.png)

-

Tuesday 8:30 am - Employment Cost Index

-

Tuesday 9 am - Case-Shiller Home Prices

-

Wednesday 8:15 am - ADP Employment Preview

-

Wednesday 2:30 pm - Powell News Conference

-

Friday 8:30 am - NFP

Disclaimer: Nothing here is trading advice or solicitation.

This is for educational purposes only.

Math-minded people here, pardon any typos.

THE BIG PICTURE THEMES:

Risk assets are continuing to show a lot of resilience in their 2023 uptrend.

VIX readings are now lower than at any time in 2022 and the trend should be assumed to continue, absent a catalyst to the contrary.

Wednesday, Jerome Powell is going to have a News Conference; this is going to be the biggest potential mover, followed by Friday’s NFP release.

Crypto volatility remains to the upside, as prices continue to explode higher.

Last week we noted that BTC RR-Skew seemed confused as LT options priced in higher RR-Skew than ST options; today this trend has reversed and priced itself in a manner congruent with the upside momentum higher that we are currently witnessing.

BTC: $23,763 +4.65%

ETH :$1,645 +0.57%

SOL: $26.12 +7.86%

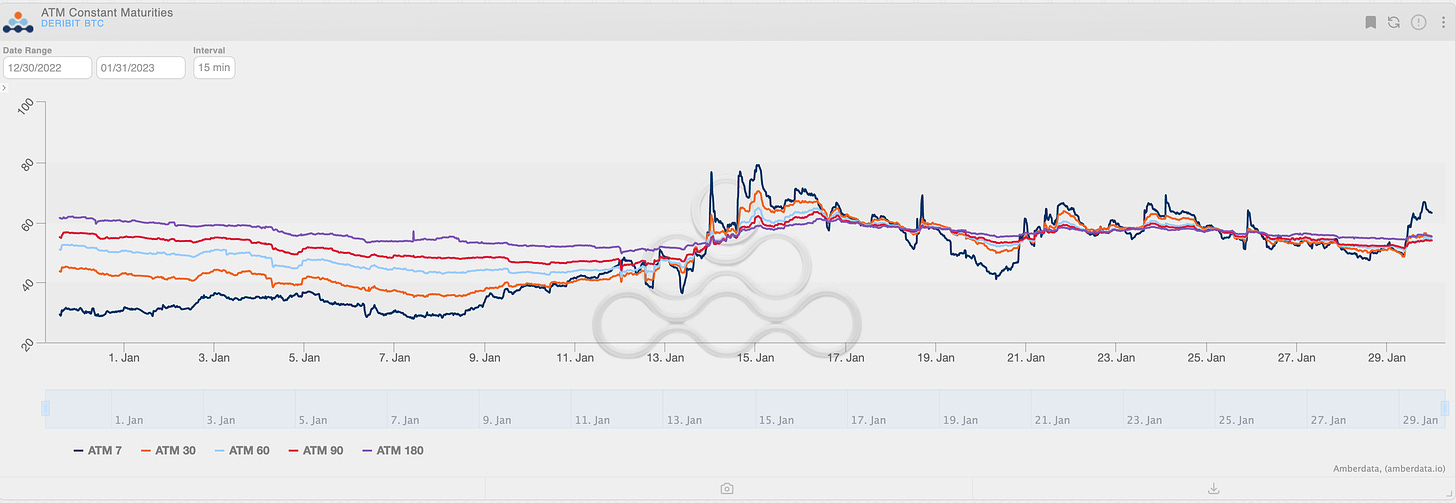

TERM STRUCTURE

(Jan. 29th, 2023 - BTC Term Structure - Deribit)

The term structure has shifted higher into Backwardation as spot prices continue to ramp higher.

The option market is currently pricing some more explosive action in the short-term and a continued phenomenon of positive spot/vol. correlation.

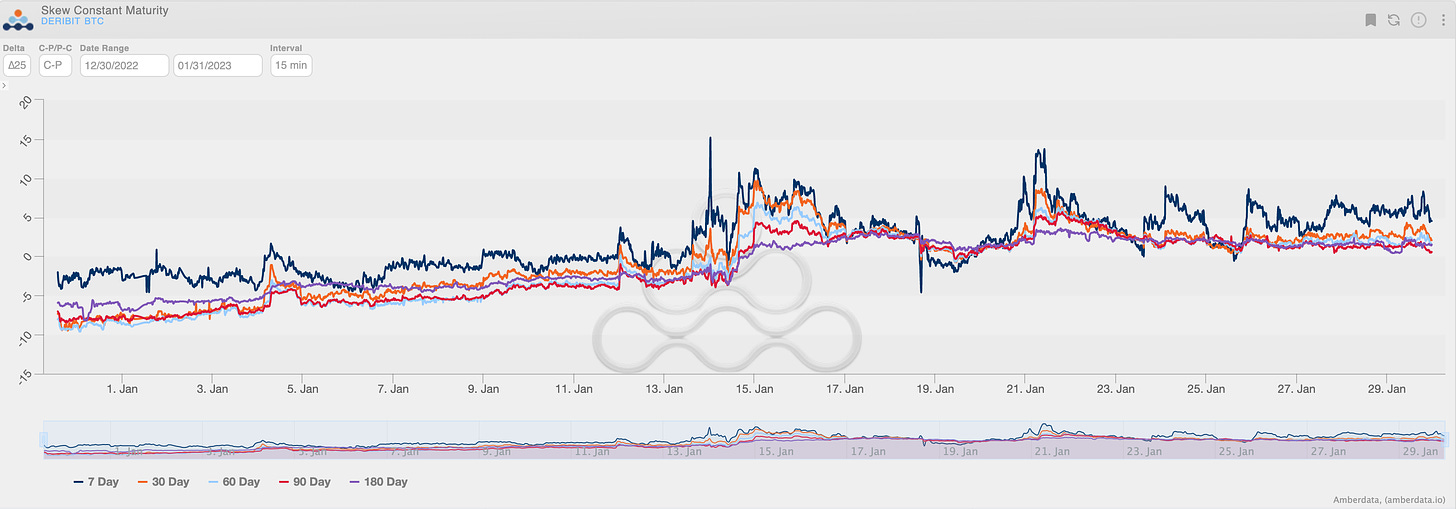

SKEWS

(Jan. 29th, 2023 - BTC RR SKEW (C-P) ∆25 - Deribit)

As noted earlier, RR-Skew price action on 1/19 and 1/23 seemed very counterintuitive.

Although spot prices were stalled with resistance, a relaxation in RR-Skew signaled a relaxation of positive spot/vol. correlation risk … pricing something like the symmetry between FUD Risk & FOMO Risk (surprising to me).

Fomo risk is still clearly running the market and FUD risk has now been exhausted, given the FTX, Genesis, etc headlines.

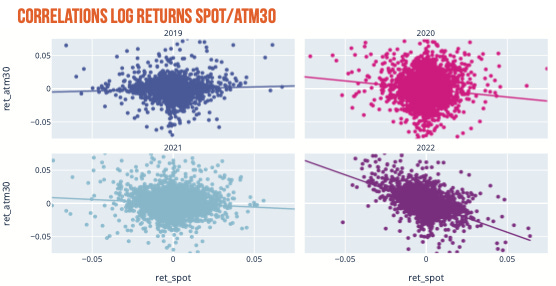

In the LT spot/vol., correlation is likely going to be negative and correlated to Macro movements (at least in my opinion and judging by 2022 trends).

VOLATILITY PREMIUM

(Jan. 29th, 2023 - BTC IV-RV)

There’s a little bit of an IV “pop” higher here, but definitely nothing worth selling.

We’re still clearly ripping higher and the VRP is extremely small.

If anything, options are essentially cheap.

RV is justifying the current IV levels and historically speaking, current vol. readings aren’t far from median levels.

Given this metric, long vol makes the most sense here.

PROPRIETARY “GVOL-DIRECTION” FLOWS - @Gravity5ucks

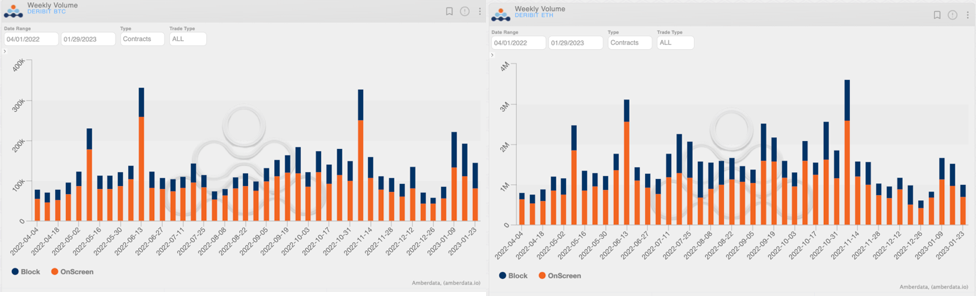

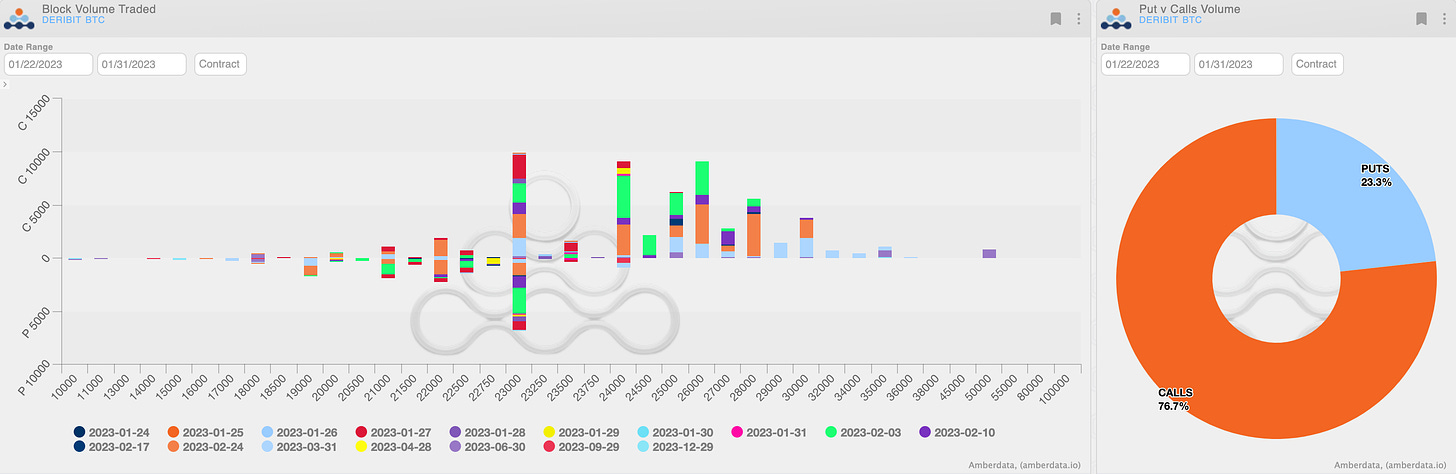

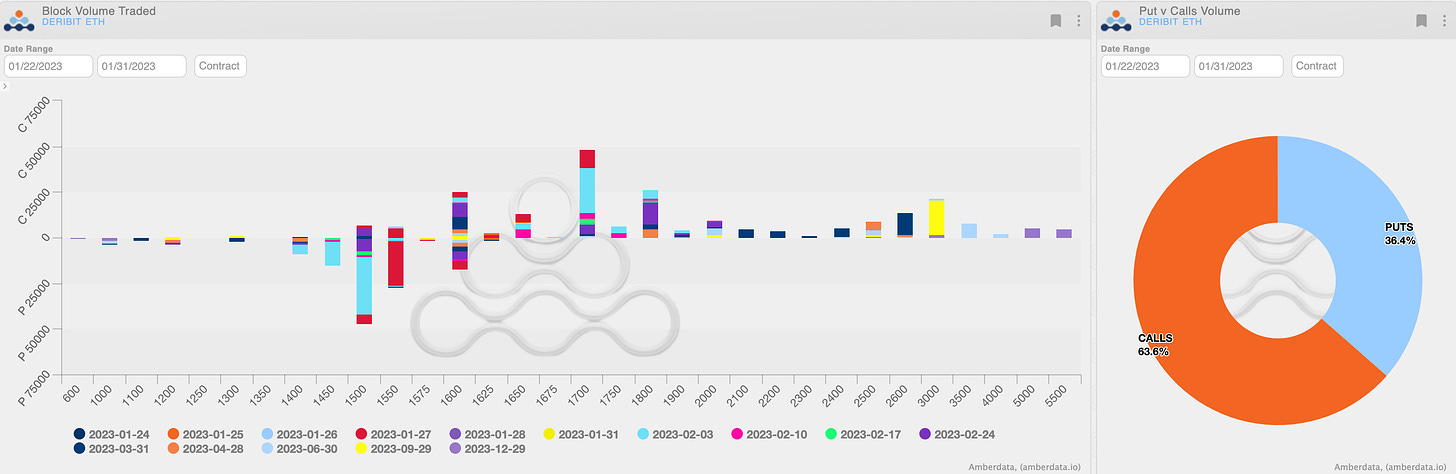

Weekly volumes are falling but if those of Bitcoin are at the top of the last year’s distribution, those of Ethereum are in the low part.

Also confirmed by notional with BTC $3.3B vs ETH $1.6B.

(BTC vs ETH Weekly Volumes Contracts - Options Deribit Historical Section)

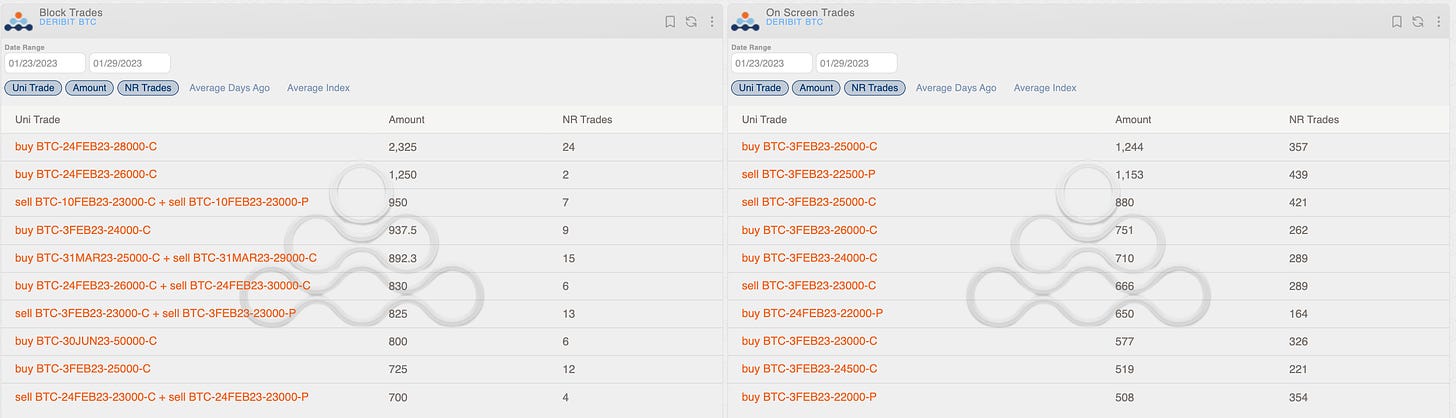

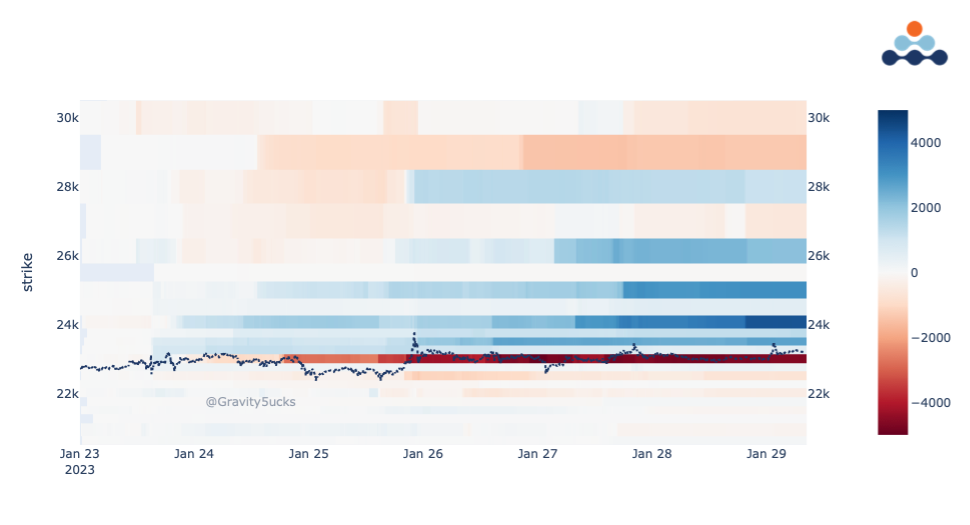

First days with nothing to highlight, but with the index stabilized and volatility realized falling, the temptation to sell straddle $23k was irresistible. The trade clearly dominates the heat map.

In general, the flow was calls-only with $26k-$28k exposures on blocks, while onscreen stubborn buying on the $23k-$25k dailies.

(BTC AD direction table with uni_trade - Options Scanner section)

(BTC Cumulative Weekly Volumes Heatmap)

Paradigm Block Insights (22Jan - 29Jan)

More lethargic spot action with BTC trading range bound after peaking at ~23700 on Wed. Flows a mix of BTC call spreads and straddle selling early in the week, and outright call buying on Friday. ETH is relatively quiet.

BTC +1.5% / ETH -3% / NDX +4.5%

On Monday, BTC Feb/Mar call spreads bought given flat upside skew driving decent payouts. Feb 24k/28k below was ~4.6x times payout-to-cost and a 25-delta spread.

1200x 24Feb 24k/28k CS

800x 31Mar 25k/29k CS

500x 24Feb 24k/26k CS

BTC straddle selling prevalent early in the week…a great trade, given the strong reset in implieds and muted realized. A lot of questions if these were sold outright or if part of a vol relative value trade.

1100x 10Feb 23k straddle sold

1000x 24Feb 20k straddle sold

1000x 24Feb 23k straddle sold

550x 27Jan 23k straddle sold

With 25d skew across the curve still in favor of calls, we saw plays for mean reversion via BTC and ETH risk reversals.

BTC 1M 25d skew still trades -3v (calls over), but has come off from -8v levels we saw a week ago.

5000x 3-Feb-23 1500/1700 RRPut bot

1500x 29-Dec-23 1000/3000 RRPut bot

150x 29-Dec-23 15000/35000 RRPut bot

As Wednesday’s rally picked up steam, we saw significant chasing of spot via outright topside. This has been a prevalent theme in January: when spot breaks out we see simultaneous call buying.

2300x 24Feb 28k Call bot

1000x 24Feb 26k Call bot

This outright upside buying then continued on Friday from a variety of takers in large size. Perhaps the timing has to do with gamma exposure expiring on 27Jan expiry.

1000x 24Feb 26k Call bot

850x 3Feb 24k Call bot

650x 3Feb 25k Call bot

After a dire December for option volumes - given FTX fallout- Paradigm is on pace for its second largest month ever in option volumes (spot rally helped!).

ICYMI: Check out the latest TBP episode with Gordon Grant, Head of Derivatives at Genesis!

We cover crypto spot reflexivity, dealer positioning, opportunistic/systematic flow trends, and BTC hashpower migration.

BTC

ETH

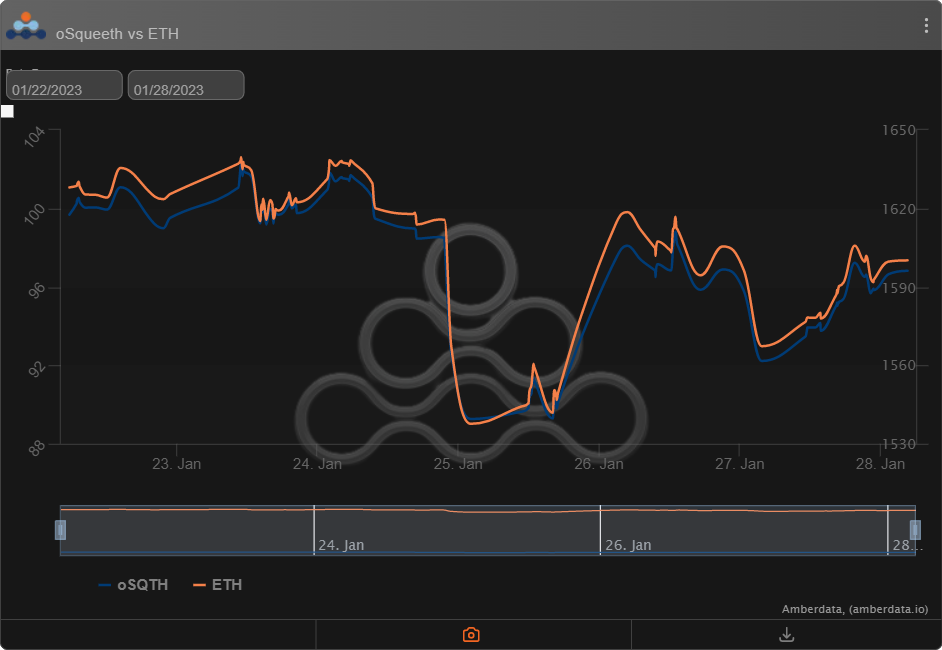

The Squeecosystem Report (1/22/23 - 1/28/23)

After last week’s injection of volatility back into the markets, this week left the sell side with a breather. Markets remained steady, with a lack of direction into the monthly expiration. ETH ended the week -1.70% and oSQTH ended the week -2.87%.

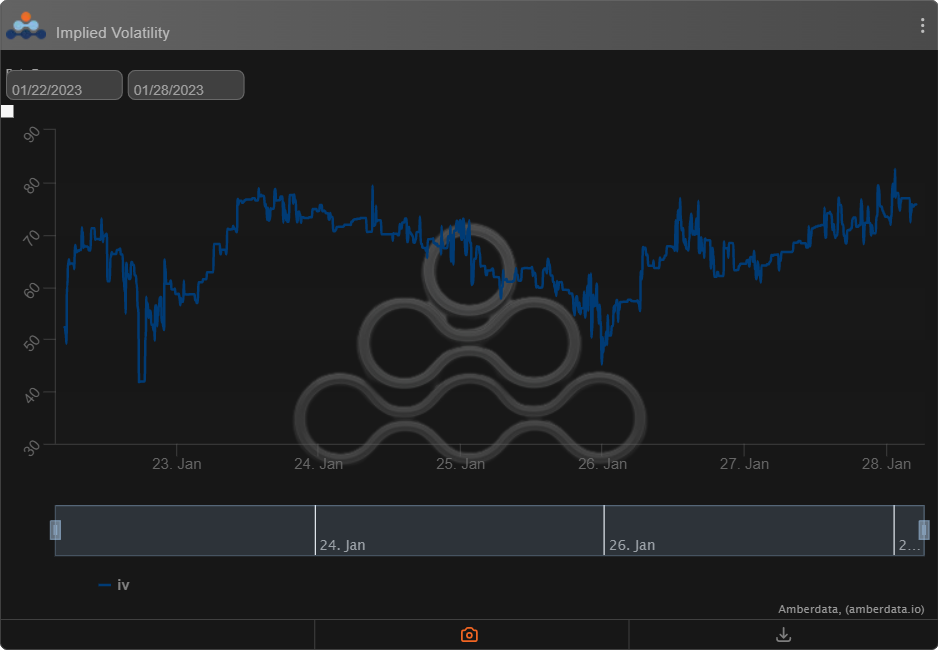

Volatility

Squeeth IV normalized this week, greatly benefiting Crab depositors willing to take the other side of last week's pop. Squeeth provided intra-week opportunities for vol traders to trade against Deribit ETH options.

Volume

The 7-day total volume for oSQTH via Uniswap oSQTH/ETH pool was $4.01m. January 22nd and January 26th both saw the highest volume, with a daily total of $1.11m traded. An additional $1.03m traded via OTC auctions this week.

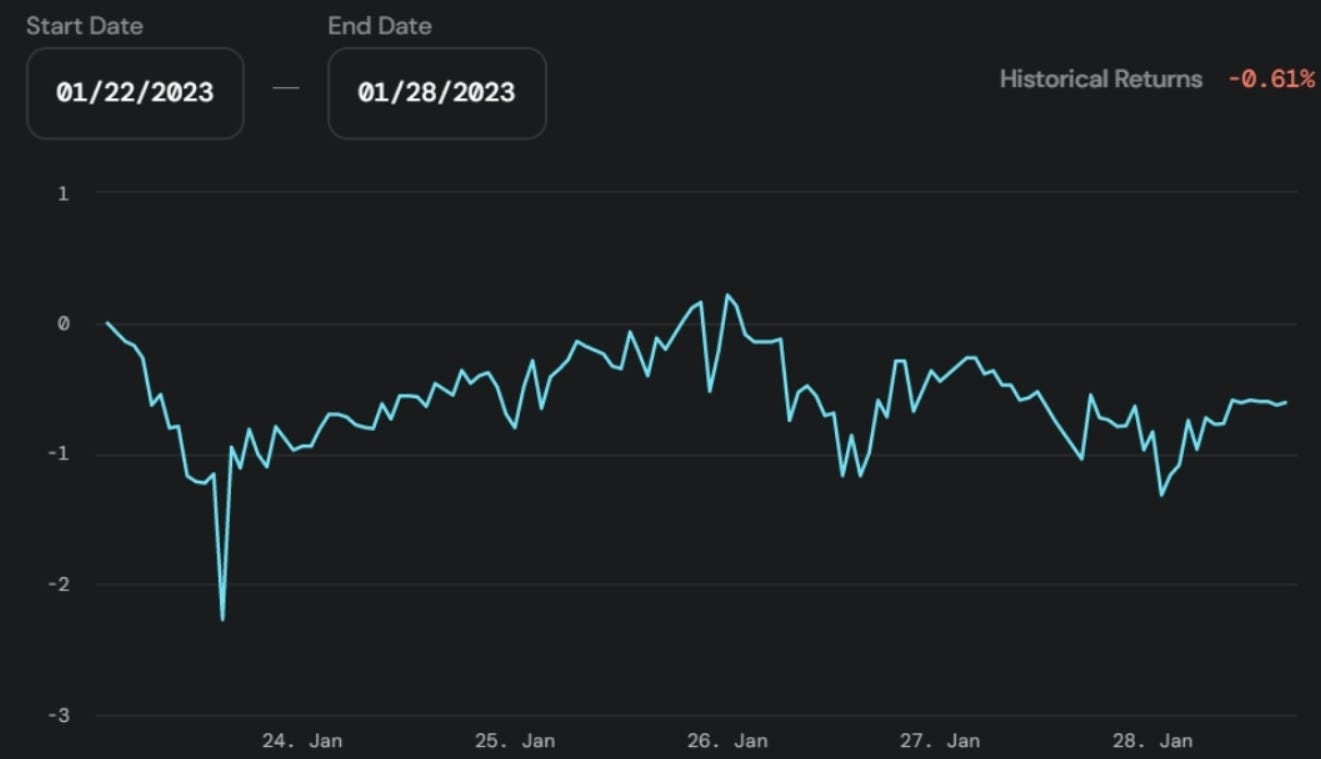

Crab Strategy

Crab stalled its monstrous comeback this week, ending the week -0.61%.

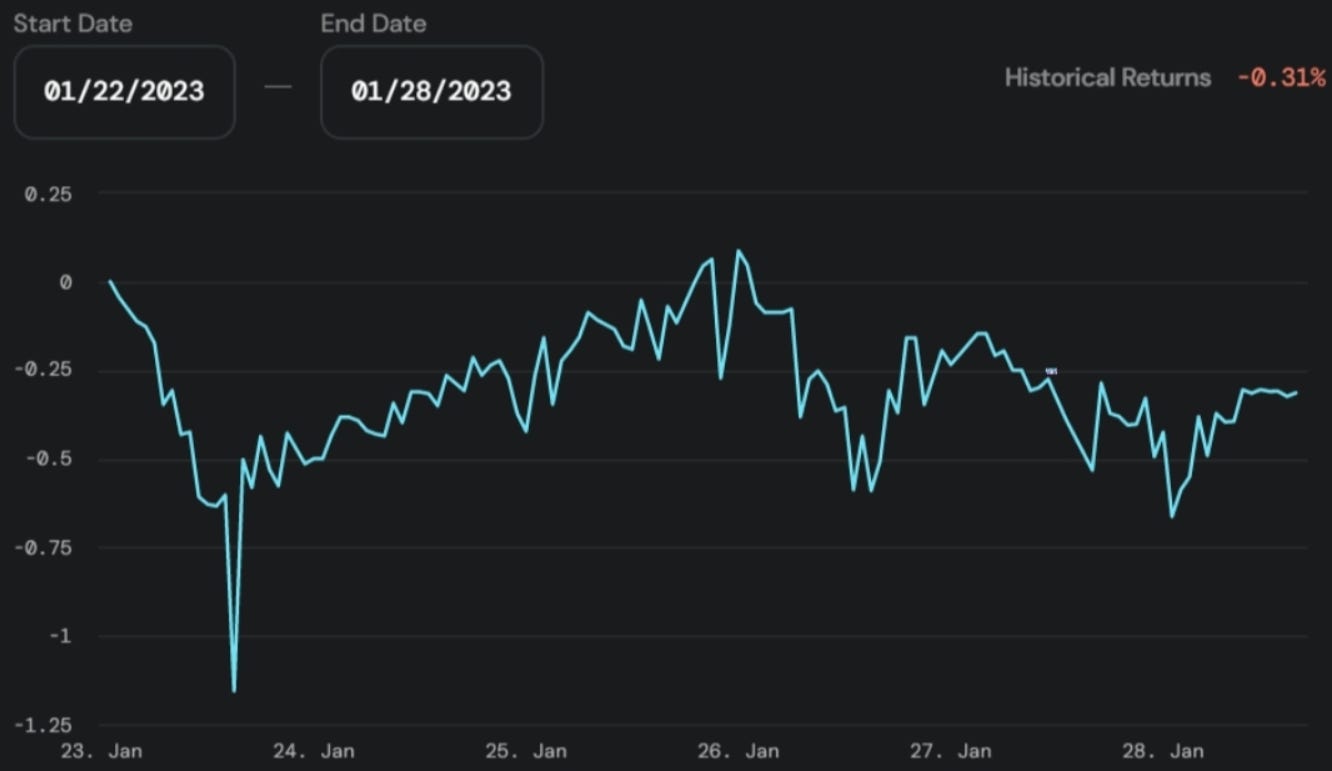

Zen-Bull Strategy

Zen-Bull returned -0.31% for depositors in ETH terms. Since inception Zen-Bull has outperformed ETH by +0.47% in USDC terms.

Twitter: https://twitter.com/opyn

Discord: discord.gg/opyn

Greg Magadini

Greg Magadini is the Director of Derivatives at Amberdata. Previously, he co-founded Genesis Volatility (later acquired by Amberdata). Greg Magadini started his career as a proprietary trader for DRW and Chopper Trading in Chicago IL. Greg has nearly 15-years of options trading experience and has been active in the...