Amberdata 2024 Digital Asset Market Intelligence Report - Ethereum

Welcome to Amberdata’s End-of-Year Report for 2024. At Amberdata, our mission is to shed light on these rapid developments by analyzing a broad range of metrics—from Gini Coefficients and holder distributions to UTXO analytics and funding-rate differentials—combining both on-chain and off-chain data. Whether you’re tracking whale flows for institutional insight, evaluating stablecoin liquidity for a DeFi project, or navigating the derivatives market as a retail trader, our platform provides the depth and breadth of intelligence needed for confident, data-driven decision-making.

In this report, we explore Ethereum’s key metrics and evolving market dynamics. This is the second installment in a comprehensive four-part series that began with our deep dive into Bitcoin in Part 1, continues with an analysis of stablecoin trends in Part 3, and concludes by examining exchanges and derivatives in Part 4. Download the full report here.

Ethereum

Ethereum’s Gini Coefficient is notably higher than Bitcoin’s, underscoring a more pronounced whale presence that can sway market dynamics. Even so, smaller address buckets consistently grew this year, reflecting ongoing demand from both retail and institutional participants. The proof-of-stake landscape continued to evolve: validator deposits indicate long-term conviction despite occasional net outflow months, and liquid staking yields converged as competition among providers stabilized returns. MVRV ratios suggest Ethereum holders remain broadly profitable, yet whale-led trades can spark short bursts of volatility. Institutional engagement is evident in the ETF data; after a mid-year lull, net inflows surged in Q4, signaling renewed confidence in Ethereum’s long-term viability and smart contract capabilities.

ETH Gini Coefficient

Over the past four months, Ethereum’s Gini coefficient has increased from 0.7563 in September to 0.7630 in December 2024—an incremental but clear sign of growing ownership concentration. Notably, this figure is already substantially higher than Bitcoin’s Gini coefficient (which has hovered around 0.46–0.47), indicating that Ethereum’s supply remains more tightly held by larger holders.

This steady uptrend suggests a consolidation phase, with whales selectively accumulating ETH over the fall and early winter. For traders and institutions, the rise in concentration could foreshadow heightened price movements, as large-scale buying or selling by bigger addresses tends to amplify short-term volatility. While smaller addresses continue to participate, the gradual climb points to whale activity having an outsized market influence. If this drift persists into 2025, we could see sharper intra-month fluctuations; nonetheless, the pace of increase remains measured, implying that the market still maintains a relatively balanced environment despite the overall tilt toward larger holders.

ETH Holder and Supply Distribution Dec 2024

Ethereum’s December 2024 distribution snapshot paints an even more pronounced “whale effect” than what we see in Bitcoin. Addresses holding 0–0.001 ETH comprise over 56% of all wallets, yet together they control just 0.013% of the total ETH supply. Meanwhile, at the upper end, the 10,000+ ETH cohort—only 0.0008% of all holders—commands a striking 74.47% of Ethereum’s circulating coins.

By comparison, the largest Bitcoin addresses in a similar range (10,000+ BTC) hold around 15% of its supply—a far smaller slice than Ethereum’s top-tier addresses. This stark disparity underscores how a select few whale wallets wield disproportionately high market influence in ETH. Smaller holders, though numerous, collectively control only a sliver of total supply, limiting their impact on price movements.

From a market dynamics perspective, this concentrated ownership structure means that large transfers or sales by a tiny fraction of holders can rapidly sway Ethereum’s price and sentiment. While smaller addresses do provide liquidity, the heavy tilt toward bigger wallets—far more pronounced than in Bitcoin—highlights the importance of monitoring whale activity for anyone trading or investing in ETH.

ETH Holders vs Supply by Bucket.png?width=800&height=600&name=Image%2026%202024%20Research%20report%20(1000%20x%20750%20px).png)

Over the last four months, Ethereum’s distribution data shows a clear trend: the largest addresses (those holding 10,000+ ETH) have steadily expanded their share of the total supply, climbing from about 73.27% in early September 2024 to 74.47% by December. Meanwhile, the supply share held by “mid-tier” brackets—100–1,000 ETH and 1,000–10,000 ETH—has been inching lower. This shift indicates that high-capacity wallets are actively accumulating, even as their overall percentage of addresses remains extremely small (just 0.00079% of all ETH addresses in December).

In contrast, Bitcoin has lately seen its mid-tier cohorts (e.g., 100–1,000 BTC) steadily grow their portion of total coins, suggesting a somewhat broader base of accumulation. Ethereum’s pattern, by comparison, underscores that market influence is even more skewed toward the largest holders, who can meaningfully sway price action and liquidity with relatively few transactions. For traders, this intensified whale concentration implies paying close attention to on-chain movements from the biggest wallets. Smaller and mid-sized holders remain significant, but they have seen a slight reduction in their overall share—a reminder that major shifts in Ethereum’s market landscape often originate with the largest players.

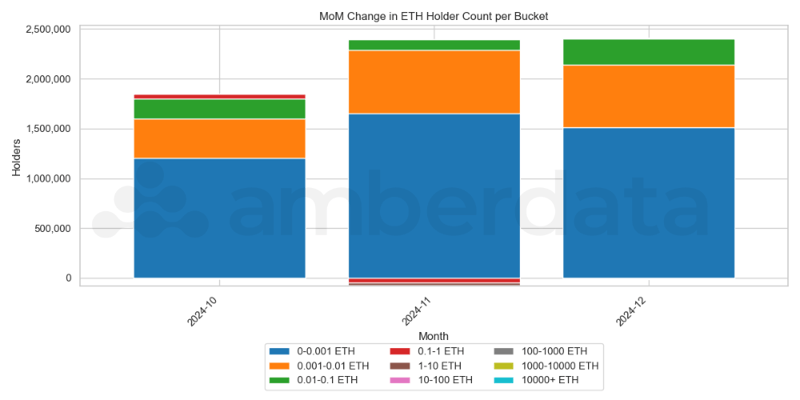

ETH Holders Month on Month Change by Bucket

From October through December 2024, the smallest buckets—particularly 0–0.001 ETH and 0.001–0.01 ETH—saw substantial net gains in address count each month, suggesting a steady influx of new or casual holders. In October alone, over 1.2 million addresses were added to the 0–0.001 ETH bracket, followed by an even larger jump (+1.65 million) in November and another +1.51 million in December. A similar story plays out in the 0.001–0.01 ETH range, which also added hundreds of thousands of addresses each month. These surges point to ongoing retail-level interest, likely tied to short-term price swings or broader market sentiment.

Higher up the chain, the 0.1–1 ETH bracket shows more mixed behavior, spiking by +51,640 addresses in October before dropping significantly (−48,296) in November, then swinging back to a modest gain in December. The mid-tier buckets (1–10 ETH, 10–100 ETH) remained largely negative, indicating net attrition or consolidation among those holders—possibly shifting their balances to other brackets or exiting. Notably, after two months of negative or flat changes, the 100–1,000 ETH and 10,000+ ETH cohorts both turned positive in December (+80 and +38 addresses, respectively). This late-year pickup in larger wallets could signal renewed whale or institutional interest. Compared to Bitcoin’s recent trend of mid-tier accumulation, Ethereum’s data shows that newcomers dominate the address growth, while whales appear to be re-emerging only at the tail end of the quarter, setting up a potentially pivotal start to 2025.

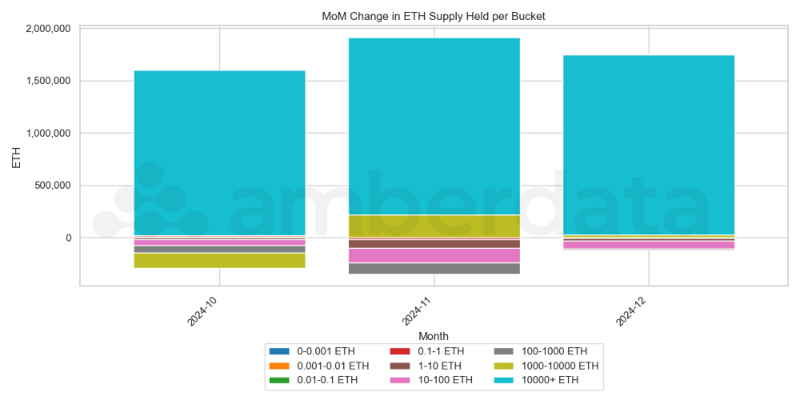

ETH Supply Month on Month Change by Bucket

From October through December 2024, Ethereum’s largest addresses (10,000+ ETH) posted inflows of about +1,576,200 ETH in October, +1,693,050 in November, and +1,715,120 in December, underscoring steady whale accumulation. Mid-range segments like 1–10 ETH, 10–100 ETH, and 100–1,000 ETH generally saw net outflows—such as −25,260 ETH from 1–10 ETH in December and −74,570 from 10–100 ETH—suggesting that some holders in these brackets may have taken profits or reallocated. Meanwhile, the 1,000–10,000 ETH bucket dipped by −151,680 ETH in October, soared by +212,800 in November, and finished December with a smaller +26,970 gain, pointing to sporadic but notable swings in mid-tier capital.

At the smallest scales, addresses holding under 0.1 ETH (0–0.001, 0.001–0.01, 0.01–0.1) consistently added new supply each month, though at comparatively modest levels—ranging from about +180 ETH to +7,810 ETH in October. In contrast to Bitcoin’s more robust mid-tier accumulation trend, Ethereum’s data highlights the ongoing influence of the largest holders, as whales continue consolidating supply heading into 2025.

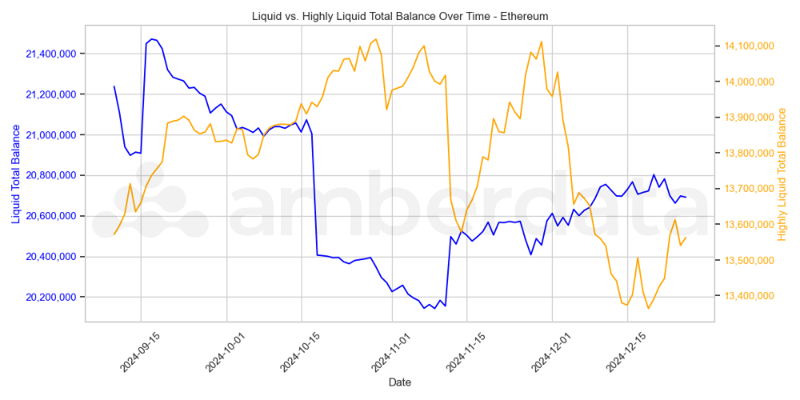

ETH Liquid and Highly Liquid Balances

Ethereum’s highly liquid supply remained relatively stable, starting near 13.57 million ETH and fluctuating up toward 14.08 million on some days before ending slightly lower at about 13.56 million. These modest changes suggest that the pool of ETH immediately available for rapid trading or exchange activity has not undergone a dramatic shift, although periodic upticks likely reflect short-term inflows to trading venues—possibly driven by seasonal or price-related events.

In contrast, the liquid segment—ETH that moves more frequently than “illiquid” coins but is less immediately tradable than “highly liquid” holdings—has trended down from roughly 21.24 million ETH in early September to around 20.69 million by late December. While the month-to-month shifts have not been drastic, this gradual decrease hints that more addresses may be moving into longer holding patterns or off-exchange storage. Together, these patterns indicate a market where near-term tradable supply is steady, yet a portion of moderately accessible ETH is slowly transitioning to a longer-term, less active state.

ETH Price vs NUPL and MVRV

.png?width=800&height=422&name=image%2030%202024%20Research%20Report%20(1000%20x%20527%20px).png)

Ethereum’s price began around $2,358 on September 9, 2024, and climbed steadily into early October, briefly dipping but ultimately surpassing $3,700 in late November. By December 6, ETH peaked above $4,000, aligning with an MVRV high near 1.58—well above the 1.0 baseline that often separates undervalued from overvalued territory. NUPL (Net Unrealized Profit/Loss) followed suit, moving from slightly negative values in mid-September to a local peak of 0.365 on December 6, suggesting that a sizable share of the market was sitting on unrealized gains.

However, as December wore on, both price and on-chain metrics cooled. MVRV slipped back from 1.58 to about 1.27 by December 26, while NUPL receded to 0.210, reflecting partial profit-taking and renewed caution. Even so, these end-of-year readings still indicate a market in net profit, well above the near-zero or negative values seen back in September. For traders and investors, the late-year pullback may offer a healthier reset as Ethereum transitions into 2025. The data shows that while the bullish momentum has paused, overall sentiment remains relatively positive, with the majority of addresses continuing to hold unrealized gains despite the year-end correction.

ETH Price vs PiCycle

.png?width=800&height=422&name=image%2031%202024%20Research%20Report%20(1000%20x%20527%20px).png)

Between early October and late December 2024, Ethereum’s price began around $2,440 and climbed to roughly $4,030 on December 6, before easing back to about $3,330 by December 26. During that stretch, the 30-day moving average (MA30Day) rose from about $2,480 to nearly $3,690, underscoring robust short-term momentum. By contrast, the 200-day moving average (MA200Day) dipped from around $3,080 to $2,990, highlighting that the longer-term trend, though still supportive, lagged behind Q4’s rapid gains.

Meanwhile, the piCycle indicator—a cyclical tool comparing shorter- and longer-term moving averages to identify potential market tops or shifts—advanced from about 5,670 in early October to over 6,130 by late December. This uptick hints at a sustained bullish phase, though it can also signal overextension. From a market-structure perspective, a strong 30-day MA well above a flatter 200-day MA points to heightened optimism, but the retreat after December’s high suggests a round of profit-taking or typical year-end cool-off. If Ethereum’s price holds above its 200-day MA into 2025, another upswing may materialize—assuming broader conditions remain supportive.

ETH New, Passive and Active Addresses

Since mid-November, Ethereum’s 30-day moving average of new addresses has leveled off, indicating fewer fresh entrants compared to the burst seen earlier in the fall. At the same time, 30-day Passive Addresses (those holding rather than transacting) have steadily climbed, taking up a larger slice of the overall address base. This pattern suggests that although new user growth has moderated, an increasing proportion of existing participants are choosing to “park” their ETH rather than trade it actively.

From a market perspective, this rising share of passive holders can signal growing conviction—or at least limited willingness to sell—especially as year-end volatility tapers. Meanwhile, the flattening of new-address growth may reflect seasonal quiet or a wait-and-see attitude among would-be entrants. Overall, the data points to a shift from the frenetic onboarding phase of mid-fall toward a more measured period, with modest new-user inflows and a swelling cohort of long-term holders anchoring the network.

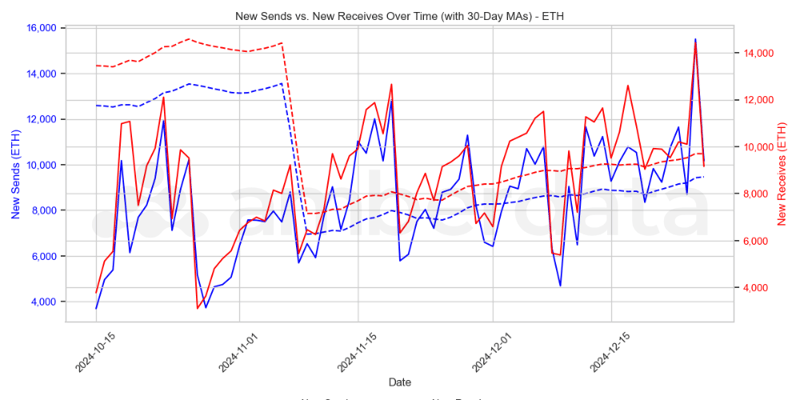

ETH New Inputs vs New Outputs

Since mid-November, daily new inputs and daily new outputs for Ethereum have followed a clear upward trajectory, regularly surpassing 10,000 by late November. By December 25, new inputs peaked at 15,510 and new outputs at 14,420, marking one of the highest activity levels this quarter. This trend is also mirrored in the 30-day moving averages, with new inputs’ MA climbing from the mid-7,000s in mid-November to roughly 9,430 by December 25, and new outputs’ MA rising from around 8,000 to about 9,710 over the same period.

Following that late-December spike, both daily metrics pulled back toward the 10,000–11,000 range, aligning with typical year-end slowdowns. Even after this seasonally driven dip, both the daily counts and 30-day MAs remain significantly above their mid-November levels, signaling sustained on-chain engagement. From a market standpoint, these strong gains in transaction initiations (new inputs) and completions (new outputs) underscore healthy liquidity, suggesting continued willingness to move—or accumulate—ETH. While the holiday peak has receded, Ethereum’s underlying trend of rising new inputs and outputs appears intact heading into the new year, pointing to resilient network activity and supportive market sentiment.

ETH Market Cap vs Realized Cap and MVRV

.png?width=800&height=422&name=image%2034%202024%20Research%20Report%20(1000%20x%20527%20px).png)

Between mid-September and late December 2024, Ethereum’s Market Cap expanded significantly, beginning around $280–$290 billion and surging above $480 billion by December 6. This growth outpaced the Realized Cap (which rose from roughly $287 billion to over $317 billion), illustrating how spot prices and overall investor sentiment moved faster than the aggregated on-chain cost basis. Notably, on a few dates—such as September 16 and September 18—Realized Cap briefly edged above Market Cap, suggesting the network was momentarily “underwater,” with average holder cost basis exceeding current prices.

This widening gap is reflected in the MVRV ratio (Market Value / Realized Value), which started near 1.00 in early September and climbed above 1.57 by December 6—indicating a growing portion of addresses were “in profit.” Historically, higher MVRV can prompt profit-taking, though institutions may see it as confirmation of bullish momentum, especially given that Realized Cap also trended upward. Overall, consistently elevated realized values point to renewed capital inflows, suggesting strong underlying support heading into 2025 despite any near-term corrections.

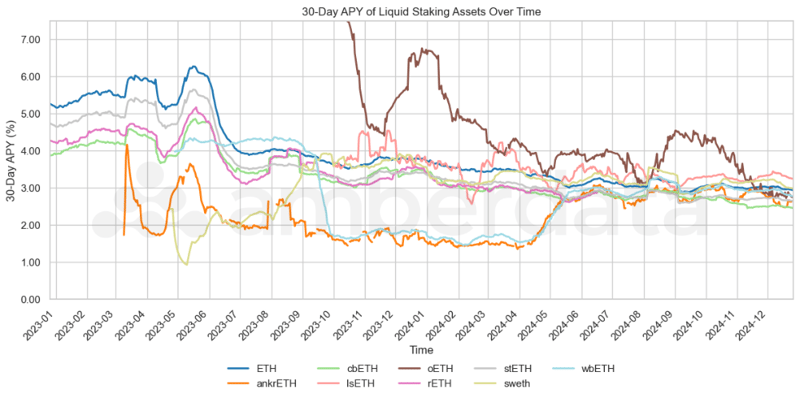

ETH Liquid Staking 30 Day APY

Liquid staking has emerged as a key pillar of Ethereum’s proof-of-stake ecosystem, enabling holders to earn validator rewards without sacrificing liquidity. Throughout 2024, the 30-day APYs offered by popular liquid-staking derivatives (e.g., ankrETH, oETH, wBETH) began the year with substantial gaps—oETH, for instance, surpassed 6.50% in January, while ankrETH and wBETH lingered closer to 1.50%–1.70%. These yields primarily derive from validator rewards (block subsidies, transaction fees, and MEV) plus any supplementary incentives or promotions each protocol may offer. Initially, these disparities attracted yield-chasing investors who quickly moved capital to whichever platform offered a premium, leading to short-lived spikes in APY.

By December, however, the majority of derivatives converged in the 2.60%–3.00% range, underscoring how competition and market forces drive APYs toward a more uniform level. When one protocol’s yield rises, additional capital inflows dilute the rewards, pushing its APY down; conversely, platforms with lagging yields may introduce token-based incentives or lower fees to regain competitiveness. This cyclical process of “arbitrage-like” behavior not only stabilizes rates but also illustrates a maturing liquid-staking sector.

For investors, this convergence means liquid staking now offers relatively steady returns anchored to Ethereum’s consensus yields. While some derivatives may still exhibit brief spikes or dips due to protocol-specific events or promotions, the overall market trend suggests an increasingly level playing field. As liquid-staking providers refine their models, investors can expect modest but reliable APYs tied closely to the underlying economics of Ethereum’s proof-of-stake network.

ETH Validator Net Deposits

From December 2022 through mid-2024, Ethereum’s validator deposits generally outpaced withdrawals, driving a robust net inflow of staked ETH. Early on—especially around February–March 2023—deposits surged past 1 million ETH per month, reflecting strong enthusiasm, likely boosted by the post-Merge momentum. However, by late 2024, this pattern began to reverse. In November and December 2024, withdrawals exceeded deposits, resulting in negative net figures of roughly −849,380 ETH in November and an even larger −1.65 million ETH in December.

Several factors could explain this year-end drawdown. Some validators may be locking in profits after the prolonged bull run in staking yields, while others could be shifting capital elsewhere—possibly into liquid-staking derivatives or alternative protocols offering competitive returns. Additionally, macro-level uncertainty or an anticipation of upcoming protocol changes sometimes prompts validators to reduce exposure. Regardless, these figures highlight that Ethereum’s staking dynamics can fluctuate significantly based on market sentiment, technological developments, and the broader crypto landscape.

Overall, while ETH staking saw substantial net growth through much of 2023 and early 2024, the pronounced decline in deposits relative to withdrawals at year’s end signals a period of heightened caution among validators, hinting that some are opting to scale back or redistribute staked holdings heading into 2025.

ETH ETF Cumulative Totals

Between July and September 2024 (Q3), on-chain wallet data shows a noticeable dip in institutional ETH ETF holdings among major asset managers. BlackRock trimmed its position from roughly 243,000 ETH in July to around 207,000 ETH by September, hinting at partial profit-taking or a cautious approach amid market choppiness. Grayscale made an even sharper cut, sliding from about 1.78 million ETH to 992,000 ETH, likely driven by risk management as sentiment cooled mid-year. Meanwhile, smaller participants like 21Shares and Invesco maintained more moderate allocations, suggesting a measured stance during this defensive phase.

From October through December 2024 (Q4), however, institutional appetite rebounded decisively. BlackRock vaulted to over 1.10 million ETH by December, effectively reversing its Q3 retreat. Grayscale climbed back toward 814,000 ETH, while Fidelity executed a late but substantial push—going from under 27,000 ETH to over 216,000 ETH in just three months. This swift pivot reflects how rapidly institutions can act when sentiment and regulatory prospects brighten.

In broader market terms, such a year-end surge signals that Ethereum is increasingly viewed as a cornerstone asset, with deeper liquidity and sturdier price support. The renewed accumulation by top-tier managers often paves the way for additional inflows, solidifying ETH’s position as a strategic holding within diversified crypto portfolios.

ETH ETF Month on Month Changes

After the SEC approved the first spot Ethereum ETFs on July 23, 2024, on-chain data revealed pronounced month-to-month variations in institutional ETH fund activity. Bitwise, for instance, recorded an initial +1.11 million ETH move soon after the launch but rebalanced with –932,000 ETH the following month—indicating a significant early commitment followed by a retreat. BlackRock followed a similar pattern: +203,000 ETH in one month, +99,000 in the next, then –135,000 shortly thereafter. Grayscale pivoted from +1.54 million ETH to –784,000 ETH over a similarly brief period, and Fidelity, having added +76,800 ETH, stepped back by –26,800 ETH not long after.

Later in the year, some funds turned notably bullish again. BlackRock’s largest monthly intake was +1.28 million ETH, with Grayscale Mini also reversing outflows to add around +541,000 ETH. However, this upturn did not carry over for every manager: December brought –438,600 ETH for BlackRock and –269,800 ETH for VanEck, suggesting year-end rebalancing.

By comparison, monthly Bitcoin ETF inflows have tended to climb more steadily, reflecting Bitcoin’s clearer “digital gold” narrative. Ethereum, by contrast, presents additional layers—such as utility in decentralized finance, evolving token economics, and smart contract functionality—that may be less straightforward for traditional investors. This complexity can lead to larger short-term repositioning as institutions test the waters. Over time, as ETH ETFs accumulate more performance data and familiarity, their inflows may begin to mirror Bitcoin’s stability and contribute to a broader acceptance of Ethereum as a key institutional asset.

Conclusion

Overall, Ethereum’s data presents a nuanced picture that remains directionally positive as we move into 2025. A steadily climbing Gini Coefficient—from 0.7563 to 0.7630—confirms that large holders continue to consolidate, potentially amplifying price fluctuations in the near term. At the same time, the brisk expansion of smaller address cohorts highlights sustained retail interest, signaling that new entrants remain eager to participate despite whale dominance. While mid-tier brackets have slightly contracted, December’s uptick in large-wallet accumulation points to renewed institutional and high-net-worth involvement, mirroring the bullish pivot seen late in the year across various on-chain and ETF metrics.

From a proof-of-stake perspective, validator deposits have cooled in Q4, with net outflows in November and December hinting at profit-taking or strategic reallocations after a strong year for staking yields. Yet liquid-staking platforms continue to mature, converging around similar APYs and reflecting a more level playing field. Meanwhile, the late surge in ETF allocations—particularly among major asset managers—suggests growing acceptance of Ethereum as a core holding, reinforcing the network’s position as a principal player in smart contract innovation and decentralized finance.

Taken together, these indicators paint a market poised for further upside if whale-driven volatility remains contained and retail engagement persists. While short-term corrections are likely—given the significant whale concentration—long-term sentiment appears constructive, supported by advancing proof-of-stake dynamics, institutional buy-in, and robust on-chain metrics. As 2025 unfolds, Ethereum seems well-positioned to balance growth and stability, bolstered by an increasingly diverse holder base and maturing stakeholder ecosystem.

Disclaimers

The information contained in this report is provided by Amberdata solely for educational and informational purposes. The contents of this report should not be construed as financial, investment, legal, tax, or any other form of professional advice. Amberdata does not provide personalized recommendations; any opinions or suggestions expressed in this report are for general informational purposes only.

Although Amberdata has made every effort to ensure the accuracy and completeness of the information provided, it cannot be held responsible for any errors, omissions, inaccuracies, or outdated information. Market conditions, regulations, and laws are subject to change, and readers should perform their own research and consult with a qualified professional before making any financial decisions or taking any actions based on the information provided in this report.

Past performance is not indicative of future results, and any investments discussed or mentioned in this report may not be suitable for all individuals or circumstances. Investing involves risks, and the value of investments can go up or down. Amberdata disclaims any liability for any loss or damage that may arise from the use of, or reliance on, the information contained in this report.

By accessing and using the information provided in this report, you agree to indemnify and hold harmless Amberdata, its affiliates, and their respective officers, directors, employees, and agents from and against any and all claims, losses, liabilities, damages, or expenses (including reasonable attorney’s fees) arising from your use of or reliance on the information contained herein.

Copyright © 2025 Amberdata. All rights reserved.

Michael Marshall

Mike Marshall is Head of Research at Amberdata. He leads pioneering research initiatives at the forefront of blockchain and cryptocurrency analytics. Mike is a seasoned quantitative analyst with a 15-year track record in developing AI-driven trading algorithms and pioneering proprietary cryptocurrency strategies. His...