

Blocks longing upside calls in range $29k-$31k while selling $23k put.

Quite the opposite on-screen with $23k put bought.

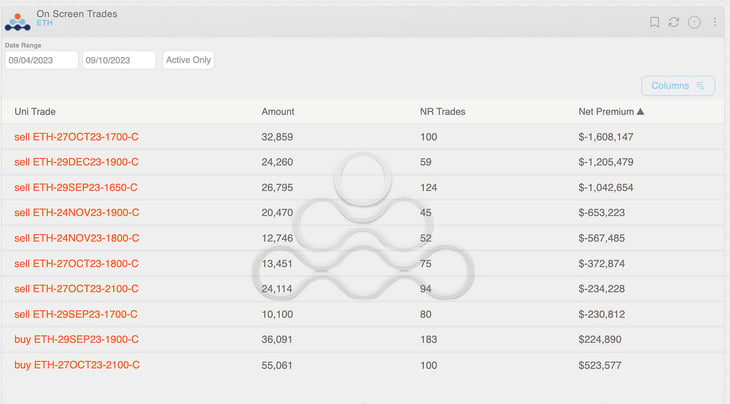

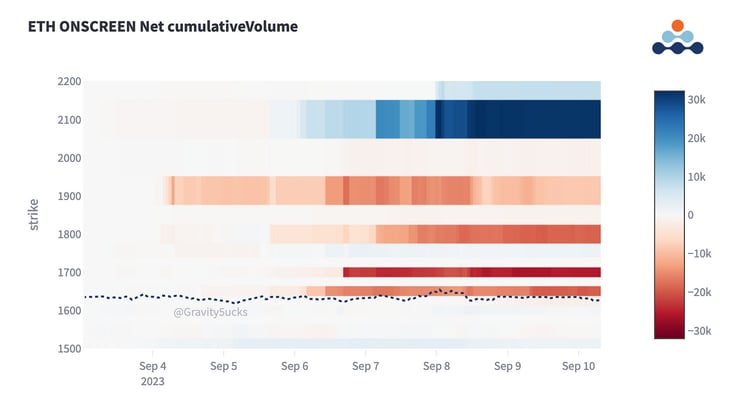

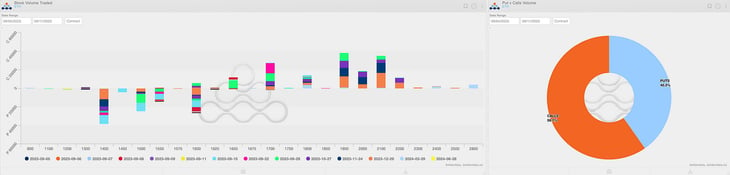

On Ethereum surprisingly more action on-screen compared to blocks with the usual “short calls flow” rebalancing risk across maturities and strikes.

(ETH Heatmaps Onscreen)

Paradigm Block Insights

BTC

ETH

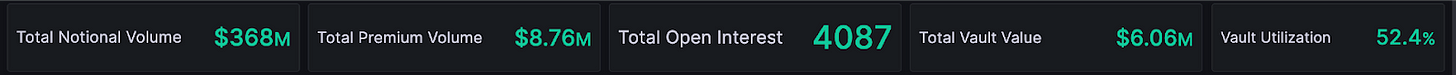

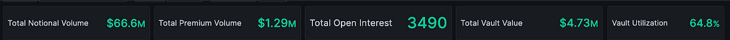

Lyra Weekly Review

Check out more info on Lyra V2 launching soon!

https://twitter.com/lyrafinance/status/1699588384577196426?s=20

V1 Arbitrum:

V1 Optimism

Volatility

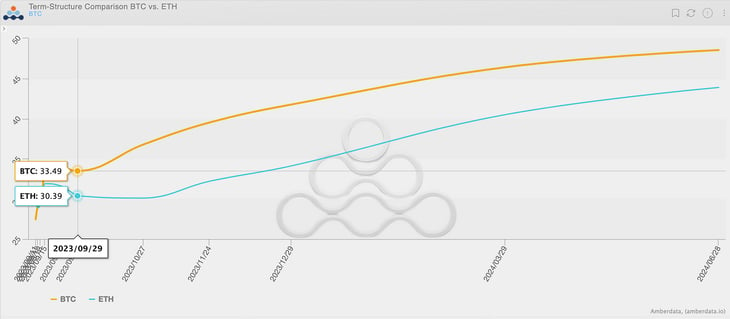

Current ATM IV is ~33% in ETH, back on recent lows. Both ETH and BTC sit in backwardation as realized volatility continues to be low.

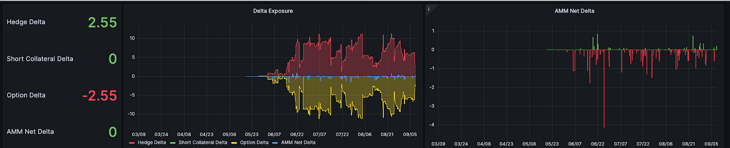

ETH Market-Making Vault

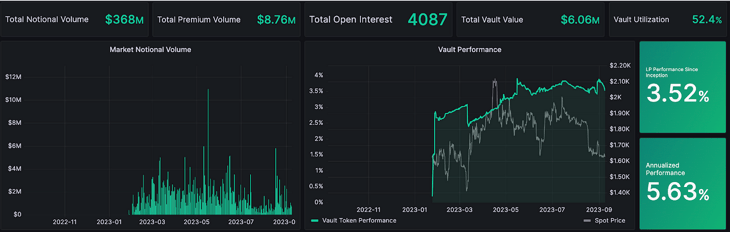

ETH Arbitrum: +3.52% since inception, +5.63% annualized

ETH Optimism:

Depositors earn an additional 5.72-20.97% rewards APY, boosted up to 49.05% for LYRA Stakers by depositing USDC to Lyra’s Market Making Vaults.

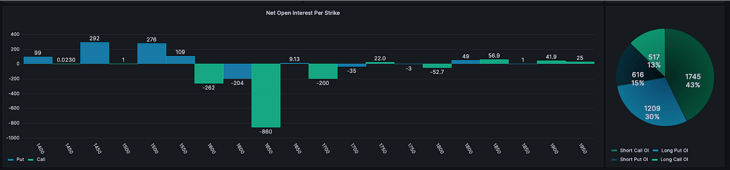

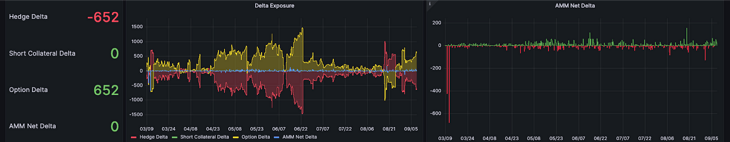

Net MMV Exposure:

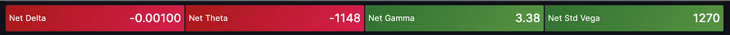

ETH vaults on both Arbitrum and Optimism remain long at-the-money options and short small out of the monies. Vaults require a move in underlying or will continue bleeding theta over the next week.

ETH Arbitrum:

ETH Optimism:

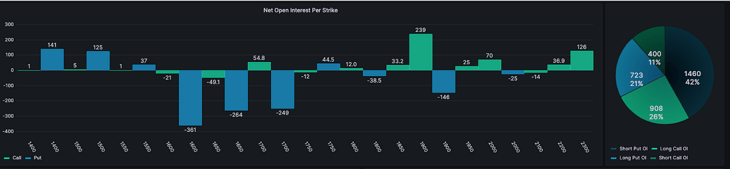

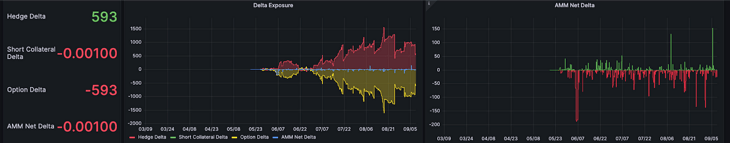

BTC Volatility

BTC IV has settled ~40%, remaining slightly firmer than ETH.

Net BTC MMV Exposure:

BTC vaults also remain long gamma, short theta

Learn more about Lyra in this GVOL explainer video!

Trade: app.lyra.finance

Twitter: https://twitter.com/lyrafinance

Discord://discord.gg/Lyra

Watch @itseneff and @GenesisVol talk options here

AMBERDATA DISCLAIMER: The information provided in this research is for educational purposes only and is not investment or financial advice. Please do your own research before making any investment decisions. None of the information in this report constitutes or should be relied on as a suggestion, offer, or other solicitation to engage in or refrain from engaging, in any purchase, sale, or any other investment-related activity. Cryptocurrency investments are volatile and high-risk in nature. Don't invest more than what you can afford to lose.

Greg Magadini

Greg Magadini is the Director of Derivatives at Amberdata. Previously, he co-founded Genesis Volatility (later acquired by Amberdata). Greg Magadini started his career as a proprietary trader for DRW and Chopper Trading in Chicago IL. Greg has nearly 15-years of options trading experience and has been active in the...