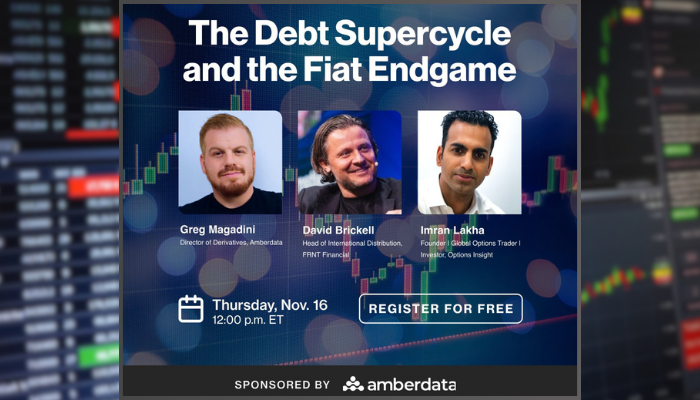

Coindesk Webinar Overview: The Debt Supercycle and the Fiat Endgame

On Thursday, November 16th, Greg Magadini (Amberdata), David Brickell (FRNT), and Imran Lakha (Options Insight) joined CoinDesk moderator Andy Beahr to explore how large Debt-to-GDP ratios, Central Bank balance sheet expansions, and current geopolitical risks are driving investors out of fiat currencies and into BTC. The webinar covered current macroeconomics with crypto trading insights from seasoned traders with a macro mindset.

Overview

The discussion began by examining the Western world's current debt supercycle, then looked to Japan whose bubble occurred 16 years earlier. The team dove into the Japanese bond, real estate, and FX markets to show that Japan will likely be a first mover into BTC, as Japan is notably not expected to move to a "Gold Standard" like the BRICS countries. The team believes that Japan has a unique opportunity to be a first mover into digital hard assets like BTC.

This was truly an interesting session leveraging Greg’s extensive research into the Japanese economy combined with the entire team’s deep digital asset and trading backgrounds.

A recording of the full discussion is available here.

Stay tuned for more upcoming webinars!

About Amberdata

Amberdata is the leading provider of digital asset data. We deliver comprehensive data and insights into blockchain networks, crypto markets, and decentralized finance, empowering financial institutions with data for research, trading, risk, analytics, reporting, and compliance. Amberdata serves as a critical piece of infrastructure for financial institutions entering the asset class and participating in digital asset markets.

To learn more, visit Amberdata.io.

Amberdata

Amberdata is the leading provider of global financial infrastructure for digital assets. Our institutional-grade solutions deliver data, analytics and comprehensive tools and insights that empower financial institutions to research, trade, and manage risk and compliance in digital assets. Amberdata serves as a...